Research Methodology on Indoor Robots Market

Introduction

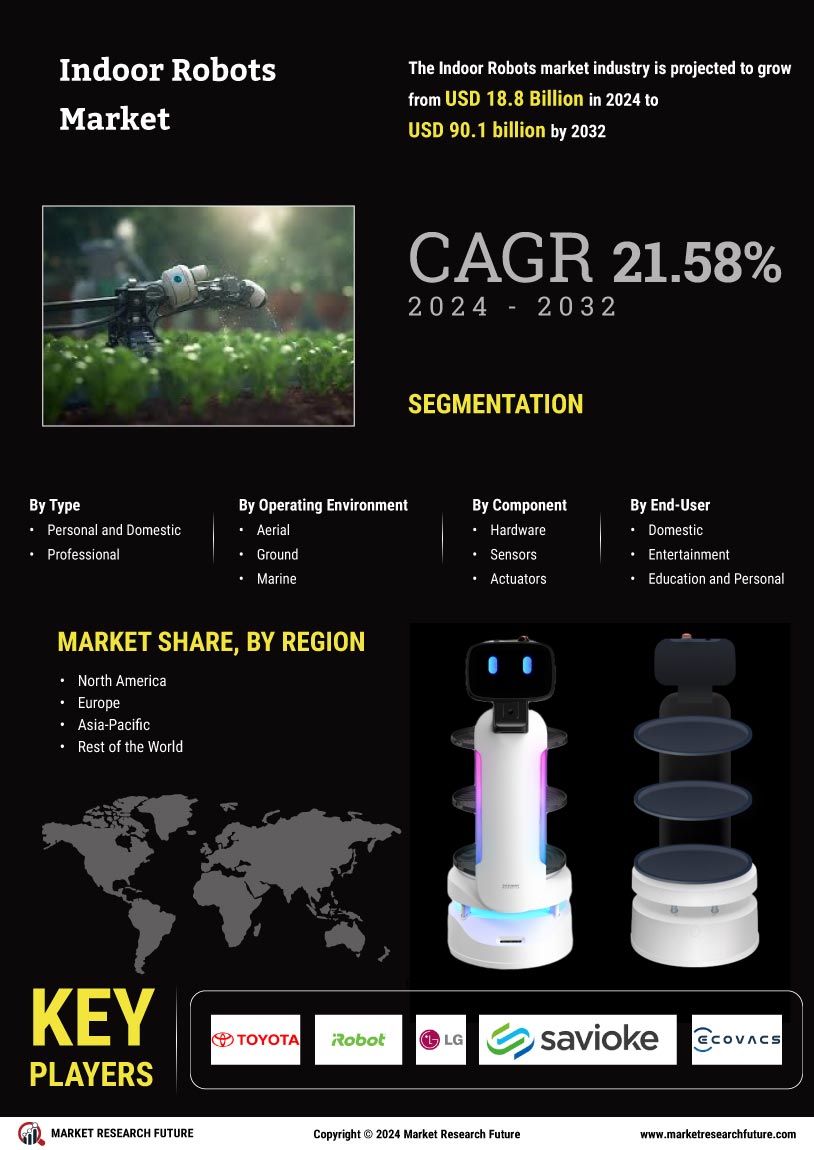

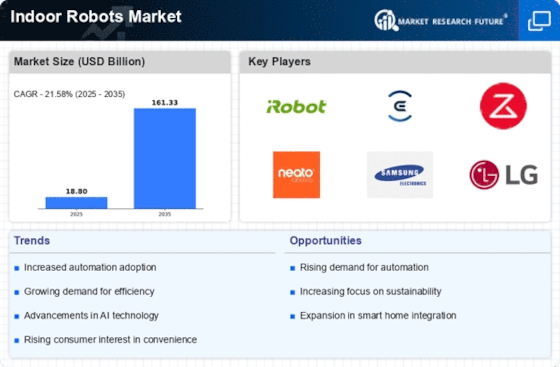

The indoor robots market is driven by the advancement in technology, which enables the use of indoor robots for various applications such as entertainment, service, and security. According to Market Research Future (MRFR), the global indoor robots market is anticipated to expand at a tremendous growth rate in the forecast period from 2023-2030.

The rapid growth of the indoor robots market is attributed to the growing adoption of advanced technology in various sectors, increasing demand for automated solutions, and development in artificial intelligence technology. Increasing demand for efficient, safe, and cost-effective solutions is driving the growth of the market. Initiatives taken by the government in countries from different regions fuel the growth of this market, as these initiatives promote the development of robot technology.

Research Methodology

This report is based on Market Research Future's (MRFR) comprehensive and detailed research methodology. The research methodology employed for this report is based on research techniques such as primary and secondary research. The research concentrated on the geographical aspects of the market, as well as the complete analysis of the competitive landscape.

Primary Research

To collect proper and reliable data, primary and secondary research was conducted. Primary research provided information such as market dynamics and trends, product launches, and competitors' activities in the market. MRFR conducted interviews and discussions with industry experts and stakeholders to collect the data.

Secondary Research

This research report comprises secondary sources such as annual reports, Industrial Automation magazine, press releases, and other government data sources. MRFR had also performed extensive industry and company reports on the various industry players operating in the indoor robots market.

Market Determinants

The Indoor Robot Market report takes into consideration all the major factors that may stimulate or risk the growth of this market. The primary driving factors along with the market's most promising growth opportunities, the threats and challenges that the market is likely to face, and the upcoming technological advancements are discussed at length.

Market Segmentation

The indoor robots market is segmented according to product type, application and technology. Based on the product type, the market is segmented into humanoids, security and security bots, vacuum cleaning bots, medical bots, and others. The application segment of the market is divided into entertainment, domestic assistance, monitoring & security, and healthcare. Based on technology, the market is further segregated into robotic process automation, artificial intelligence, IoT, and others.

Geographic Analysis

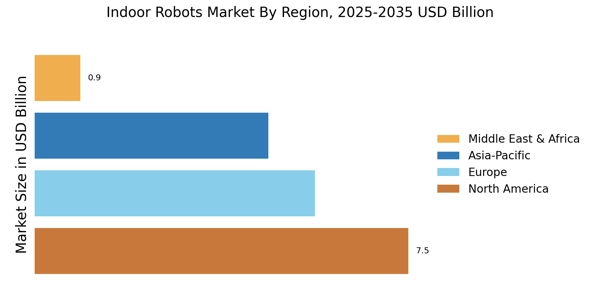

The geographic analysis of the indoor robots market covers the regions such as North America, Europe, Asia-Pacific, and the Rest of the World. Of the mentioned regions, the Asia-Pacific is dominating the market due to the presence of major countries such as Japan, China, India, South Korea, and Australia with their respective manufacturers of advanced automation systems and robots. Europe follows the trend with its technological advancements and investments in the manufacturing of robots and their components.

Competitive Analysis

The report includes the major market players in the indoor robots market from all the major regions. The research further analyses the strategic developments of the market such as partnerships, joint ventures, collaborations, acquisitions, and partnerships in the market.

Conclusion

Hence, the research report concludes with a broad overview of the indoor robots market, where the market players are evaluated, and the market size is estimated according to the prevalent market segmentation. The overall analysis of the market offers a brief understanding of the indoor robots market and forecast from 2023 to 2030.