Market Analysis

Indoor Robots Market (Global, 2024)

Introduction

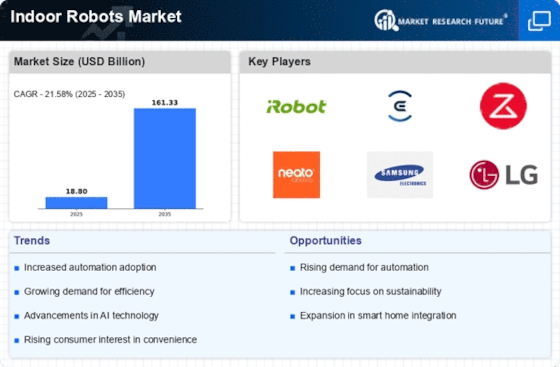

Indoor robots market is going through a transformational phase, owing to the advancements in artificial intelligence, machine learning, and robotics technology. The increasing demand for convenience and efficiency in daily life has led to the growing demand for indoor robots, which includes vacuum cleaners, lawn mowers, personal assistants, and security devices. In addition, the wide range of applications of these robots in the residential and commercial sectors is further expected to propel the growth of this market. The growing trend of automation in various industries and the integration of smart home technologies are expected to drive the investment in this market. Furthermore, the increasing awareness regarding the benefits of indoor robots such as time saving and better quality of life is expected to create a conducive environment for the growth of this market. As the manufacturers continue to refine their products and respond to the needs of consumers, the indoor robots market is expected to undergo a significant transformation, which will be in line with the advancements in the underlying technology and the changing lifestyle of consumers.

PESTLE Analysis

- Political

- By 2024 the governments of the world are becoming increasingly receptive to the new technology of automation and robotization. In Europe, for example, the European Union has set aside a budget of around fifteen hundred million to promote the development of robots. It is to be spent on improving the competitiveness of the European robot industry and encouraging closer collaboration between public and private organisations. Japan and South Korea have also introduced tax breaks of up to thirty per cent on companies investing in robots.

- Economic

- Indoor robots in 2024 are characterized by a growing demand for automation in both the residential and commercial spheres. Spending on smart home appliances, including household robots, is expected to reach an average of $ 1,200 per household, an increase of 15 percent over 2023. In the commercial sector, companies will also be more willing to use robots to optimize operations. Forty percent of companies in the retail sector will spend on robots, which means that the industry will spend about $500 million.

- Social

- By 2024, a survey showed that 66% of consumers in cities would be willing to use robots to do their chores. The time-saving convenience of the convenience industry has been enhanced. In addition, the world's population is aging, and by 2024, one in five people will be over 60 years old. The demand for robots that help people live and improve the quality of life of the elderly will also increase.

- Technological

- The domestic robot market is being transformed by technological advances, with over 75% of new models by 2024 featuring artificial intelligence for improved navigation and task execution. Machine-learning algorithms are being used to learn about the preferences of their owners and the layout of their homes, enhancing their functionality. As well as more efficient navigation, the development of advanced sensors and 5G wireless communications will also increase the performance of domestic robots, with over 50 million robots expected to be fitted with these features by 2024.

- Legal

- By 2024 the regulatory framework for domestic robots is more clearly defined. Safety standards are introduced, and the manufacturers are obliged to comply with them. For example, the International Organization for Standardization (ISO) defines the safety requirements for personal care robots, affecting about 30 percent of the domestic robot market. Furthermore, data protection regulations are tightening, and in Europe the General Data Protection Regulation (GDPR) with a fine of up to 20 million for non-compliance with the regulation, will also affect the handling of data collected by domestic robots.

- Environmental

- The environment impact of robots is being taken into account more and more. And manufacturers are putting greater emphasis on the question of sustainability. Estimates for 2024 suggest that 40 per cent of the materials used in robots will be re-usable, and that this will reflect a desire to reduce waste. Energy-saving technology will be the norm, and robots will use 30 per cent less energy than previous models. The shift towards eco-friendly products is a result of the demand from consumers. Surveys show that up to 70 per cent of consumers prefer to buy products which are environmentally friendly.

Porter's Five Forces

- Threat of New Entrants

- Indoor robots - the threat of new entrants is moderate. The market is growing rapidly, but the high investment in research and development and the high level of technology and knowledge required for entry create a high barrier to entry. Brand loyalty is high among the established players, which deters new entrants. However, new developments and decreasing costs may attract some new entrants.

- Bargaining Power of Suppliers

- The bargaining power of suppliers on the market for domestic robots is relatively low. There are a large number of suppliers of components for the manufacture of such robots, such as sensors, microprocessors, and batteries. There are many suppliers, which makes it easy for the manufacturers to change suppliers. Furthermore, as technology develops, the number of alternative components increases, which further reduces the power of suppliers.

- Bargaining Power of Buyers

- The buyers of the domestic robots market have a high bargaining power because of the many choices they have. The many similar products on the market make it easy for consumers to compare features and prices, and this leads to increased competition among suppliers. Moreover, as consumers become more informed and demand better quality and functionality, they can exert considerable pressure on suppliers to meet their expectations.

- Threat of Substitutes

- The threat of substitutes in the indoor robot market is moderate. Indoor robots offer unique functionality, but there are also alternatives, such as cleaning services and human labor for tasks that robots can perform. However, the convenience and efficiency provided by indoor robots may limit the attractiveness of alternatives. As the technology improves, the threat of substitutes will also diminish over time.

- Competitive Rivalry

- Competition in the indoor robots market is high, with many companies competing for a share of the market. The market is growing fast, and the competition is fierce. Companies are constantly improving and developing their products to differentiate themselves, which increases the competition even further. Also, price competition is intense as manufacturers compete to attract price-conscious consumers.

SWOT Analysis

Strengths

- Increasing consumer demand for automation in household tasks.

- Advancements in AI and machine learning enhancing robot capabilities.

- Diverse applications ranging from cleaning to security and companionship.

Weaknesses

- High initial cost of advanced indoor robots.

- Limited consumer awareness and understanding of robot functionalities.

- Dependence on technology and potential for malfunctions.

Opportunities

- Growing trend of smart homes and IoT integration.

- Expansion into emerging markets with rising disposable incomes.

- Potential for partnerships with tech companies for innovative solutions.

Threats

- Intense competition from both established players and new entrants.

- Regulatory challenges regarding safety and privacy concerns.

- Economic downturns affecting consumer spending on non-essential items.

Summary

The indoor robots market is characterized by a high demand for consumer products and technological advances. The high cost and lack of awareness are challenges that must be addressed. Opportunities are to be found in integration with smart home systems and in new markets. Competition and regulatory issues are major threats. Strengths and weaknesses must be exploited to seize opportunities.

Leave a Comment