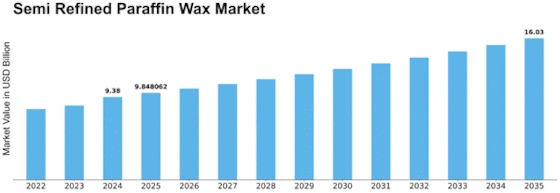

Semi Refined Paraffin Wax Size

Semi Refined Paraffin Wax Market Growth Projections and Opportunities

The Semi Refined Paraffin Wax Market is influenced by various market factors that collectively contribute to its growth and dynamics. One of the primary drivers is the widespread use of semi-refined paraffin wax across diverse industries. Semi-refined paraffin wax, derived from crude oil during the refining process, finds applications in candles, packaging, cosmetics, rubber, and textiles. Its versatility as a cost-effective and readily available material makes it a preferred choice in numerous manufacturing processes. As end-user industries expand and evolve, the demand for semi-refined paraffin wax remains steady, contributing to the growth of the market.

Moreover, the cosmetics and personal care industry plays a significant role in shaping the Semi Refined Paraffin Wax Market. Semi-refined paraffin wax is commonly used in cosmetic formulations, such as creams, lotions, and lipsticks, where it serves as a stabilizing and texturizing agent. The cosmetic industry's constant innovation and the introduction of new products influence the demand for semi-refined paraffin wax, as manufacturers seek reliable and cost-efficient ingredients to meet consumer preferences and regulatory requirements in the United States.

Technological advancements in refining processes contribute to market dynamics. Continuous efforts to improve the efficiency and quality of semi-refined paraffin wax production enhance its properties and broaden its applications. Innovations in refining techniques also address environmental considerations, aiming to reduce the environmental impact of the refining process and meet sustainability goals. Technological advancements contribute to the competitiveness of semi-refined paraffin wax in the market.

Global economic conditions and trade dynamics impact the Semi Refined Paraffin Wax Market. As a globally traded commodity, factors such as international trade agreements, tariffs, and geopolitical events can influence the supply chain and market conditions for semi-refined paraffin wax in the US. Economic stability and trade policies play a role in determining the accessibility and cost competitiveness of semi-refined paraffin wax materials.

Environmental considerations and regulatory standards also play a role in shaping the semi-refined paraffin wax market. The industry is subject to regulations governing the refining process and the presence of impurities in the final product. Compliance with environmental standards is essential for manufacturers to ensure the quality and safety of semi-refined paraffin wax for various applications. Adherence to regulations contributes to the industry's overall sustainability and environmental responsibility.

Market competition and industry collaborations are notable factors influencing the Semi Refined Paraffin Wax Market. The market comprises both large manufacturers and regional players, fostering a competitive landscape. Collaboration between semi-refined paraffin wax producers, end-users, and research institutions facilitates the development of new applications and the improvement of existing products. Partnerships within the industry supply chain contribute to the overall growth and innovation within the semi-refined paraffin wax market.

Challenges related to fluctuations in crude oil prices, alternative materials, and consumer preferences for natural and sustainable products are factors that the industry addresses. The pricing of semi-refined paraffin wax is closely tied to crude oil prices, making the market susceptible to volatility. The emergence of alternative materials and the growing demand for natural and sustainable products pose challenges for traditional wax-based industries. The industry responds by exploring sustainable sourcing practices and developing eco-friendly alternatives to stay competitive in the market.

Leave a Comment