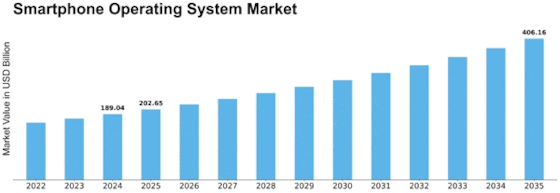

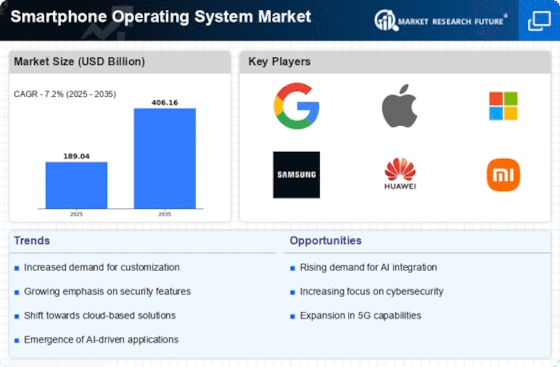

Smartphone Operating System Size

Smartphone Operating System Market Growth Projections and Opportunities

The smartphone operating system market is a dynamic and profoundly serious scene impacted by a bunch of market factors. Innovation in technology is a crucial factor in this market's success. By introducing new security measures and features to attract users, operating system developers strive to stay ahead. The capacity to give a consistent and easy to understand experience is significant, prompting steady updates and enhancements.

Buyer inclinations and conduct assume a huge part in forming the cell phone operating system market. As clients request more customized encounters, operating system suppliers should fit their frameworks to live up to these assumptions. An operating system's overall appeal is influenced by features like app availability, customization options, and the design of the user interface. Moreover, the rising dependence on cell phones for different day to day errands has prompted a developing interest for proficient and instinctive working frameworks.

The cutthroat scene is additionally vigorously impacted by the connections between working framework engineers and cell phone makers. Numerous operating system suppliers team up with gadget makers to pre-introduce their frameworks on new cell phones. This pre-establishment can essentially affect piece of the pie, as clients frequently adhere to the default operating system on their gadgets. Organizations and arrangements between operating system engineers and makers can thusly shape the market and decide the outcome of a specific working framework.

Security is a basic variable that has acquired unmistakable quality as of late. With cell phones becoming vaults of touchy individual and monetary data, clients focus on working frameworks that focus on security highlights. Operating system suppliers put vigorously in creating strong safety efforts, like encryption, biometric verification, and ordinary security refreshes, to impart trust in clients and address developing worries about information protection.

Worldwide financial circumstances and market drifts likewise influence the smartphone operating system market. Monetary slumps can impact customer buying power, influencing the interest for very good quality cell phones and, subsequently, the decision of working frameworks. Moreover, developing business sectors present the two difficulties and valuable open doors. Operating system suppliers should adjust their techniques to take special care of different shopper needs and inclinations in various districts, taking into account factors, for example, language support, neighbourhood application accessibility, and valuing.

The legitimate and administrative climate is another critical market factor. Antitrust guidelines and fights in court between significant tech organizations can reshape the cutthroat scene of the cell phone operating system market. Administrative changes can affect how working frameworks are created, advertised, and appropriated, impacting the procedures of operating system suppliers and producers the same.

The advancement of innovation and the presentation of recent fads, like expanded reality (AR) and augmented reality (VR), can likewise influence the cell phone operating system market. Working frameworks that successfully incorporate and uphold these arising innovations are probably going to acquire an upper hand. Operating system suppliers need to keep up to date with innovative headways and adjust their frameworks to oblige the changing requirements and assumptions for clients. With everything taken into account, the market is a puzzling climate influenced by an immense number of components. The elements of this profoundly serious market are formed to a great extent by mechanical development, purchaser inclinations, organizations with makers, security concerns, monetary circumstances, worldwide market patterns, legitimate and administrative scenes, and the joining of arising innovations. In order to survive and thrive in a constantly expanding and demanding industry, working framework engineers must carefully investigate these variables.

Leave a Comment