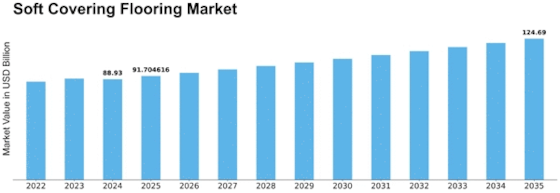

Soft Covering Flooring Size

Soft Covering Flooring Market Growth Projections and Opportunities

The Soft Covering Flooring Market is a result of many market factors that shape its dynamics and growth. An increase in demand for aesthetically appealing and comfortable flooring solutions for both residential and commercial spaces is one of the key driving forces. The Soft Covering Flooring Market is expected to reach USD 110.50 billion by 2030, rising at a CAGR of 3.90% during the projection period (2021 - 2030). Moreover, economic factors play a crucial role in shaping the market landscape. The general well-being of an economy, like disposable income and employment levels, will directly affect consumer expenditure on home improvement and interior décor services. In good times, people are more likely to make improvements to their living spaces, thereby leading to a high demand for soft-covering flooring materials. In addition, innovation and technological developments are significant contributing factors in this industry. Manufacturers continuously come up with new materials and manufacturing procedures aimed at improving durability and stain resistance, among other qualities associated with soft floor alternatives. Additionally, changing trends in interior design as well as architecture has an impact on the soft-covering flooring market. Most of these materials related to soft covering floors tend to be aligned with current designs, pushing consumers towards them if they wish to achieve a modern, stylish appearance within their homes or workplaces such as offices or business environments or others where they spend most of their time each day or night. Government policy relating to environmental standards and safety aspects for soft-covering flooring options also influences the soft-covering flooring market. The manufacturing process implemented by these firms may change due to the nature of regulations which are very drastic regarding using certain chemicals or products on floors. Compliance with these regulations not only ensures access to markets but also enhances companies' reputation as responsible corporate citizens. Furthermore, global events can affect the soft-covering flooring sectors in major ways. For instance, supply chain disruptions, such as those caused by the COVID-19 pandemic, can lead to changes in the cost of basic inputs and their availability, changing the overall price structure of the industry. Competitive pressures within the industry also help shape the soft-covering flooring market. Consequently, the presence of many manufacturers and suppliers has led to intense competition based on product quality, pricing, and branding strategies. Corporate interests, customer preferences, and lifestyle trends are some other external factors that shape this sector in terms of demand for different types of products, depending on consumers' choices and specific needs. Considering a shift towards germ-free spaces that require minimal upkeep may lead customers to flooring options with easy cleaning properties. These factors encompass everything from economic conditions and technological advancements to design trends and regulatory frameworks to influence customers and stakeholders into choosing available options.

Leave a Comment