- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

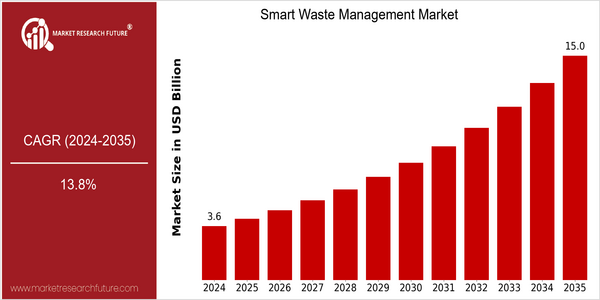

| Year | Value |

|---|---|

| 2024 | USD 3.62 Billion |

| 2035 | USD 15.0 Billion |

| CAGR (2025-2035) | 13.8 % |

Note – Market size depicts the revenue generated over the financial year

The Smart Waste Management Market is poised for significant growth, with a current market size of USD 3.62 billion in 2024, projected to expand to USD 15.0 billion by 2035. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 13.8% from 2025 to 2035. The increasing urbanization, coupled with the rising need for efficient waste management solutions, is driving this market expansion. Technological advancements, such as IoT-enabled waste bins, AI-driven analytics for waste sorting, and automated collection systems, are revolutionizing traditional waste management practices, making them more efficient and sustainable. Key players in the smart waste management sector, such as Veolia, Waste Management, and Bigbelly, are actively investing in innovative technologies and forming strategic partnerships to enhance their service offerings. For instance, Veolia has been focusing on integrating smart technologies into its waste management processes, while Bigbelly has pioneered solar-powered waste and recycling stations that optimize collection routes. These initiatives not only improve operational efficiency but also contribute to environmental sustainability, further propelling the market's growth.

Regional Market Size

Regional Deep Dive

The Smart Waste Management Market is experiencing significant growth across various regions, driven by increasing urbanization, technological advancements, and a growing emphasis on sustainability. In North America, the market is characterized by a high adoption rate of IoT technologies and smart city initiatives, while Europe is focusing on stringent regulations and innovative recycling solutions. The Asia-Pacific region is witnessing rapid urban growth, leading to a surge in waste generation and the need for efficient waste management systems. Meanwhile, the Middle East and Africa are gradually adopting smart waste solutions, influenced by government initiatives aimed at enhancing urban infrastructure. Latin America is also emerging as a key player, with investments in smart technologies to address waste management challenges.

Europe

- The European Union's Circular Economy Action Plan is driving innovation in waste management, pushing for the adoption of smart technologies to improve recycling rates and reduce landfill waste.

- Countries like Sweden and Germany are at the forefront of implementing smart waste bins equipped with sensors that monitor fill levels, optimizing collection routes and reducing carbon emissions.

Asia Pacific

- China's government has introduced the 'Waste Sorting Law,' mandating cities to implement smart waste management systems, significantly boosting the demand for technology-driven solutions.

- In Japan, companies like Hitachi are developing advanced waste management systems that utilize AI and big data to enhance recycling processes and reduce waste generation.

Latin America

- Brazil is investing in smart waste management technologies as part of its National Solid Waste Policy, focusing on improving waste segregation and recycling rates.

- Cities like Santiago, Chile, are implementing smart waste management systems that utilize mobile applications to inform residents about waste collection schedules and recycling practices.

North America

- The U.S. Environmental Protection Agency (EPA) has launched initiatives promoting smart waste management technologies, encouraging municipalities to adopt IoT-based solutions for better waste tracking and management.

- Companies like Rubicon Technologies and Waste Management, Inc. are leading the charge in integrating AI and data analytics into waste collection processes, enhancing operational efficiency and reducing costs.

Middle East And Africa

- The UAE's Smart Dubai initiative is promoting the use of smart waste management solutions, with projects like the Smart Waste Bin pilot program aimed at improving waste collection efficiency.

- In South Africa, the government is collaborating with private firms to implement smart waste management technologies in urban areas, addressing the challenges of informal waste collection.

Did You Know?

“Approximately 30% of the waste generated globally is not managed in an environmentally safe manner, highlighting the urgent need for smart waste management solutions.” — World Bank

Segmental Market Size

The Smart Waste Management Market is experiencing significant growth, driven by increasing urbanization and the need for efficient waste disposal solutions. Key factors propelling demand include stringent regulatory policies aimed at reducing landfill waste and enhancing recycling rates, as well as technological advancements in IoT and AI that optimize waste collection and processing. Cities like San Francisco and Amsterdam are leading the charge, implementing smart bins equipped with sensors that monitor waste levels and streamline collection routes. Current adoption is in the scaled deployment phase, with notable projects such as the Smart Waste Management initiative in Barcelona, which integrates real-time data analytics for waste management. Primary applications include smart bins, waste tracking systems, and recycling management platforms, exemplified by companies like Bigbelly and Ecube Labs. Macro trends such as sustainability initiatives and government mandates for waste reduction are accelerating growth, while technologies like machine learning and cloud computing are shaping the segment's evolution, enabling more efficient waste management solutions.

Future Outlook

The Smart Waste Management Market is poised for significant growth from 2024 to 2035, with a projected market value increase from $3.62 billion to $15.0 billion, reflecting a robust compound annual growth rate (CAGR) of 13.8%. This growth trajectory is driven by the increasing urbanization and population density in cities, which necessitate more efficient waste management solutions. As municipalities and private sectors seek to optimize waste collection and recycling processes, the adoption of smart technologies such as IoT sensors, AI-driven analytics, and automated waste sorting systems will become more prevalent. By 2035, it is anticipated that smart waste management solutions will penetrate over 60% of urban areas globally, significantly enhancing operational efficiencies and reducing environmental impacts. Key technological advancements, including real-time data analytics and machine learning algorithms, will play a crucial role in shaping the future of the market. These technologies will enable predictive maintenance of waste collection vehicles and optimize routing, thereby reducing fuel consumption and operational costs. Additionally, supportive government policies aimed at sustainability and waste reduction will further accelerate market growth. Emerging trends such as the integration of circular economy principles and increased consumer awareness regarding waste management will also drive demand for smart solutions. As stakeholders increasingly recognize the economic and environmental benefits of smart waste management, the market is set to evolve into a critical component of urban infrastructure by 2035.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 13.5% |

Smart Waste Management Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.