Top Industry Leaders in the Smartphone Application Processor Market

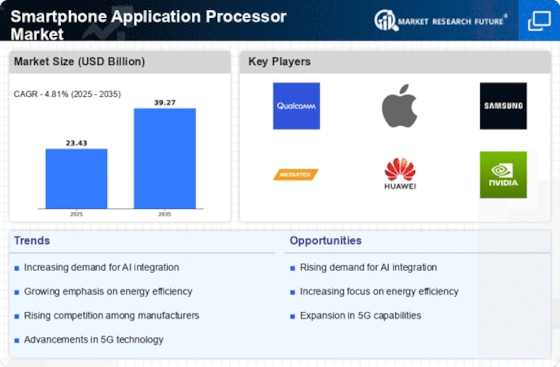

Competitive Landscape of the Smartphone Application Processor Market:

The smartphone application processor (AP) market pulsates at the heart of the mobile revolution, dictating performance, power efficiency, and ultimately, user experience. Understanding its competitive landscape is crucial for navigating this dynamic arena.

Key Players

- Analog Devices, Inc

- Renesas Mobile Corporation

- Lenovo Group Ltd

- Infineon Technologies AG

- Atmel Corporation

- Samsung Electronics

- Qualcomm

- Huawei Technologies Co., Ltd

- Apple, Inc

- HTC Corporation

- Advanced Micro Devices, Inc

- MediaTek Inc

Strategies Adopted by Key Players:

- Qualcomm: The undisputed leader, Qualcomm holds a formidable 28% market share (Q3 2023). Their "Snapdragon" series caters to premium and mid-range segments, with the 8 Gen 2 powering flagships like Samsung's Galaxy Fold/Flip. Strong partnerships with OEMs and a focus on AI and 5G integration fuel their dominance.

- MediaTek: MediaTek thrives in the budget-conscious arena, capturing 33% share. Their Dimensity series offers value-packed performance for entry-level and mid-range smartphones. Aggressive pricing, strategic partnerships with Chinese OEMs, and an expanding 5G portfolio drive their growth.

- Apple: A closed ecosystem king, Apple controls 18% share with its custom A-series chips powering iPhones. Vertical integration ensures tight optimization and cutting-edge performance, albeit limited to their own devices.

Factors for Market Share Analysis:

Beyond headline numbers, deeper analysis reveals nuanced aspects:

- Segment Focus: Each player has a sweet spot. Qualcomm reigns in premium, MediaTek in budget, while Apple remains exclusive. Understanding where a company competes is crucial.

- Geographic Presence: Regional variations are significant. Qualcomm leads in North America, MediaTek shines in China, while Samsung's Exynos chips find traction in their home turf.

- Technology Diversification: 5G penetration, AI integration, and image processing capabilities are key differentiators. Companies must invest in these areas to stay competitive.

New and Emerging Players:

The landscape is not static. New faces are challenging the established order:

- Samsung: Their Exynos series, powering Galaxy S-series flagships, aims to reclaim premium market share. Recent advancements in performance and AI are promising.

- UNISOC: Primarily focused on China, UNISOC offers cost-effective 4G and 5G chips for budget devices. Their growing portfolio could disrupt the entry-level segment.

- Emerging Startups: Risky ventures like ARM and Esperanto aim to revolutionize the market with custom-designed, open-source chips. Their success could reshape the entire industry dynamic.

Industry Developments

Analog Devices, Inc.

- Date: December 12, 2023

- Development: Announced the MaxLinear MaxxFusion® MXM10z14 ultra-low-power processor for wearables and hearables. This ultra-compact processor features an Arm Cortex-M7 core and offers low power consumption while providing high performance for audio and sensor processing.

- Date: November 3, 2023

- Development: Partnered with MediaTek to integrate Analog Devices' Power Management ICs (PMICs) into MediaTek's Dimensity chipsets. This collaboration aims to improve power efficiency and performance in smartphones powered by MediaTek chipsets.

Renesas Mobile Corporation

- Date: December 20, 2023

- Development: Launched the RZ/G3M series of high-performance processors for industrial and automotive applications. These processors utilize Arm Cortex-A75 cores and offer advanced features like real-time virtualization and functional safety compliance for demanding industrial and automotive environments.

- Date: October 26, 2023

- Development: Announced the R-Car M4 system-on-chip (SoC) for mid-range smartphones. This SoC features an Arm Cortex-A76 core and integrates an AI accelerator for AI-powered applications.