Market Share

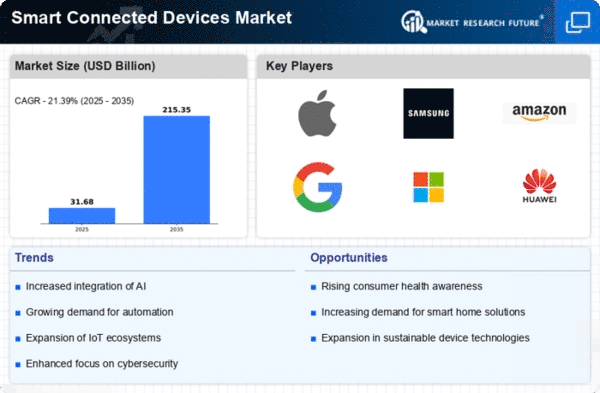

Smart Connected Devices Market Share Analysis

In the dynamic landscape of the Smart Connected Devices Market, companies deploy various market share positioning strategies to gain a competitive edge and establish themselves as leaders in this rapidly evolving industry. One crucial strategy involves continuous innovation and differentiation. Companies invest heavily in research and development to create smart connected devices with advanced features, improved connectivity, and enhanced functionalities. Whether it's smartphones, smartwatches, or other IoT devices, staying at the forefront of technological advancements is paramount. By offering cutting-edge products, companies attract consumers who seek the latest and most sophisticated smart devices, positioning themselves as industry innovators.

Cost leadership is another pivotal strategy within the Smart Connected Devices Market. Companies aim to provide cost-effective solutions by optimizing manufacturing processes, negotiating favorable supplier agreements, and enhancing overall operational efficiency. This approach appeals to a broad customer base, particularly those who prioritize affordability without compromising on quality. Strategic partnerships with component suppliers and distribution channels are often leveraged to ensure a streamlined supply chain, contributing to overall cost-effectiveness.

Market segmentation plays a crucial role in effective market share positioning within the Smart Connected Devices Market. Companies identify specific consumer segments or target markets based on demographics, preferences, or use-case scenarios. Tailoring products to address the unique needs of these segments allows companies to capture significant market shares within specific niches. For example, a company might focus on developing ruggedized smart devices for outdoor enthusiasts or specialized health monitoring features for the elderly population.

Strategic collaborations and partnerships are instrumental in enhancing market share within the Smart Connected Devices Market. Companies often form alliances with tech giants, software developers, or other device manufacturers to create seamless ecosystems. This integration ensures that smart devices can work cohesively with various platforms and services, enhancing the overall user experience. Additionally, collaborations with telecom providers can optimize connectivity, ensuring that smart devices remain connected and functional in diverse environments.

Leave a Comment