Rising Demand for Accurate Testing Solutions

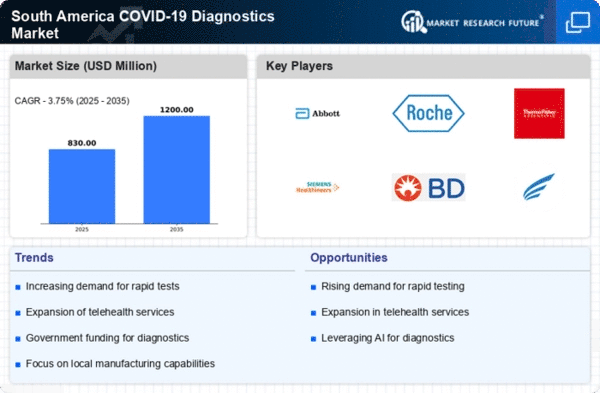

The The COVID-19 diagnostics market in South America experiences a notable surge. in demand for accurate testing solutions. This demand is driven by the need for reliable diagnostics to manage public health effectively. As of November 2025, the market is projected to grow at a CAGR of approximately 12%, reflecting the increasing emphasis on precision in testing methodologies. The rise in cases and the necessity for timely results compel healthcare providers to adopt advanced diagnostic technologies. Furthermore, the growing awareness among the population regarding the importance of early detection contributes to this trend. Consequently, manufacturers are focusing on developing innovative testing kits that ensure high sensitivity and specificity, thereby enhancing the overall efficacy of the covid 19-diagnostics market in South America.

Technological Advancements in Diagnostic Tools

Technological advancements significantly influence the covid 19-diagnostics market in South America. The introduction of novel diagnostic tools, such as molecular testing and point-of-care devices, enhances the speed and accuracy of testing. As of November 2025, the market witnesses a shift towards more sophisticated technologies that can deliver results within hours, thereby addressing the urgent need for timely diagnosis. The integration of artificial intelligence and machine learning in diagnostic processes further optimizes testing efficiency. These innovations not only improve patient outcomes but also reduce the burden on healthcare systems. Consequently, the ongoing evolution of technology in the diagnostic sector is likely to propel the growth of the covid 19-diagnostics market in South America, as stakeholders seek to adopt cutting-edge solutions.

Increased Public Awareness and Health Education

Increased public awareness and health education are pivotal drivers of the covid 19-diagnostics market in South America. As communities become more informed about the importance of testing, there is a corresponding rise in demand for diagnostic services. Campaigns aimed at educating the public about the benefits of early detection and regular testing have proven effective. As of November 2025, surveys indicate that approximately 70% of the population recognizes the significance of timely testing in managing health crises. This heightened awareness encourages individuals to seek testing proactively, thereby increasing the volume of tests conducted. Health organizations and governments are actively promoting these educational initiatives, which not only enhance public health outcomes but also stimulate growth in the covid 19-diagnostics market.

Emerging Variants and Continuous Need for Testing

The emergence of new variants of the virus continues to impact the covid 19-diagnostics market in South America. As variants evolve, the need for ongoing testing remains critical to monitor and control outbreaks effectively. As of November 2025, health authorities emphasize the importance of adapting diagnostic strategies to detect these variants accurately. This situation creates a sustained demand for innovative testing solutions that can address the challenges posed by evolving pathogens. Consequently, manufacturers are compelled to develop versatile diagnostic kits that can identify multiple variants, ensuring comprehensive surveillance. The persistent threat of new variants reinforces the necessity for robust testing frameworks, thereby driving the growth of the covid 19-diagnostics market in South America.

Government Initiatives to Enhance Testing Infrastructure

Government initiatives play a crucial role in shaping the covid 19-diagnostics market in South America. Various countries in the region are investing significantly in enhancing their testing infrastructure to combat the ongoing health crisis. As of November 2025, it is estimated that public health expenditures on diagnostic services have increased by 15% compared to previous years. These investments aim to improve laboratory capacities, expand testing sites, and ensure the availability of essential diagnostic tools. Additionally, governments are collaborating with private entities to streamline the distribution of testing kits, thereby facilitating quicker access for the population. Such initiatives not only bolster the testing capabilities but also instill public confidence in the healthcare system, ultimately driving growth in the covid 19-diagnostics market.