Rising Energy Demand

The gas turbine market in South Korea is experiencing a notable surge in demand due to the country's increasing energy requirements. As urbanization and industrialization continue to expand, the need for reliable and efficient power generation becomes paramount. The energy consumption in South Korea has been projected to grow at a rate of approximately 2.5% annually, necessitating the deployment of advanced gas turbine technologies. This trend is further supported by the government's commitment to transitioning towards cleaner energy sources, which enhances the attractiveness of gas turbines. The gas turbine market is thus positioned to benefit from this rising energy demand, as these systems offer flexibility and efficiency in meeting the growing power needs of both residential and commercial sectors.

Environmental Regulations

In South Korea, stringent environmental regulations are shaping the gas turbine market. The government has implemented policies aimed at reducing greenhouse gas emissions and promoting cleaner energy solutions. As a result, gas turbines, which emit significantly lower levels of pollutants compared to traditional coal-fired power plants, are becoming increasingly favored. The gas turbine market is likely to see growth as companies invest in cleaner technologies to comply with these regulations. The South Korean government aims to reduce its carbon emissions by 37% by 2030, which could drive further adoption of gas turbines. This regulatory landscape creates a favorable environment for the gas turbine market, encouraging innovation and investment in cleaner energy technologies.

Technological Innovations

Technological advancements are playing a crucial role in shaping the gas turbine market in South Korea. Innovations in turbine design, materials, and control systems are enhancing the efficiency and performance of gas turbines. For instance, the introduction of advanced materials allows for higher operating temperatures, which can improve efficiency by up to 10%. The gas turbine market is likely to benefit from these innovations, as they enable operators to achieve greater output while reducing fuel consumption. Furthermore, the integration of digital technologies, such as predictive maintenance and real-time monitoring, is expected to optimize the performance of gas turbines, making them more attractive to energy producers in South Korea.

Investment in Infrastructure

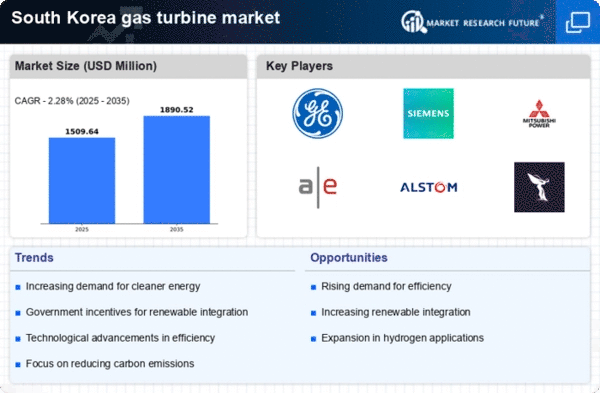

The gas turbine market in South Korea is poised for growth due to substantial investments in energy infrastructure. The government has allocated significant funding for the development of new power plants and the modernization of existing facilities. In 2025, it is estimated that investments in energy infrastructure will reach approximately $10 billion, with a considerable portion directed towards gas turbine technologies. This influx of capital is expected to enhance the operational efficiency and reliability of power generation systems. The gas turbine market stands to gain from these investments, as they facilitate the deployment of state-of-the-art gas turbine solutions that can meet the evolving energy demands of the nation.

Shift Towards Renewable Energy Integration

The gas turbine market in South Korea is witnessing a shift towards the integration of renewable energy sources. As the country aims to diversify its energy mix, gas turbines are increasingly being utilized as a complementary technology to support intermittent renewable sources like wind and solar. This trend is particularly relevant as South Korea targets a 20% share of renewables in its energy portfolio by 2030. The gas turbine market is likely to thrive as these systems provide the necessary flexibility and reliability to balance the grid. By serving as backup power sources, gas turbines can ensure a stable energy supply while facilitating the transition to a more sustainable energy landscape.