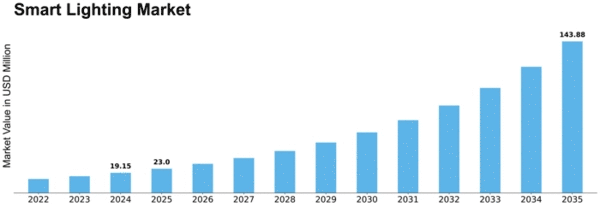

Smart Lighting Size

Smart Lighting Market Growth Projections and Opportunities

In modern-day global, there may be a fab manner to lighten up our homes referred to as smart lighting. It's like great high-tech lighting fixtures with unique LED lighting fixtures that could hook up with apps or smart domestic gadgets. These lighting fixtures can turn on and stale by means of themselves or be controlled from a ways away so that you do not want regular light switches. Because of all these fancy functions, a whole lot of human beings need smart lighting, and the market for it has been developing for a long time. Around the world, companies are finding new possibilities for this type of lighting. The authorities are likewise helping make "smart towns," and because of this, there are even more chances for the Smart Lighting market to develop. Some clever lighting can even trade colorations, like from white to orange, which is better for certain locations. The Smart Lighting market has experienced a dynamic boom in recent years fueled by advancements in technology and a developing emphasis on energy efficiency and sustainability. One key driving force of the Smart Lighting market is the increasing adoption of clever domestic structures. As consumers are looking for more management and convenience in handling their residing areas, Smart Lighting answers have turned out to be an integral part of domestic automation. The ability to remotely control lights, regulate shade temperatures, and set light schedules via cellphone apps or voice instructions has resonated with consumers, driving the demand for Smart Lighting merchandise. Moreover, the worldwide push towards strength conservation and sustainability has played a pivotal role in shaping the market dynamics of smart lighting. Governments and regulatory bodies worldwide are imposing stringent power performance standards, prompting groups and customers alike to include power-green lighting answers. Smart lighting, with its capability to optimize electricity utilization via capabilities like occupancy sensing and sunlight-hours harvesting, aligns seamlessly with those environmental targets. Interconnectivity and interoperability are also key factors influencing the Smart Lighting market. The upward push of the Internet of Things (IoT) has enabled Smart Lighting systems to combine with different smart devices and systems, creating a relaxed environment within homes, workplaces, and public spaces. This interoperability not only enhances a person's revelatory power but also opens avenues for innovative programs, such as integrating lighting fixtures with security systems, entertainment setups, and clever construction control. The Smart Lighting market is effectively evolving not only in terms of product features but also in terms of geographical expansion. As urbanization speeds up globally, smart lighting is becoming a critical part of smart city projects. Municipalities are investing in sensible light systems to enhance public safety, lessen strength consumption, and create more sustainable urban environments. This geographical diversification is reshaping the market panorama and offering new increased possibilities for enterprise participants.

Leave a Comment