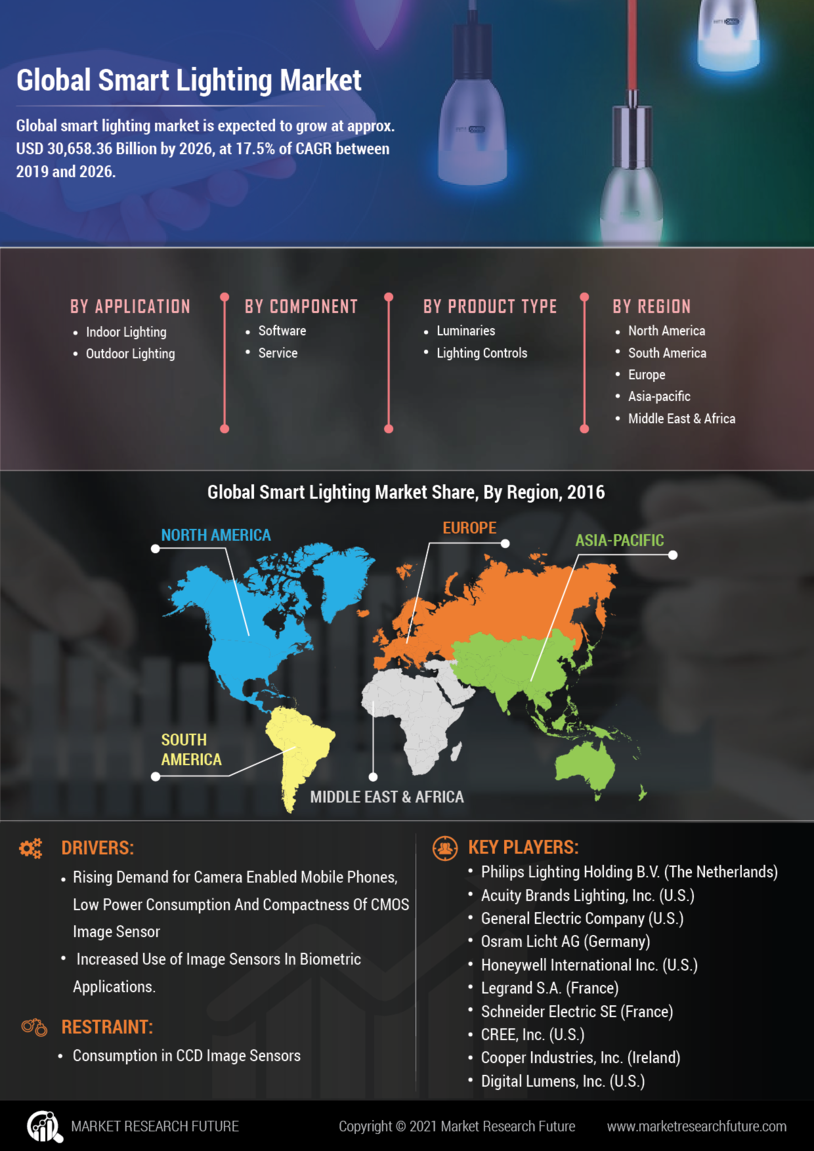

Smart Lighting Market Summary

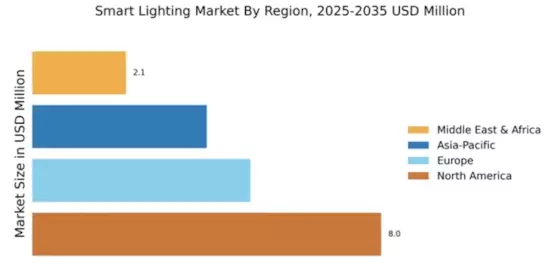

As per MRFR analysis, the Smart Lighting Market Size was estimated at 19.15 USD Million in 2024. The Smart Lighting industry is projected to grow from 23.01 in 2025 to 143.88 by 2035, exhibiting a compound annual growth rate (CAGR) of 20.12% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Smart Lighting Market is poised for substantial growth driven by technological advancements and increasing energy efficiency demands.

- The integration of IoT technology is transforming smart lighting solutions, enhancing connectivity and control.

- Energy efficiency remains a focal point, with consumers increasingly seeking sustainable lighting options.

- Customization and user experience are becoming paramount, as consumers desire tailored lighting solutions for their homes and outdoor spaces.

- Rising demand for energy efficiency and government initiatives are key drivers propelling market growth in North America and Asia-Pacific, particularly in the residential and outdoor segments.

Market Size & Forecast

| 2024 Market Size | 19.15 (USD Million) |

| 2035 Market Size | 143.88 (USD Million) |

| CAGR (2025 - 2035) | 20.12% |

Major Players

Signify (NL), Osram (DE), Acuity Brands (US), Cree Lighting (US), GE Lighting (US), Philips Hue (NL), Legrand (FR), Zumtobel Group (AT), Lutron Electronics (US)