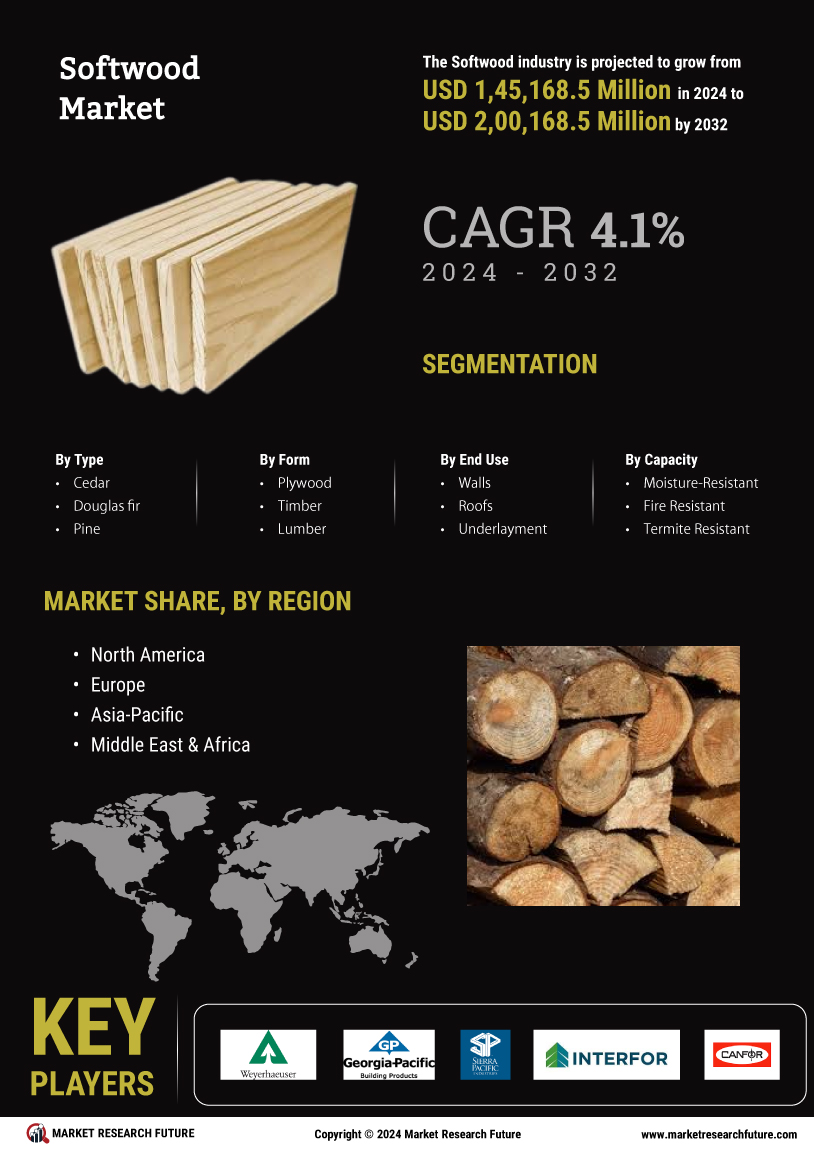

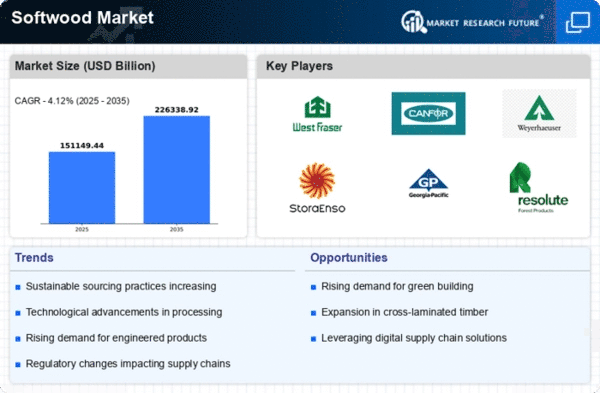

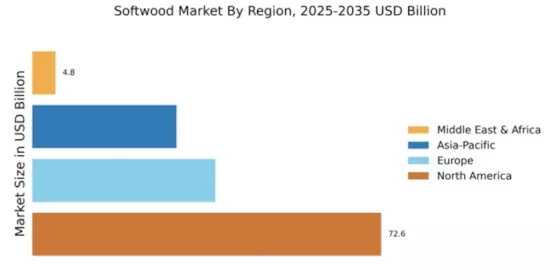

The Softwood Market is currently characterized by a dynamic competitive landscape, driven by factors such as increasing demand for sustainable building materials, technological advancements, and a growing emphasis on environmental stewardship. Major players like West Fraser Timber Co Ltd (CA), Canfor Corporation (CA), and Weyerhaeuser Company (US) are strategically positioning themselves through innovation and regional expansion. For instance, West Fraser Timber Co Ltd (CA) has focused on enhancing its production capabilities while investing in sustainable forestry practices, which not only aligns with market trends but also strengthens its competitive edge.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The Softwood Market appears moderately fragmented, with key players exerting considerable influence over pricing and supply dynamics. This competitive structure allows for a variety of strategies to coexist, fostering innovation and responsiveness to market demands.

In November Canfor Corporation (CA) announced a significant investment in a new sawmill in British Columbia, aimed at increasing production capacity by 20%. This strategic move is likely to bolster Canfor's market share and enhance its ability to meet the rising demand for softwood lumber, particularly in the residential construction sector. The investment underscores Canfor's commitment to growth and operational efficiency, positioning it favorably against competitors.

In October Weyerhaeuser Company (US) launched a new line of engineered wood products designed for sustainable construction. This initiative not only reflects Weyerhaeuser's focus on innovation but also addresses the growing consumer preference for environmentally friendly building materials. By diversifying its product offerings, Weyerhaeuser is likely to capture a larger segment of the market, particularly among eco-conscious builders and developers.

In September Stora Enso Oyj (FI) entered into a partnership with a technology firm to develop AI-driven solutions for optimizing wood processing operations. This collaboration is indicative of a broader trend towards digital transformation within the industry, as companies seek to leverage technology to enhance productivity and reduce waste. Stora Enso's proactive approach may set a precedent for others in the market, emphasizing the importance of technological integration in maintaining competitiveness.

As of December the Softwood Market is witnessing trends such as digitalization, sustainability, and AI integration, which are reshaping competitive dynamics. Strategic alliances are becoming increasingly vital, enabling companies to pool resources and expertise to navigate market challenges. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition towards innovation, technology adoption, and supply chain reliability. This transition may redefine how companies engage with customers and position themselves in the marketplace.