Government Policies and Incentives

Government policies and incentives are significantly influencing the Automotive Lithium-Ion Battery Market. Many countries are implementing stringent regulations to promote the use of electric vehicles and reduce reliance on fossil fuels. For example, tax credits, rebates, and subsidies for EV purchases are becoming increasingly common, encouraging consumers to opt for electric vehicles. Additionally, investments in research and development for battery technologies are being prioritized, with funding reaching billions of dollars. These initiatives not only stimulate demand for lithium-ion batteries but also foster innovation within the Automotive Lithium-Ion Battery Market, creating a favorable environment for growth.

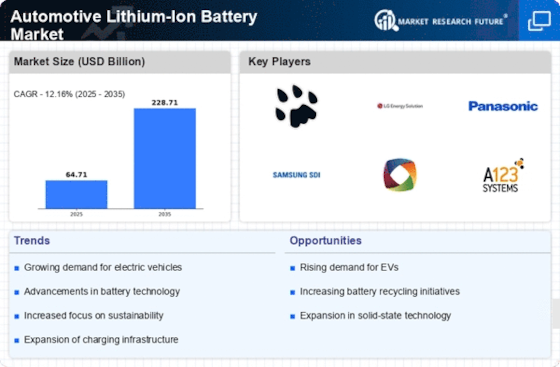

Rising Demand for Electric Vehicles

The Automotive Lithium-Ion Battery Market is experiencing a surge in demand driven by the increasing adoption of electric vehicles (EVs). As consumers become more environmentally conscious, the shift towards EVs is accelerating. In 2025, it is estimated that the number of electric vehicles on the road will surpass 30 million units, significantly boosting the demand for lithium-ion batteries. This trend is further supported by government incentives and regulations aimed at reducing carbon emissions. Consequently, manufacturers are compelled to enhance their production capacities to meet this growing demand, thereby propelling the Automotive Lithium-Ion Battery Market forward.

Expansion of Renewable Energy Integration

The integration of renewable energy sources into the automotive sector is emerging as a crucial driver for the Automotive Lithium-Ion Battery Market. As the world shifts towards sustainable energy solutions, the demand for energy storage systems is increasing. Lithium-ion batteries are essential for storing energy generated from renewable sources such as solar and wind. This synergy between renewable energy and electric vehicles is expected to enhance the appeal of lithium-ion batteries, as they provide a means to store excess energy for later use. Consequently, the Automotive Lithium-Ion Battery Market is likely to benefit from this growing trend, as more consumers and businesses seek sustainable energy solutions.

Increased Focus on Vehicle Electrification

The automotive industry is witnessing an increased focus on vehicle electrification, which is a key driver for the Automotive Lithium-Ion Battery Market. Major automotive manufacturers are committing to electrifying their fleets, with many pledging to transition to fully electric lineups by 2030. This shift is not only a response to consumer demand but also a strategic move to comply with evolving environmental regulations. As a result, the demand for lithium-ion batteries is expected to rise sharply, with projections indicating a compound annual growth rate of over 15% in the coming years. This electrification trend is likely to reshape the Automotive Lithium-Ion Battery Market, creating new opportunities for innovation and growth.

Technological Innovations in Battery Efficiency

Technological advancements in battery efficiency are playing a pivotal role in the Automotive Lithium-Ion Battery Market. Innovations such as solid-state batteries and improved energy density are enhancing the performance of lithium-ion batteries. For instance, the energy density of lithium-ion batteries has improved by approximately 20% over the past few years, allowing for longer driving ranges and shorter charging times. These advancements not only improve the overall user experience but also contribute to the competitiveness of electric vehicles in the automotive market. As a result, the Automotive Lithium-Ion Battery Market is likely to witness sustained growth as these technologies become more mainstream.