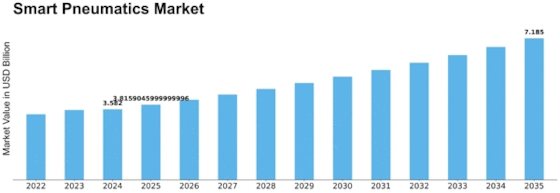

Smart Pneumatics Size

Smart Pneumatics Market Growth Projections and Opportunities

Different factors are considered in determining the dynamics and growth direction of the Smart Pneumatics Market. One of these factors is rapidly evolving technology that has led to increased automation across industries. This has resulted in increased demand for smart pneumatics systems, which combine sensors with control systems, as industries seek to operate efficiently and at low cost. Furthermore, there is a focus on energy-efficient smart pneumatics that has also positively impacted their market growth rates. As awareness about environmental sustainability grows and the need arises for reduced energy consumption, manufacturing sectors are adopting equipment such as smart pneumatic systems that save electricity consumed for power-balancing purposes. These devices combine certain valve features with sensors, making this possible, which would otherwise be impossible, hence allowing companies to satisfy their eco-friendly objectives while reducing operational costs. The growing market can also be attributed to technological advancements and innovations in pneumatic systems. Manufacturers are always working on bettering the functions of smart pneumatic solutions, such as predictive maintenance capabilities and remote monitoring. Market determinants are greatly affected by regulatory standards and directives, too. Governments and regulatory authorities worldwide have been keen on ensuring safety at places of work, including adherence to environmental conservation measures, forcing manufacturers into investing in smart pneumatic schemes that conform to these standards. Thus, an increase in operational efficiency and safer workplace conditions underlie the popularity of smart pneumatics among companies. The smart pneumatics market is driven significantly by the Industry 4.0 trend, which has marked the introduction of digital technologies within industrial operations. The fourth industrial revolution encouraged the development of intelligent factories where devices communicate in real-time with one another, as well as machines being highly automated, having Humans supervising them only when necessary. Other market determinants mirror the influence exerted by different end-user industries on this market's performance, indicating a higher demand for smart pneumatics from manufacturing, automotive, food & beverages processing firms, plus healthcare providers striving to improve operating efficiencies and remain competitive within their respective domains. Its adaptability means many applications across sectors such as manufacturing, automotive, food and beverage, and healthcare have been facilitated through smart pneumatics, making them well accepted.

Leave a Comment