Smart Food Packaging Size

Market Size Snapshot

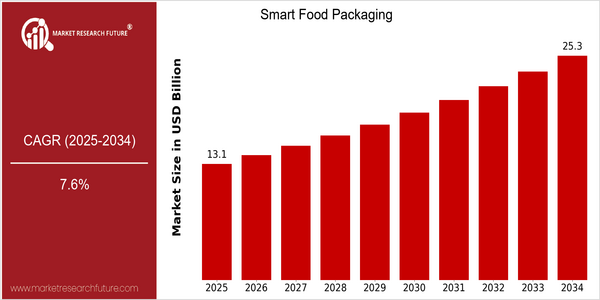

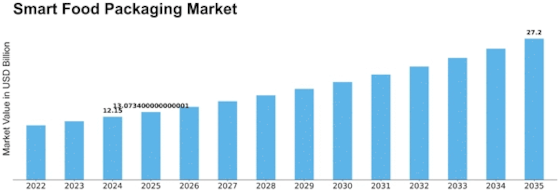

| Year | Value |

|---|---|

| 2025 | USD 13.07 Billion |

| 2034 | USD 25.28 Billion |

| CAGR (2025-2034) | 7.6 % |

Note – Market size depicts the revenue generated over the financial year

A report on the market for smart food packaging is to be published by Grand View Research, Inc. According to the report, the market is expected to grow at a CAGR of 7.6% between the years 2016 and 2024. The increasing demand for improved food safety, extended shelf life, and enhanced customer engagement through smart packaging solutions are the main reasons for the growth. The report also notes that technological advancements such as the integration of the Internet of Things (IoT) and radio frequency identification (RFID) are revolutionizing the food packaging industry. These advancements are enabling the real-time monitoring and tracking of food, which is becoming increasingly important in today’s health-conscious consumer environment. In addition, the report says that the leading companies in the smart food packaging industry such as Amcor, Sealed Air, and Tetra Pak are launching new products and entering into strategic alliances to strengthen their positions in the market. For instance, Amcor has recently launched a new line of smart packaging that combines sensors with smart technology to monitor the freshness of food. Sealed Air has focused on smart and sustainable packaging solutions. These initiatives not only demonstrate the companies’ commitment to innovation but also highlight the increasing focus on sustainable and customer-centric packaging solutions in the food industry.

Regional Market Size

Regional Deep Dive

The Smart Food Packaging Market is experiencing a significant growth in various regions of the world, driven by the increasing demand for convenience, safety, and sustainability. The North American region is characterized by high adoption of smart food packaging technology and a strong focus on food safety regulations. Europe is witnessing an upsurge in demand for sustainable food packaging solutions, while the Asia-Pacific region is experiencing a surge in growth due to urbanization and changing consumer lifestyles. The Middle East and Africa region is slowly adopting smart food packaging technology, driven by the growth of the food and beverage industry. Latin America is a promising region, driven by the need for food preservation and reduction in food wastage.

Europe

- The European Union's Green Deal is pushing for sustainable packaging solutions, leading to increased investments in biodegradable and recyclable smart packaging technologies.

- Innovations from companies like Tetra Pak and Smartrac are focusing on integrating IoT capabilities into packaging, allowing for real-time monitoring of food conditions, which is expected to enhance consumer trust and reduce food waste.

Asia Pacific

- Rapid urbanization in countries like China and India is driving the demand for smart food packaging solutions that cater to the fast-paced lifestyle of consumers, with companies like Huhtamaki leading the charge.

- Government initiatives promoting food safety and quality standards are encouraging the adoption of smart packaging technologies, particularly in the food and beverage sector.

Latin America

- Brazil is witnessing a rise in demand for smart packaging solutions due to increasing consumer awareness about food safety and sustainability, with local companies exploring innovative packaging technologies.

- Government programs aimed at reducing food waste are encouraging the adoption of smart packaging solutions that extend shelf life and improve food preservation.

North America

- The U.S. Food and Drug Administration (FDA) has recently updated regulations to support the use of smart packaging technologies, which is expected to enhance food safety and traceability in the market.

- Companies like Amcor and Sealed Air are investing heavily in R&D to develop intelligent packaging solutions that incorporate sensors and indicators, catering to the growing demand for freshness and quality assurance.

Middle East And Africa

- The growing food and beverage industry in the UAE is prompting investments in smart packaging solutions, with companies like Al Bayader International focusing on innovative packaging designs.

- Regulatory bodies are beginning to recognize the importance of smart packaging for food safety, leading to increased collaboration between government and private sectors to promote these technologies.

Did You Know?

“Approximately 30% of food produced globally is wasted, and smart food packaging technologies are being developed to help reduce this waste by extending shelf life and improving inventory management.” — Food and Agriculture Organization (FAO)

Segmental Market Size

The smart food packaging market is growing rapidly, playing a vital role in improving food safety and extending shelf life. The demand is driven by the rising awareness of consumers regarding food safety and quality, as well as by stricter government regulations aimed at reducing food waste. Further, technological advancements such as the integration of IoT and RFID into smart food packaging are expected to enable real-time monitoring of food conditions. In terms of adoption, smart food packaging is at the stage of commercialization, with companies such as Amcor and Sealed Air leading the way with new solutions. North America and Europe are expected to remain the key regions for the smart food packaging market. In terms of application, smart food packaging is primarily used for freshness indicators, temperature monitoring, and anti-counterfeiting, particularly in the dairy and meat industries. Nanotechnology and biodegradable materials are expected to shape the market’s future.

Future Outlook

From 2025 to 2034, the smart food packaging market is expected to increase from $13.07 billion to $25.2 billion, at a compound annual growth rate (CAGR) of 7.6%. This growth is driven by the rising demand for convenience, sustainability and food safety. Awareness of food waste and the importance of extending shelf life will also lead to the emergence of smart packaging solutions. By 2034, it is estimated that smart food packaging will represent about one-third of the total food packaging market, up from one-fifth in 2025. This indicates a significant shift towards more intelligent packaging solutions. In the future, technological developments such as the Internet of Things (IoT) and the development of biodegradable materials will play a significant role in the development of smart food packaging. These innovations will not only increase the functionality of food packaging, but will also meet the sustainable development goals of the world, thus satisfying the demands of the consumers. In addition, government support for food safety and food waste reduction will also drive the market. Also, new trends such as individualized packaging and artificial intelligence will optimize supply chains and improve the experience of consumers. Food distribution strategies will be further developed.

Leave a Comment