Growing Electric Vehicle Adoption

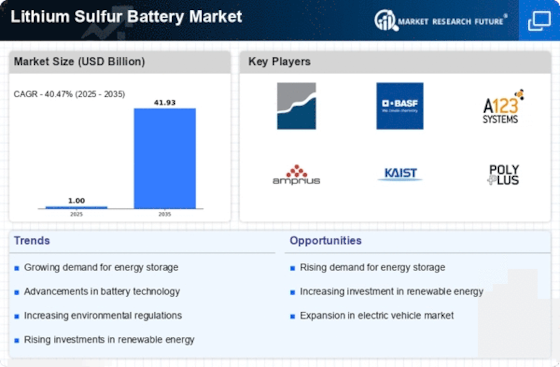

The Lithium Sulfur Battery Market is poised for growth due to the accelerating adoption of electric vehicles (EVs). As consumers and manufacturers alike prioritize sustainability, the demand for batteries that offer longer ranges and faster charging times is intensifying. Lithium sulfur batteries, with their high energy density and potential for lower costs, are becoming increasingly attractive to EV manufacturers. Market analysts suggest that the EV sector could drive a substantial portion of the lithium sulfur battery market, with projections indicating that the number of electric vehicles on the road may reach hundreds of millions by the end of the decade. This trend is likely to catalyze investments in lithium sulfur battery technology, further enhancing its market presence.

Increasing Energy Density Requirements

The Lithium Sulfur Battery Market is experiencing a surge in demand for batteries with higher energy densities. As industries such as electric vehicles and portable electronics evolve, the need for batteries that can store more energy in a smaller footprint becomes paramount. Lithium sulfur batteries, with their theoretical energy density of up to 500 Wh/kg, present a compelling alternative to traditional lithium-ion batteries. This shift is driven by consumer preferences for longer-lasting devices and vehicles, which necessitate advancements in battery technology. The market is projected to grow as manufacturers invest in research and development to enhance the performance of lithium sulfur batteries, potentially leading to a market size that could reach several billion dollars in the coming years.

Advancements in Manufacturing Techniques

The Lithium Sulfur Battery Market is benefiting from significant advancements in manufacturing techniques that enhance the scalability and efficiency of battery production. Innovations such as improved electrode design and novel synthesis methods are enabling manufacturers to produce lithium sulfur batteries at a lower cost and with higher reliability. These advancements are crucial as they address historical challenges related to the commercialization of lithium sulfur technology. As production costs decrease, the market is likely to see an influx of new players and increased competition, which could lead to a broader adoption of lithium sulfur batteries across various applications, including consumer electronics and grid storage.

Rising Investment in Energy Storage Solutions

The Lithium Sulfur Battery Market is witnessing a notable increase in investment directed towards energy storage solutions. As the demand for renewable energy sources grows, the need for efficient energy storage systems becomes critical. Lithium sulfur batteries, with their potential for high capacity and lower costs, are emerging as a viable option for large-scale energy storage applications. Investors are recognizing the potential of lithium sulfur technology to address the intermittency issues associated with renewable energy sources. This influx of capital is likely to accelerate research and development efforts, leading to innovations that could further enhance the performance and market viability of lithium sulfur batteries in the energy storage sector.

Environmental Regulations and Sustainability Initiatives

The Lithium Sulfur Battery Market is increasingly influenced by stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable practices. Governments worldwide are implementing policies that encourage the adoption of cleaner energy technologies, including advanced battery systems. Lithium sulfur batteries, known for their lower environmental impact compared to conventional batteries, align well with these initiatives. The market is likely to benefit from incentives and subsidies aimed at promoting the use of sustainable energy solutions. As industries seek to comply with these regulations, the demand for lithium sulfur batteries is expected to rise, potentially leading to a significant increase in market penetration.