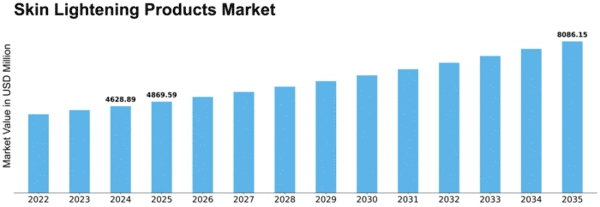

Market Growth Projections

The Global Skin Lightening Products Market Industry is projected to experience substantial growth, with estimates indicating a market value of 9.2 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 4.01% from 2025 to 2035. Such projections underscore the potential for sustained demand in the coming years, driven by various factors including consumer preferences, technological advancements, and regulatory changes. As the market evolves, stakeholders may need to adapt strategies to align with these growth projections, ensuring they remain competitive in an increasingly dynamic landscape.

Rising Demand for Skin Lightening Products

The Global Skin Lightening Products Market Industry experiences a notable surge in demand, driven by increasing consumer awareness regarding skin tone and aesthetics. In 2024, the market is valued at approximately 5.97 USD Billion, reflecting a growing inclination towards products that enhance skin appearance. This trend is particularly pronounced in regions where fair skin is culturally associated with beauty and social status. As consumers become more informed about the ingredients and efficacy of these products, the market is expected to expand further, indicating a potential for sustained growth in the coming years.

Regulatory Changes and Compliance Standards

The Global Skin Lightening Products Market Industry is subject to evolving regulatory frameworks aimed at ensuring consumer safety. Governments worldwide are implementing stricter regulations regarding the use of certain harmful ingredients in skin lightening products. This regulatory landscape necessitates compliance from manufacturers, prompting them to reformulate products to meet safety standards. While this may pose challenges for some brands, it also presents opportunities for those willing to innovate. As the market adapts to these changes, the emphasis on compliance may enhance consumer trust and drive demand for safer alternatives, potentially influencing market dynamics.

Cultural Shifts and Changing Beauty Standards

Cultural shifts towards inclusivity and diversity are reshaping the Global Skin Lightening Products Market Industry. While traditional beauty standards often favored lighter skin tones, there is a growing movement advocating for the celebration of all skin tones. This shift may lead to a diversification of product offerings, catering to a broader audience. As the market evolves, brands that embrace inclusivity and promote diverse beauty ideals may gain a competitive edge. This cultural transformation could influence consumer preferences, potentially impacting the overall growth trajectory of the market as it adapts to changing societal values.

Technological Advancements in Product Formulation

Innovations in product formulation are transforming the Global Skin Lightening Products Market Industry. Advances in dermatological research and technology have led to the development of safer and more effective skin lightening agents. For instance, the introduction of natural and organic ingredients is appealing to health-conscious consumers. These innovations not only enhance product efficacy but also address safety concerns associated with traditional skin lightening agents. As consumers increasingly seek products that align with their values, the market is likely to witness a shift towards formulations that prioritize both effectiveness and safety, thereby fostering growth.

Influence of Social Media and Celebrity Endorsements

The Global Skin Lightening Products Market Industry is significantly influenced by social media platforms and celebrity endorsements. The proliferation of beauty influencers and public figures promoting skin lightening products has led to increased visibility and acceptance among consumers. This trend is particularly evident in markets with high social media penetration, where consumers are exposed to various beauty standards. As a result, brands are investing heavily in marketing strategies that leverage these platforms, potentially driving market growth. The impact of social media on consumer behavior suggests a dynamic shift in how skin lightening products are perceived and purchased.

Leave a Comment