Signal Generators Size

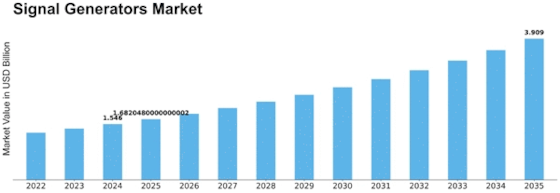

Signal Generators Market Growth Projections and Opportunities

The Signal Generators Market is influenced by a myriad of factors that collectively shape its dynamics. One of the primary determinants is technological advancements. As the industry continually evolves, signal generator manufacturers strive to integrate the latest technologies into their products. The advent of advanced semiconductor technologies, increased use of software-defined radio (SDR), and the growing demand for high-frequency applications are driving innovation in signal generators.

Market demand is another crucial factor. The Signal Generators Market is highly responsive to the needs of various industries such as telecommunications, electronics, and aerospace. The increasing deployment of wireless communication technologies, expansion of 5G networks, and the rising demand for Internet of Things (IoT) devices contribute significantly to the market's growth. Moreover, as electronic devices become more complex, the need for accurate and reliable signal generators intensifies, fostering market expansion.

Global economic conditions also play a pivotal role in shaping the Signal Generators Market. Economic stability, investment climate, and consumer purchasing power impact the overall demand for electronic testing equipment, including signal generators. During periods of economic growth, industries invest more in research and development, leading to increased demand for testing and measurement instruments. Conversely, economic downturns may result in reduced capital expenditures, affecting the market adversely.

Regulatory factors contribute to the market landscape as well. Compliance with international standards and regulations is paramount in the development and manufacturing of signal generators. Companies operating in the market must adhere to industry-specific guidelines to ensure the quality, safety, and reliability of their products. Stringent regulatory frameworks can influence product designs, manufacturing processes, and market entry barriers, shaping the competitive landscape.

Competitive dynamics and market consolidation are essential market factors. The Signal Generators Market is characterized by the presence of numerous players, ranging from established multinational corporations to emerging startups. Intense competition drives companies to innovate, improve product offerings, and explore new market segments. Merger and acquisition activities also influence the market, leading to consolidation as companies aim to enhance their market share and capabilities.

Technological convergence is an emerging factor influencing the Signal Generators Market. The integration of various technologies, such as artificial intelligence (AI) and machine learning (ML), into signal generators enhances their performance and capabilities. AI-driven signal generators can adapt to dynamic testing requirements, optimize signal generation parameters, and provide more efficient and precise testing solutions, aligning with the industry's evolving needs.

Environmental considerations and sustainability are gaining prominence in the Signal Generators Market. Manufacturers are increasingly focusing on developing energy-efficient and environmentally friendly products. This shift is driven by a growing awareness of environmental issues and the need for sustainable business practices. Energy-efficient signal generators not only reduce operational costs for end-users but also contribute to a positive brand image for manufacturers, aligning with the global push towards eco-friendly technologies.

Leave a Comment