Increasing Energy Storage Needs

The sodium sulfur-battery market is experiencing a surge in demand due to the increasing need for energy storage solutions. As renewable energy sources like solar and wind become more prevalent, the requirement for efficient storage systems grows. Sodium sulfur batteries, with their high energy density and long cycle life, are well-suited for large-scale energy storage applications. According to recent data, the energy storage market in the US is projected to reach $10 billion by 2026, with sodium sulfur batteries playing a crucial role in this growth. This trend indicates a strong potential for the sodium sulfur-battery market, as utilities and businesses seek reliable storage options to balance supply and demand.

Rising Demand for Grid Stability

The sodium sulfur-battery market is experiencing growth driven by the rising demand for grid stability. As the energy landscape evolves, utilities are seeking reliable storage solutions to manage fluctuations in energy supply and demand. Sodium sulfur batteries, with their ability to provide rapid response times and high discharge rates, are well-positioned to support grid stability. The increasing integration of renewable energy sources into the grid necessitates advanced storage technologies to ensure reliability. This trend indicates a robust future for the sodium sulfur-battery market, as utilities invest in solutions that enhance grid resilience and performance.

Government Incentives and Funding

The sodium sulfur-battery market is likely to benefit from various government incentives and funding programs aimed at promoting clean energy technologies. Federal and state initiatives are increasingly providing financial support for research and development in energy storage solutions. For example, the US Department of Energy has allocated substantial funds to support innovative battery technologies, including sodium sulfur systems. This financial backing may encourage companies to invest in the development and commercialization of sodium sulfur batteries, thereby expanding the market. The presence of such incentives suggests a favorable environment for the sodium sulfur-battery market to thrive.

Advancements in Battery Technology

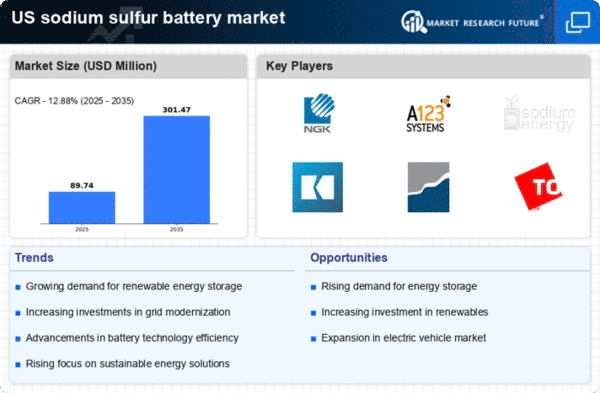

The sodium sulfur-battery market is poised for growth due to ongoing advancements in battery technology. Innovations in materials and manufacturing processes are enhancing the performance and efficiency of sodium sulfur batteries. For instance, improvements in thermal management and electrolyte formulations are increasing the operational temperature range and cycle stability of these batteries. As a result, the sodium sulfur-battery market is expected to see a compound annual growth rate (CAGR) of approximately 15% over the next five years. This technological evolution is likely to attract investments and drive adoption across various sectors, including grid storage and electric vehicles.

Environmental Sustainability Initiatives

The sodium sulfur-battery market is benefiting from a heightened focus on environmental sustainability. As organizations and governments strive to reduce carbon footprints, the demand for eco-friendly energy storage solutions is increasing. Sodium sulfur batteries are considered a greener alternative due to their use of abundant materials and lower environmental impact compared to traditional lead-acid or lithium-ion batteries. The US government has set ambitious targets for reducing greenhouse gas emissions, which may further drive investments in sustainable technologies. This shift towards sustainability is likely to enhance the sodium sulfur-battery market, as stakeholders seek to align with environmental goals.