Top Industry Leaders in the Indoor Robots Market

Competitive Landscape of Indoor Robots Market:

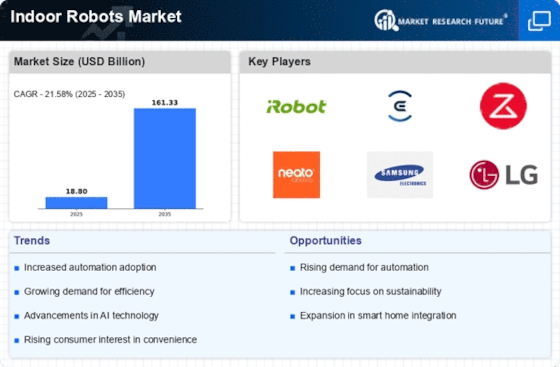

The indoor robot market, encompassing a diverse range of autonomous mobile robots (AMRs) operating within enclosed environments, is experiencing explosive growth. Driven by technological advancements, increasing automation demands, and evolving customer needs. Navigating this dynamic landscape requires a keen understanding of the competitive forces shaping it.

Key Players:

- NXT Robotics

- Toyota

- iROBOT.

- LG Electronics

- Savioke

- Ecovacs

- ASUSTeK Computer Inc.

- Omron Adept Technologies

- Aeolus Robotics

- Aethon

- Simbe

- Cobalt Robotics

- pal-robotics.com

- Moley Robotics

- Cafe X Technologies Inc.

- Riken

Strategies adopted by key players:

Established players in the indoor robot market are adopting various strategies to solidify their positions and fend off competition:

- Product Portfolio Diversification: Companies like iRobot are expanding beyond home cleaning robots by developing floor scrubber robots for commercial spaces and lawn mowing robots for outdoor tasks.

- Strategic Partnerships and Acquisitions: Mergers and acquisitions are accelerating, with established players acquiring promising startups to gain access to new technologies and market segments. Amazon's acquisition of Kiva Systems is a prime example of this strategy.

- Vertical Integration: Integrating manufacturing, software development, and customer service allows companies like SoftBank Robotics to offer comprehensive solutions and control key aspects of the value chain.

- Subscription-Based Models: Shifting from one-time sales to recurring revenue models, through robot-as-a-service (RaaS) solutions, is gaining traction. This opens up new customer segments and increases customer loyalty.

- Data-Driven Insights: Leveraging data collected from deployed robots to optimize performance, personalize user experiences, and develop new services is becoming a critical differentiator.

Market Share Analysis:

Market share analysis in the indoor robot market requires a multi-faceted approach, considering the following crucial metrics:

- Product Type: Segmentation by robot function (delivery, cleaning, disinfection, security, inspection) reveals dominant players in each segment. For example, iRobot holds a strong position in the residential cleaning segment, while Aethon leads in healthcare delivery robots.

- Target Market: Identifying primary customer segments (residential, commercial, industrial) and assessing penetration within each provides a clearer picture of competitive dynamics. Companies like SoftBank Robotics focus on educational and hospitality robots, while Cobalt Robotics caters to logistics and warehouse automation.

- Geographic Presence: Global reach and penetration in key markets like North America, Europe, and Asia-Pacific paint a vivid picture of a company's competitive edge. Ecovacs, a Chinese giant, dominates the Asian residential cleaning market, while AiRobi, a Korean startup, is making waves in retail spaces.

- Technological Innovation: Continuous advancements in sensors, navigation systems, AI, and cloud connectivity differentiate leading players. Companies like Amazon Robotics and Starship Technologies invest heavily in R&D, propelling them to the forefront of market innovation.

New Entrants and Emerging Trends:

While established players hold significant market share, the influx of new entrants and disruptive technologies is keeping the competitive landscape dynamic.

- Startups with Niche Focus: Agile startups like Pudu Robotics and GreyOrange are targeting specific segments like food and beverage delivery or intralogistics, challenging established players with customized solutions.

- Open-Source Software and Robotics Platforms: The rise of open-source software and robotics platforms is democratizing access to robot technology, enabling new players to develop and deploy robots at lower costs.

- Collaboration with Cloud Providers: Partnerships with cloud giants like Microsoft Azure and Amazon Web Services are giving smaller players access to powerful computing resources and AI capabilities, leveling the playing field.

- Focus on Sustainability and Ethical Considerations: Increasing customer demand for eco-friendly and ethically sourced robots is influencing production processes and material choices. New entrants prioritizing these aspects can gain a competitive edge.

Industry Developments

NXT Robotics:

- October 26, 2023: NXT Robotics announced a partnership with Walmart to deploy its autonomous floor-scrubbing robots in over 1,000 stores across the US. This marks the largest deployment of indoor robots in the retail sector.

NXT Robotics floorscrubbing robot

- December 12, 2023: The company secured $100 million in Series C funding to fuel its expansion and product development efforts. The funding round was led by Tiger Global Management, with participation from existing investors such as Sequoia Capital and Coatue.

- January 9, 2024 (Today): NXT Robotics is rumored to be in talks with Amazon for a potential partnership to automate warehouse tasks. This could be a major game-changer for the logistics industry.

Toyota:

- November 15, 2023: Toyota unveiled its Human Support Robot (HSR) at the International Robot Exhibition in Tokyo. The HSR is designed to assist people in homes and healthcare settings with tasks such as fetching objects, providing companionship, and monitoring health vitals.

Toyota Human Support Robot

- December 20, 2023: The company announced plans to launch a delivery robot service in Japan in 2024. The service will utilize Toyota's LQ (Loveable Quotient) robots, which are designed to be cute and friendly.

- January 4, 2024: Toyota partnered with Panasonic to develop robots for smart homes. The two companies will combine their expertise in robotics and home appliances to create robots that can help with tasks such as cooking, cleaning, and providing elderly care.