Market Share

Singleplex Immunoassay Market Share Analysis

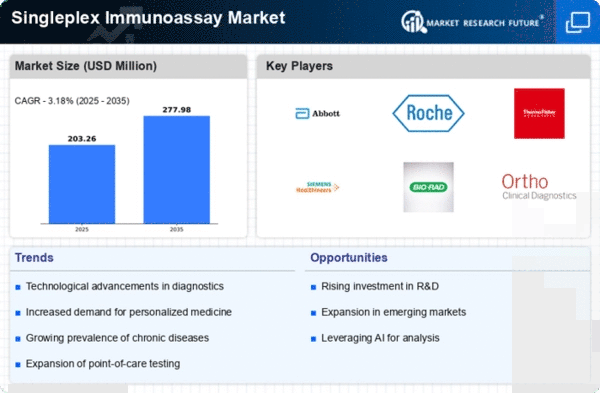

A successful market percentage positioning inside the Singleplex Immunoassay market starts off evolving with a complete evaluation of the present-day market landscape. Understanding the demand, competition, and emerging trends in immunoassay technologies is essential in formulating powerful strategies. Singleplex Immunoassays find programs in various fields, from medical diagnostics to pharmaceutical research. Companies must identify and goal unique packages, together with biomarker detection or ailment diagnosis, tailoring their advertising and improvement techniques accordingly. Focusing on customization for clinical diagnostics can be a key approach. Developing Singleplex Immunoassays that cater to the particular wishes of diagnostic laboratories, such as fast and correct detection of biomarkers, can appeal to healthcare specialists and institutions. Given the important nature of diagnostic applications, groups should prioritize regulatory compliance and satisfactory assurance. Adhering to strict requirements ensures the reliability and accuracy of Singleplex Immunoassays, constructing consideration among healthcare specialists and institutions. Education plays a pivotal role in the adoption of recent technology. Companies should spend money on academic tasks and schooling applications to familiarize healthcare experts with the blessings and packages of Singleplex Immunoassays, facilitating wider adoption. Pricing strategies are large in market proportion positioning. Offering price-powerful answers that are stable and affordable with high performance can entice a broader variety of customers, such as smaller laboratories and research centers. To cater to the various desires of researchers and clinicians, companies can become conscious of diversifying the to-be-had biomarker panels for Singleplex Immunoassays. Streamlining laboratory workflows is important. Companies can expand Singleplex Immunoassay structures that seamlessly integrate with laboratory records systems, supplying efficient information control and evaluation abilities for healthcare specialists. Embracing virtual health answers is a current method. Establishing a strong logo presence is key to increasing market share. Implementing targeted advertising campaigns, both online and offline, can beautify the visibility of Singleplex Immunoassay technologies. The area of immunoassays is dynamic, with constant technological improvements. Companies in the Singleplex Immunoassay market ought to stay adaptable to emerging developments, whether or not in assay codecs, detection technologies, or records evaluation methods, to stay competitive and maintain market relevance.

Leave a Comment