Investment in Renewable Energy

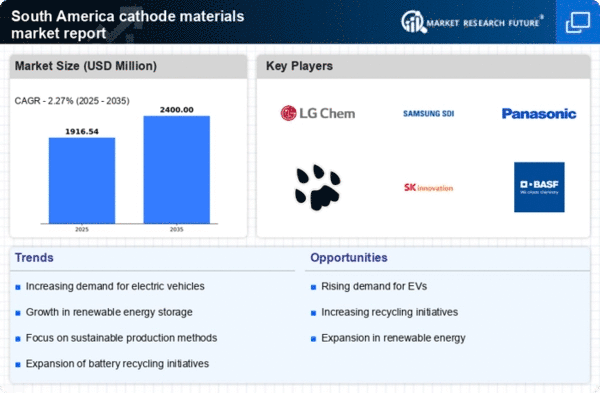

The cathode materials market in South America is likely to gain momentum from the region's increasing investment in renewable energy sources. As countries strive to meet their energy needs sustainably, the integration of energy storage solutions becomes crucial. Lithium-ion batteries, which utilize advanced cathode materials, are essential for storing energy generated from renewable sources such as solar and wind. In 2025, it is estimated that the renewable energy sector in South America will attract investments exceeding $50 billion, thereby driving demand for cathode materials. This investment trend indicates a growing recognition of the importance of energy storage in achieving energy transition goals. Consequently, the cathode materials market stands to benefit from the heightened focus on renewable energy, as manufacturers align their production capabilities with the anticipated demand for energy storage solutions.

Rising Electric Vehicle Adoption

The cathode materials market in South America is experiencing a notable surge due to the increasing adoption of electric vehicles (EVs). As governments and consumers alike prioritize sustainable transportation, the demand for lithium-ion batteries, which rely heavily on advanced cathode materials, is expected to rise significantly. In 2025, the EV market in South America is projected to grow by approximately 30%, leading to a corresponding increase in the need for high-performance cathode materials. This trend is further supported by various government incentives aimed at promoting electric mobility, which could potentially enhance the market dynamics for cathode materials. The cathode materials market is thus positioned to benefit from this shift towards electrification, as manufacturers seek to meet the evolving requirements of battery technology.

Growing Consumer Electronics Market

The cathode materials market in South America is also benefiting from the expansion of the consumer electronics market. With the increasing penetration of smartphones, laptops, and other portable devices, the demand for lithium-ion batteries is on the rise. In 2025, the consumer electronics sector in South America is projected to grow by 25%, which will likely drive the need for high-quality cathode materials. This growth is indicative of a broader trend towards digitalization and connectivity, which necessitates reliable energy storage solutions. The cathode materials market must respond to this demand by ensuring a steady supply of advanced materials that can support the performance requirements of modern consumer electronics. As such, manufacturers are expected to focus on enhancing their product offerings to cater to this burgeoning market.

Technological Advancements in Battery Chemistry

Technological advancements in battery chemistry are poised to significantly impact the cathode materials market in South America. Innovations in materials science are leading to the development of new cathode materials that enhance battery performance, longevity, and safety. For instance, the introduction of nickel-rich cathodes is expected to improve energy density, which is crucial for applications in electric vehicles and portable electronics. As of 2025, the market for advanced battery technologies is projected to grow at a CAGR of 15%, indicating a robust demand for innovative cathode materials. This trend suggests that the cathode materials market must adapt to these advancements to remain competitive. Manufacturers are likely to invest in research and development to create next-generation cathode materials that meet the evolving needs of consumers and industries alike.

Government Policies Supporting Battery Production

Government policies in South America are increasingly favoring the development of local battery production, which directly influences the cathode materials market. Initiatives aimed at reducing reliance on imports and fostering domestic manufacturing capabilities are becoming more prevalent. In 2025, it is anticipated that several South American countries will implement policies that provide financial incentives for local battery production, potentially increasing the market size for cathode materials by 20%. These policies may include tax breaks, grants, and subsidies for companies investing in battery manufacturing facilities. The cathode materials market is likely to see a shift in production dynamics as local manufacturers ramp up their operations to meet the growing demand for batteries, thereby enhancing the overall market landscape.