Regulatory Landscape

The evolving regulatory landscape in South Korea is a significant driver of the bfsi security market. Regulatory bodies are increasingly imposing stringent requirements on financial institutions to ensure the protection of consumer data and mitigate risks associated with cyber threats. Compliance with these regulations often necessitates substantial investments in security infrastructure and technologies. For instance, the Financial Services Commission has mandated that all financial institutions implement robust cybersecurity measures, which has led to a surge in demand for security solutions. This regulatory pressure is likely to continue shaping the bfsi security market, as organizations strive to meet compliance standards while safeguarding their operations. The potential penalties for non-compliance further incentivize firms to prioritize security investments.

Rising Cyber Threats

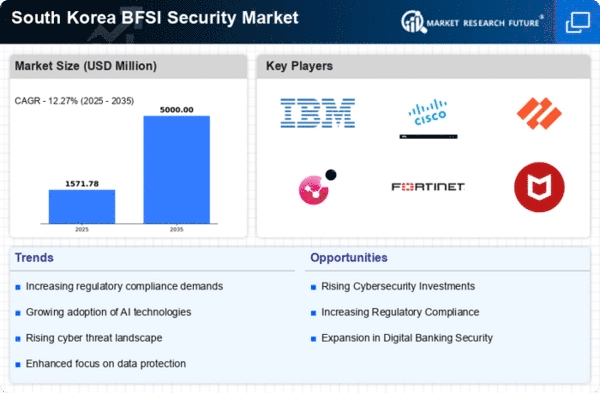

The BFSI Security Market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. In South Korea, financial institutions are particularly vulnerable to cyberattacks, which have surged by approximately 30% over the past year. This alarming trend compels organizations to invest heavily in advanced security measures to protect sensitive customer data and maintain trust. The bfsi security market is thus witnessing a shift towards more robust cybersecurity solutions, including intrusion detection systems and advanced encryption technologies. As cybercriminals continue to evolve their tactics, the need for comprehensive security frameworks becomes paramount, driving growth in the bfsi security market. Furthermore, the potential financial losses associated with data breaches, which can reach millions of dollars, further incentivizes firms to prioritize security investments.

Technological Advancements

Technological innovation plays a crucial role in shaping the bfsi security market. In South Korea, the adoption of cutting-edge technologies such as blockchain, biometrics, and cloud computing is transforming security protocols within financial institutions. For instance, the integration of biometric authentication methods has been shown to reduce fraud rates by up to 25%. As these technologies become more accessible, financial organizations are increasingly leveraging them to enhance their security postures. The bfsi security market is thus poised for growth as firms seek to implement these advanced solutions to safeguard their operations. Moreover, the ongoing development of artificial intelligence and machine learning algorithms is expected to further bolster security measures, enabling real-time threat detection and response capabilities.

Consumer Awareness and Demand

Consumer awareness regarding data privacy and security is significantly influencing the bfsi security market. In South Korea, a growing number of individuals are becoming cognizant of the risks associated with inadequate security measures, leading to increased demand for secure banking solutions. Surveys indicate that approximately 70% of consumers prioritize security features when selecting financial services. This shift in consumer behavior is prompting financial institutions to enhance their security offerings, thereby driving growth in the bfsi security market. As customers become more discerning, organizations are compelled to invest in advanced security technologies and practices to meet these expectations. Consequently, the emphasis on consumer trust and security is likely to shape the future landscape of the bfsi security market.

Collaboration and Partnerships

Collaboration among stakeholders is emerging as a vital driver in the bfsi security market. In South Korea, partnerships between financial institutions, technology providers, and cybersecurity firms are becoming increasingly common. These collaborations facilitate the sharing of knowledge, resources, and best practices, ultimately enhancing the overall security posture of the financial sector. For example, joint initiatives aimed at developing innovative security solutions have shown promise in addressing emerging threats. The bfsi security market is likely to benefit from these collaborative efforts, as they enable organizations to leverage collective expertise and resources. Furthermore, such partnerships can lead to the development of tailored security solutions that address specific challenges faced by financial institutions, thereby fostering growth in the bfsi security market.