Government Initiatives and Funding

Government initiatives play a crucial role in shaping the covid 19-diagnostics market in South Korea. The government has allocated substantial funding to enhance testing capabilities and improve diagnostic technologies. As of November 2025, investments in research and development have reached over $200 million, aimed at fostering innovation in diagnostic tools. These initiatives not only support the development of new testing methods but also ensure that existing technologies are accessible to the public. The proactive stance of the government in funding and promoting diagnostic advancements is likely to bolster the market's growth trajectory in the coming years.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning technologies into the covid 19-diagnostics market is transforming the landscape of disease detection and management. In South Korea, AI algorithms are increasingly utilized to analyze test results and predict outbreaks, enhancing the accuracy and efficiency of diagnostics. As of November 2025, the market for AI-driven diagnostic tools is projected to grow by 30% annually, reflecting a strong trend towards technological innovation. This integration not only streamlines the diagnostic process but also provides healthcare professionals with valuable insights, potentially leading to improved patient outcomes.

Increased Focus on Preventive Healthcare

The COVID-19 diagnostics market in South Korea is witnessing a shift towards preventive healthcare measures. This trend is characterized by a growing emphasis on regular testing and early detection of infections. As public awareness of health issues rises, individuals are more inclined to seek out diagnostic services proactively. The market has seen a 15% increase in routine testing services, indicating a shift in consumer behavior. This focus on prevention is likely to drive sustained growth in the diagnostics sector, as healthcare providers adapt to meet the evolving needs of the population.

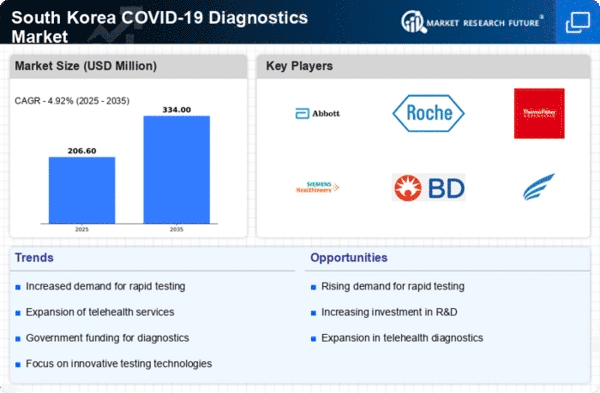

Rising Demand for Rapid Testing Solutions

The COVID-19 diagnostics market in South Korea experiences a notable surge in demand for rapid testing solutions. This trend is driven by the need for quick and accurate results, particularly in high-traffic areas such as airports and public events. The ability to deliver results within minutes enhances the efficiency of public health responses. As of November 2025, the market for rapid antigen tests has expanded significantly, with a reported growth rate of approximately 25% annually. This increasing demand for rapid testing solutions is likely to continue, as both healthcare providers and consumers prioritize speed and convenience in diagnostic processes.

Collaboration Between Public and Private Sectors

Collaboration between public and private sectors is emerging as a key driver in the covid 19-diagnostics market in South Korea. Partnerships between government agencies and private companies facilitate the sharing of resources, expertise, and technology. As of November 2025, several joint ventures have been established to enhance testing capabilities and develop innovative diagnostic solutions. This collaborative approach not only accelerates the development of new technologies but also ensures that testing remains accessible and efficient. The synergy between public and private entities is likely to foster a more resilient and responsive diagnostic market.