Market Share

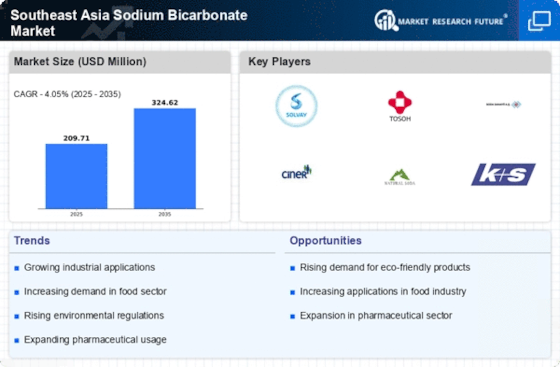

Southeast Asia Sodium Bicarbonate Market Share Analysis

Companies are making strategic moves to position their market shares within the overall Southeast Asia Sodium Bicarbonate Market by using various strategies. The competition among companies in the region's sodium bicarbonate market, driven by a variety of sectors such as food and beverages, pharmaceuticals, chemicals, etc., makes them adopt effective approaches. A popular strategy is differentiation, where firms focus on creating unique value propositions for their sodium bicarbonate products. They can develop special formulations targeting particular industries like pharmaceuticals that may require high purity grades or even custom blends for food processing. Through product differentiation, companies intend to specialize within a market segment that has specific demands from its customers in terms of sodium bicarbonate properties. Moreover, another approach through which a firm may gain market share is cost leadership. In this case, competitive pricing of the company's products is achieved through optimization of production processes and enhancement of operational efficiency as well as economies of scale. Market segmentation also remains a widely embraced strategy since organizations design their sodium bicarbonate to suit various geographical, demographic, or industrial segments. This enables firms to understand and address unique demands among different customer groups. For example, companies can target and capture specific market segments by designing product formulations in line with the tastes of the food industry or developing specialized grades for pharmaceuticals. Another notable aspect of Southeast Asia's Sodium Bicarbonate market strategies for attaining market share is collaboration and partnerships. They focus on synergies from collaboration with distributors, suppliers, and research institutions. Additionally, positioning for market share has sustainability aspects that are becoming increasingly important. Companies have become eco-friendly conscious in order to incorporate eco-friendly practices into their production process, source sustainable raw materials, and adopt responsible waste management systems due to an increase in environmental awareness. Further, companies seek new markets within Southeast Asia or beyond the region so as to broaden their customer base and reduce dependence on particular markets; hence, geographical diversification as a means of expanding one's business operations is employed across the region. The strategy involves conducting extensive market research activities, being aware of cultural peculiarities, and tailoring one's product offering to meet diverse consumer segment preferences.

Leave a Comment