Environmental Benefits

The Automotive Lithium-Sulfur Battery Market is increasingly aligned with environmental sustainability goals. Lithium-sulfur batteries are considered more environmentally friendly due to the abundance of sulfur and the reduced reliance on cobalt and nickel, which are often associated with mining and environmental degradation. The lower carbon footprint of lithium-sulfur batteries during production and their potential for recyclability contribute to a more sustainable lifecycle. As consumers and regulators alike prioritize eco-friendly solutions, the demand for lithium-sulfur technology is likely to grow. This shift towards sustainable energy storage solutions may catalyze further innovation and investment in the Automotive Lithium-Sulfur Battery Market.

Cost Reduction Potential

The Automotive Lithium-Sulfur Battery Market is also influenced by the potential for cost reductions associated with lithium-sulfur technology. The raw materials used in lithium-sulfur batteries, such as sulfur, are abundant and inexpensive compared to the metals used in lithium-ion batteries. This could lead to a decrease in overall production costs, making electric vehicles more affordable for consumers. Recent estimates suggest that the cost of lithium-sulfur batteries could drop to around 100 USD per kWh by 2030, which would be a significant milestone for the industry. As manufacturers seek to lower costs while improving performance, the economic advantages of lithium-sulfur batteries may drive their adoption in the Automotive Lithium-Sulfur Battery Market.

Increased Energy Density

The Automotive Lithium-Sulfur Battery Market is witnessing a surge in interest due to the increased energy density offered by lithium-sulfur batteries. These batteries can potentially deliver up to 500 Wh/kg, significantly higher than traditional lithium-ion batteries, which typically offer around 250 Wh/kg. This enhanced energy density allows for longer driving ranges in electric vehicles, addressing one of the primary concerns of consumers. As automakers strive to meet consumer demand for longer-range vehicles, the adoption of lithium-sulfur technology appears to be a viable solution. Furthermore, the ability to reduce battery weight while maintaining performance could lead to lighter vehicles, enhancing overall efficiency. This trend is likely to drive investments in research and development within the Automotive Lithium-Sulfur Battery Market.

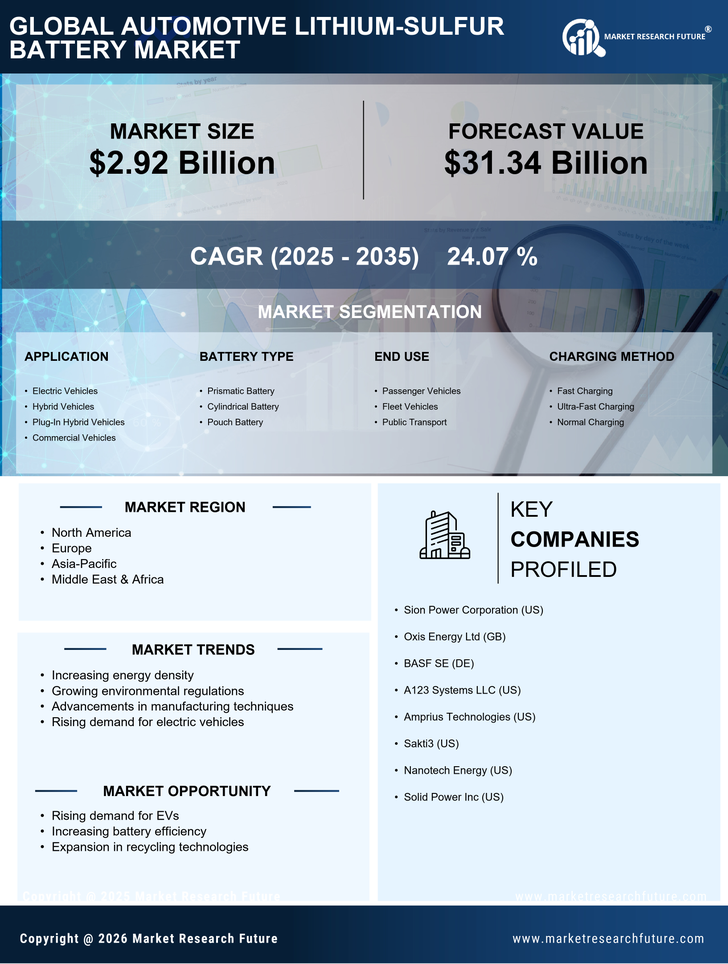

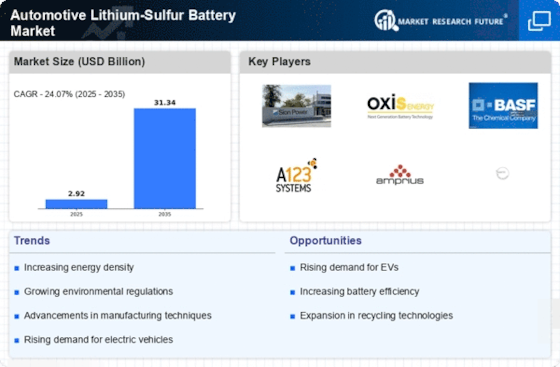

Growing Demand for Electric Vehicles

The Automotive Lithium-Sulfur Battery Market is experiencing growth driven by the rising demand for electric vehicles (EVs). As consumers become more environmentally conscious and governments implement stricter emissions regulations, the shift towards EVs is accelerating. Lithium-sulfur batteries, with their higher energy density and potential for lower costs, are well-positioned to meet the needs of this expanding market. Recent projections indicate that the EV market could reach over 30 million units by 2030, creating a substantial opportunity for lithium-sulfur technology. This growing demand for EVs is likely to propel investments and innovations within the Automotive Lithium-Sulfur Battery Market.

Advancements in Battery Management Systems

The Automotive Lithium-Sulfur Battery Market is benefiting from advancements in battery management systems (BMS). These systems are crucial for optimizing the performance and lifespan of lithium-sulfur batteries, which can be more complex to manage than traditional lithium-ion batteries. Enhanced BMS technologies can monitor battery health, optimize charging cycles, and improve safety, thereby addressing some of the challenges associated with lithium-sulfur technology. As manufacturers develop more sophisticated BMS solutions, the reliability and efficiency of lithium-sulfur batteries are expected to improve, making them more appealing to automakers. This trend may lead to increased adoption within the Automotive Lithium-Sulfur Battery Market.