Market Trends

Introduction

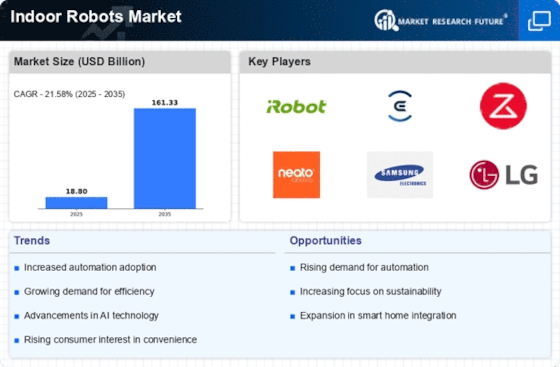

The Indoor Robots Market is currently experiencing a profound transformation, influenced by a combination of macroeconomic factors. Firstly, the emergence of new and more powerful robots, especially in the fields of artificial intelligence and machine learning, is making them more efficient and attractive to both consumers and businesses. Secondly, a push towards regulatory compliance, in the interests of safety and ethics, is influencing product development and deployment strategies. Thirdly, a changing consumer mindset, with an increasing demand for automation and convenience in everyday life, is boosting the adoption of robots across various industries. These trends are strategically important for the market’s stakeholders, as they not only influence the market’s dynamics, but also investment decisions and innovation strategies.

Top Trends

-

Increased Adoption of AI and Machine Learning

Artificial intelligence and machine learning are now being used in indoor robots, enabling them to learn about their surroundings. A company like iRobot is able to use advanced algorithms to improve the robot’s navigation and its ability to complete its tasks. According to industry reports, these robots can reduce operating costs by up to 30 percent. This trend is expected to lead to increasingly more complex and more self-sufficient systems that can be used in many different industries. -

Rise of Collaborative Robots (Cobots)

Collaborative robots are designed to work alongside people, to increase the productivity of work-places. Companies like Omron Adept Technologies develop cobots which assist in production and logistics. A survey showed that by 2025, over half of manufacturers planned to use cobots. This trend will probably lead to a safer working environment and higher productivity. -

Expansion in Healthcare Applications

Indoor robots are increasingly being used in hospitals for tasks such as patient monitoring and the delivery of medicine. Companies like Savioke are developing robots to help in hospitals, thereby improving patient care. By using robots, hospitals can reduce the burden on staff by as much as 20 percent. Future developments will see the robots taking on more complex tasks and improving the quality of care. -

Enhanced User Interaction and Personalization

A robot’s performance is improved by better intefaces and personal interactivity. It also provides better satisfaction. According to research, 75% of consumers prefer a personal service. This trend will probably lead to a growing demand for indoor robots in homes and offices. -

Sustainability and Energy Efficiency

Energy conservation is a major consideration in the design of household robots. Ecovacs is a company that is making strides in this area with its low-power, high-efficiency robots. According to research, a 15 percent reduction in operating costs can be expected when robots are used. This trend is expected to spur the development of more eco-friendly, sustainable materials and technologies. -

Integration with Smart Home Ecosystems

Indoor robots are being increasingly integrated into the smart home ecosystem, enabling them to operate seamlessly with other smart devices. NXT is developing robots that are compatible with home automation systems. By 2025, the majority of households are expected to have smart home devices. Indoor robots will become more convenient to use as a result, and their popularity will increase. -

Focus on Security and Surveillance

Indoor robots are used for security and surveillance. They are used for real-time monitoring and detection of threats. Companies like Cobalt Robotics are deploying their robots in commercial spaces for security. Statistics show that companies using robots for security and surveillance have a 40% reduction in theft. The trend will grow as security issues escalate in urban areas. -

Development of Autonomous Delivery Robots

The demand for self-driving delivery robots is soaring, especially in urban areas. The innovation in this field is being led by Cafe X Technologies Inc., which offers a contactless solution for deliveries. Market research shows that deliveries made by robot can be reduced by up to 30 per cent. This trend is set to have a profound effect on the logistics industry and on the delivery of last-mile services. -

Advancements in Navigation Technologies

Indoor robots are gaining in efficiency, thanks to improved navigation. Companies like Aeolus Robotics are using advanced sensors and mapping to make navigation easier. Navigation has been shown to make robots complete tasks up to 25% faster. This trend will likely lead to more versatile robots, capable of operating in complex environments. -

Regulatory Developments and Standards

As indoor robots become more common, safety and regulatory frameworks are developing to ensure compliance. Governing bodies are beginning to establish standards for the operation of robots in public places. A recent survey found that 70 percent of industry leaders believe that regulation will determine the future of robotics. This could lead to greater investment in compliance-related technology and procedures.

Conclusion: Navigating the Indoor Robots Landscape

The indoor robots market in 2024 is characterized by a high degree of competition and significant fragmentation, with both incumbent and new entrants competing for market share. The North American and European markets are the most advanced in automation. In Asia-Pacific, demand for automation is growing rapidly. Suppliers must strategically position themselves in the market by utilizing their capabilities in automation, artificial intelligence, and energy efficiency to gain a competitive advantage. Suppliers in the market are focusing on enhancing existing products with smart features, while new companies are disrupting the market with agile and technology-driven solutions. As the market evolves, the ability to integrate these capabilities will be the key to leadership, and it is important for strategic decision-makers to align their strategies accordingly.

Leave a Comment