Market Share

Introduction: Navigating the Competitive Landscape of Indoor Robotics

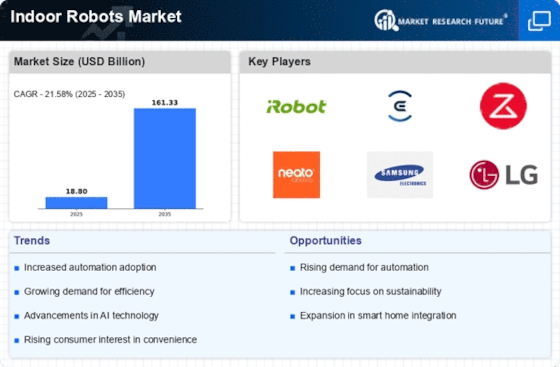

The market for indoor robots is undergoing a period of unprecedented competition, driven by the technological progress, the evolution of consumer habits and the regulatory framework, which aims to enhance safety and efficiency. The main actors, such as robot manufacturers, IT systems integrators, hardware and software suppliers, and the most innovative artificial intelligence start-ups, are fighting to gain the leadership of the market, by deploying advanced capabilities, such as machine learning, automation and IoT integration. These technology-driven differentiators not only improve the efficiency of the operation, but also change the relationship with the customer and the service model. As more and more organizations are concerned about the environment, green infrastructure has become an important factor in the positioning of suppliers. Moreover, there are still opportunities for growth, particularly in North America and Asia-Pacific, where strategic trends are aimed at promoting smart home ecosystems and commercial applications. These factors will determine the future competitive balance and the distribution of market shares.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions that integrate various robotic technologies for indoor applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Toyota | Strong automotive expertise and robotics integration | Robotic automation and mobility solutions | Global |

| LG Electronics | Diverse consumer electronics background | Smart home and robotic appliances | Global |

| iROBOT | Pioneering home robotics with strong brand recognition | Home cleaning robots | North America, Europe |

Specialized Technology Vendors

These companies focus on niche robotic technologies tailored for specific indoor applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| NXT Robotics | Advanced AI and navigation capabilities | Autonomous indoor robots | North America |

| Ecovacs | Innovative cleaning technology and features | Robotic vacuum cleaners | Global |

| Savioke | Focus on hospitality and service robots | Delivery robots for hotels | North America |

| Simbe | Retail-focused inventory management solutions | Shelf-scanning robots | North America |

| Cobalt Robotics | Security and monitoring capabilities | Indoor security robots | North America |

| Aeolus Robotics | Versatile service robots for various tasks | Multi-functional service robots | Global |

Infrastructure & Equipment Providers

These vendors provide the necessary hardware and infrastructure to support indoor robotic operations.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Omron Adept Technologies | Expertise in industrial automation | Robotic arms and automation solutions | Global |

| ASUSTeK Computer Inc. | Strong computing hardware capabilities | Robotics hardware and components | Global |

| Moley Robotics | Innovative robotic kitchen solutions | Robotic cooking technology | Global |

| Cafe X Technologies Inc. | Automated coffee-making technology | Robotic coffee kiosks | North America, Asia |

| pal-robotics.com | Focus on humanoid and service robots | Humanoid robots for various applications | Global |

| Riken | Research-driven robotics innovation | Advanced robotic systems | Asia |

| Aethon | Expertise in logistics and delivery robots | Autonomous delivery robots for healthcare | North America |

Emerging Players & Regional Champions

- Pudu Robotics (China): Specializes in delivery robots for restaurants and hospitals, recently secured contracts with major hospital chains in China, challenging established players like SoftBank Robotics by focusing on niche markets.

- Nuro (USA): Focuses on autonomous delivery robots for last-mile logistics, recently partnered with grocery chains for pilot programs, complementing traditional delivery services and competing with established logistics companies.

- Savioke (USA): Known for its hospitality robots, recently implemented solutions in several hotels across the U.S., enhancing guest experience and competing with larger automation firms by offering tailored services.

- Robotemi (USA): Offers telepresence robots for remote communication in offices and healthcare, recently expanded into educational institutions, challenging traditional communication methods and complementing existing tech solutions.

Regional Trends: Indoor robots are experiencing significant growth in North America and Asia-Pacific by 2024, mainly due to the growing demand for automation in the medical and hospitality industries. The companies are specializing in niche applications such as delivery and telepresence. The focus is on enhancing the user experience and increasing the efficiency of operations. There is also a noticeable trend towards collaboration with established suppliers. The goal is to integrate the solution into the existing framework.

Collaborations & M&A Movements

- iRobot and Amazon announced a partnership to integrate Alexa into iRobot's indoor cleaning robots, aiming to enhance user experience and expand market reach in the smart home segment.

- Samsung acquired the robotics startup Roborock in early 2024 to bolster its portfolio in the indoor robotics space and improve competitive positioning against rivals like iRobot and Ecovacs.

- LG Electronics and Google formed a collaboration to develop AI-driven indoor robots that can seamlessly interact with Google Home devices, targeting the growing demand for smart home automation.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Biometric Self-Boarding | SITA, Gemalto | SITA has implemented biometric self-boarding solutions in multiple airports, enhancing passenger flow and reducing wait times. Gemalto's technology integrates seamlessly with existing systems, providing a robust solution for identity verification. |

| AI-Powered Ops Mgmt | Siemens, IBM | Siemens utilizes AI to optimize indoor robot operations, improving efficiency in logistics and maintenance. IBM's Watson IoT platform offers advanced analytics for real-time decision-making, showcasing unique strengths in predictive maintenance. |

| Border Control | Thales, HID Global | Thales has deployed advanced border control systems that leverage AI and machine learning for enhanced security. HID Global's biometric solutions are widely adopted in various countries, providing reliable identity verification at borders. |

| Sustainability | iRobot, Ecovacs | The products iRobot makes are aimed at consumers who care about the environment. They are designed to be energy-efficient and made with sustainable materials. As a company that has also entered the indoor robot market, Ecovacs is introducing models that use recyclable components. |

| Passenger Experience | SoftBank Robotics, Samsung | Softbank’s Pepper robot enhances the passenger experience through a combination of interactivity and human-like appearance. Inside the airport, Samsung’s in-house robots are equipped with easy-to-use interfaces and provide passengers with information and assistance. |

Conclusion: Navigating the Indoor Robots Landscape

As we approach the year 2024, the indoor robots market is characterized by a high degree of competition and a high degree of fragmentation. Both old and new companies compete for a share of the market. Old companies rely on their brand value and technical knowledge, while newcomers are focusing on the development of new products with a strong emphasis on artificial intelligence, automation and sustainability. In terms of geography, there is a growing demand for flexible and scalable robot solutions, especially in urban areas where space is often scarce. Strategically, it is therefore necessary to strengthen the AI and automation capabilities to meet changing customer expectations. Sustainability is also a decisive factor in determining market leadership, as consumers with a green mindset increasingly prefer products that correspond to their values. In this highly competitive environment, it is therefore necessary to focus on investments in technology that not only improves efficiency but also corresponds to the sustainable goals of the target market.

Leave a Comment