Research Methodology on Smart Indoor Lighting Market

Introduction

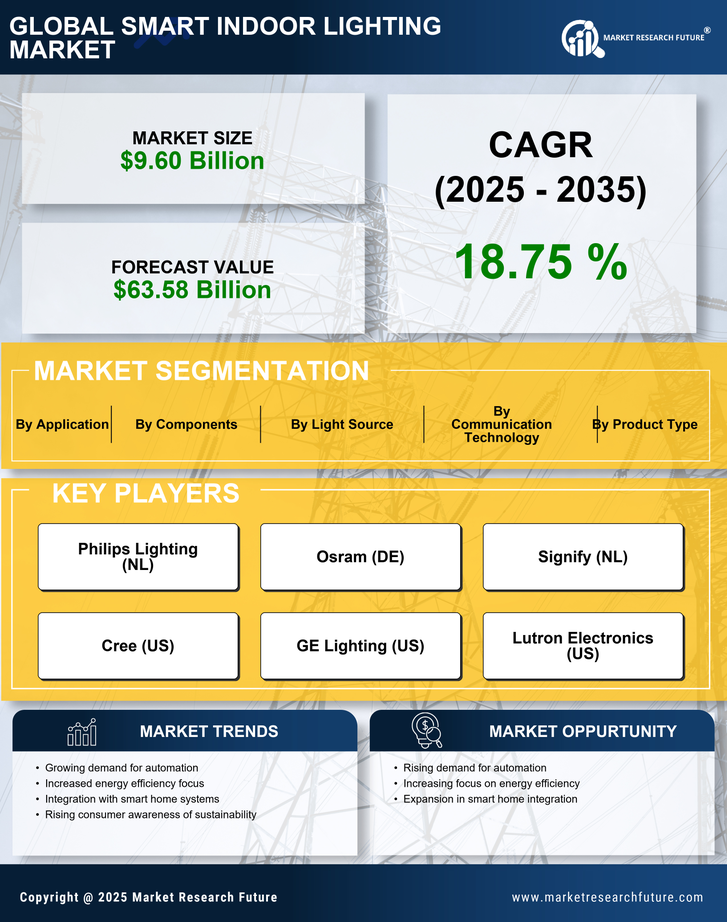

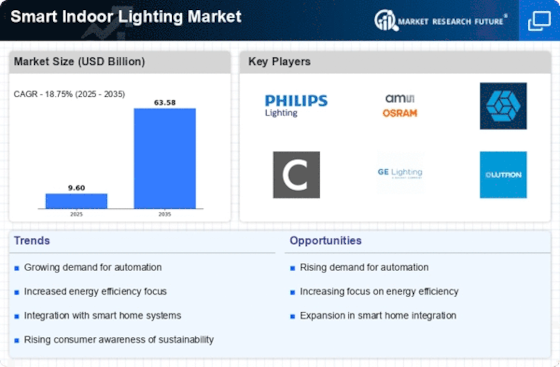

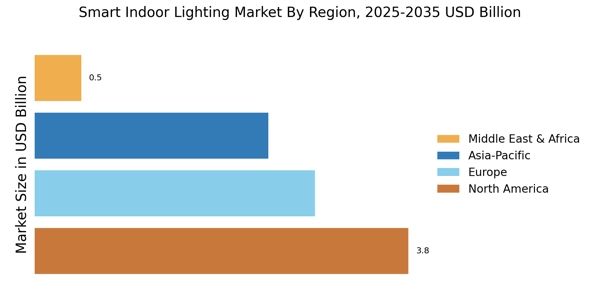

This research methodology outlines the research process and methods used to gather information and analyse the data for a smart indoor lighting market report by Market Research Future. The main aim of the research report is to assess the market potential, dynamics, and relevant trends currently impacting the smart indoor lighting market. The research methodology provides information on the strategic profiling of the key players, their core competencies and market ranking analysis of their recent developments. The report will also provide a broad road map outlining the market dynamics pertaining to the revenue, market size, trends and opportunities.

Research design

The primary goal of this research project is to identify and understand the factors that affect the growth of the smart indoor lighting market and the opportunities they provide. In order to do this, the following research design has been adopted:

Qualitative research

This is the first stage of the research project and involves conducting a literature review to compile data about the smart indoor lighting market. This type of research is driven by an inductive approach where the researcher is open to data from different sources and forms.

Quantitative research

This is the second stage of the study and involves analyzing to identify the market size and dynamics using primary data from interviews and surveys. The information from these sources will then be collated and analyzed using appropriate analytical tools and techniques to gain insights into the current trends and opportunities in the market.

Sampling

To obtain an accurate picture of the market, a representative sample of the key stakeholders and industry professionals will be selected. A stratified random sampling procedure has been adopted in which the respondents have been divided into three categories; i) industry professionals ii) industry experts iii) consumers of smart indoor lighting products. The respondents have been chosen based on their expertise and experience. The sample size is determined based on the statistical requirements and the target population, which in this case are users of smart indoor lighting products.

Data collection

Two methods of data collection will be used to gather information:

Primary data

This involves primary sources such as interviews and surveys with industry professionals and stakeholders. Interviews are conducted via phone, video or face-to-face. Survey data will be collected using online survey software or printed questionnaire.

Secondary data

This procedure involves gathering information from published sources including industry journals, online databases, websites, and reports.

Data analysis

After data collection, the data will be analysed using appropriate analytical techniques including qualitative and quantitative analysis. Qualitative analysis will involve narrative analysis and content analysis to understand and interpret the qualitative data from the interviews and surveys. Quantitative analysis will involve the use of statistical techniques such as regression and correlation analysis to identify the relationships between different variables. The results are then presented in an easy-to-understand manner.

Validity and reliability

Validity and reliability are important aspects of the research methodology as they ensure that the findings and conclusions are accurate, reliable and valid. To ensure this, the instruments used for data collection will be tested for validity and reliability.

Conclusion

The research project aims to provide an in-depth analysis of the smart indoor lighting market. The research methodology outlines the approach taken to obtain relevant data and provides insight into the tools and techniques used to analyse the data. This ensures that the findings and conclusions of the report are accurate, reliable and valid.