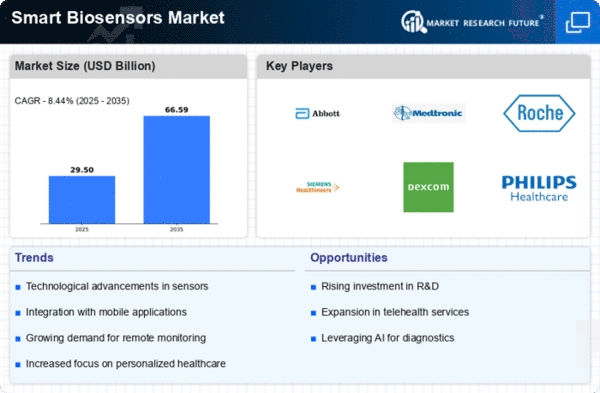

Market Share

Smart Biosensors Market Share Analysis

With a developing emphasis on health awareness and preventive medical care, buyers are effectively looking for innovations that empower ceaseless observing of their health. Smart biosensors work with ongoing information variety, enabling people to proactively deal with their prosperity and anticipate potential medical problems. Continuous mechanical progressions in the field of biosensors are energizing market development. Smart Biosensors are turning out to be more complex, with improved abilities for exact and fast identification of biomarkers. This advancement is opening additional opportunities in clinical diagnostics, natural checking, and sanitation. The frequency of persistent illnesses is on the rise internationally, prompting an elevated spotlight on compelling infection management. Smart biosensor spreads an essential job in ceaseless observing of fundamental signs and biomarkers, offering important information for overseeing persistent circumstances like diabetes, cardiovascular illnesses, and respiratory problems. The reconciliation of smart biosensors with the web of Things (IoT) is a key market factor. This availability permits consistent information move to smartphones or different gadgets, empowering remote checking and giving medical services experts continuous data. This interconnection improves patient consideration and adds to the development of the biosensors market. Smart biosensors are tracking down applications past medical services, adding to their market extension. Businesses like natural observing, food and refreshment, and guard are progressively using biosensors for recognizing toxins, guaranteeing hygiene, and improving safety efforts. As innovation develops, the expense of assembling smart biosensors is diminishing. this cost decrease is making biosensors more open to a more extensive market, including buyers and limited scope medical services offices, further driving market development. The pattern towards decentralized medical services and purpose in care testing is supporting the reception of smart biosensors. These sensors give fast and solid outcomes, diminishing the reliance on concentrated labs and empowering quick dynamic in different medical care settings.

Leave a Comment