Spain Personal Loans Market Overview:

The Spain Personal Loans Market Size was estimated at 1.63 (USD Billion) in 2023. The Spain Personal Loans Market Industry is expected to grow from 2.16 (USD Billion) in 2024 to 5.43 (USD Billion) by 2035. The Spain Personal Loans Market CAGR (growth rate) is expected to be around 8.724% during the forecast period (2025 - 2035).

Key Spain Personal Loans Market Trends Highlighted

In Spain, the personal loans market is witnessing notable trends driven by the increasing demand for accessible financing options among consumers. One of the key market drivers is the rising rate of household debt, which has prompted individuals to seek personal loans for various purposes, including home renovations, education, and debt consolidation. The improved economic conditions following the pandemic are also contributing to a more favorable lending environment. Recent trends show a growing preference for digital lending platforms as consumers become more accustomed to online services. The digitization of financial services is enhancing convenience and speed in loan applications, attracting young consumers who are tech-savvy and prefer a straightforward online experience.Furthermore, the popularity of P2P lending options is increasing, which widens the possibilities beyond banking institutions. Also, banks are responding to the changes in consumer behavior by providing more focused products that satisfy the needs of clients who need credit. There is a keen interest in customers being able to select favorable repayment terms. Available opportunities include the development of programs aimed at increasing the level of financial awareness and encouraging wiser lending.Furthermore, as sustainable practices gain traction, there is a growing market for eco-friendly loans designed to finance environmentally sustainable projects. These dynamics indicate a transformative phase within the Spain personal loans market, where innovation and consumer-centric approaches are shaping the future of lending in the region.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Spain Personal Loans Market Drivers

Increasing Consumer Demand for Personal Loans

The Spain Personal Loans Market Industry is experiencing significant growth driven by a surge in consumer demand for personal loans. In recent years, the number of personal loans granted in Spain has increased markedly, with 2022 alone witnessing over 1.3 million new personal loans valued at approximately 12 billion euros. This rise can be attributed to several factors, including the rising cost of living, which has led many individuals to seek additional financial support to cover expenses such as home repairs, education, and small business ventures.Furthermore, the Bank of Spain reported a growing trend among younger demographics, particularly millennials, who show greater willingness to leverage personal loans for immediate financial needs, indicating a structural shift in financial behavior. Enhanced digital banking solutions provided by major establishments such as Banco Santander and BBVA are also playing a pivotal role by making the application process for personal loans more accessible and user-friendly.As financial literacy improves in Spain, more consumers are likely to consider personal loans as a viable option, thus supporting the industry's growth trajectory.

Government Initiatives to Boost Lending

Government policies aimed at stimulating the economy directly impact the Spain Personal Loans Market Industry. In recent years, the Spanish government has enacted several initiatives and reforms to encourage lending and ensure financial stability, especially post-COVID-19. For instance, through programs like the ICO (Instituto de Crédito Oficial) loans, the government has facilitated credit access for individuals and businesses alike, providing a safety net during uncertain times.This initiative has led to a notable increase in personal loan uptake, especially among those facing financial hardships. Moreover, the government's commitment to supporting small and medium enterprises (SMEs) has created a favorable environment for personal loans, as many entrepreneurs seek cash flow support to sustain their operations. As the economy rebounds, these measures are expected to foster greater confidence in borrowing, thereby driving market growth.

Growth of Online Lending Platforms

The emergence of online lending platforms has significantly transformed the Spain Personal Loans Market Industry, enhancing competition and accessibility for borrowers. In Spain, the online lending sector has grown exponentially, with platforms such as Verdanza and Creditea leading the charge by offering streamlined applications and rapid funding solutions. According to industry data, online personal loan applications have surged by over 40% in the last two years, fueled by the convenience and speed that these digital solutions provide.This trend aligns with the global movement towards digitization in financial services, with Spain's younger population, who are more inclined to use technology for financial management, contributing to this growth. As regulatory measures continue to evolve and fintech companies innovate their offerings, this sector is poised to become increasingly influential in shaping the future of personal lending in Spain.

Rising Financial Literacy Among Consumers

A growing trend of financial literacy among Spanish consumers is increasingly driving the Spain Personal Loans Market Industry. Recent studies indicate that around 60% of Spaniards now possess a basic understanding of personal finance, a significant increase from previous years. Organizations like the Bank of Spain have been actively promoting financial education through various initiatives, including public workshops and online resources aimed at improving consumer understanding of credit products.This heightened awareness is leading to more informed borrowing decisions, where consumers are not only seeking loans for emergencies but are also utilizing them for planned investments such as home renovations or education. The positive impact of enhanced financial literacy on borrowing behavior is expected to continue, stimulating demand for personal loans in the coming years.

Spain Personal Loans Market Segment Insights:

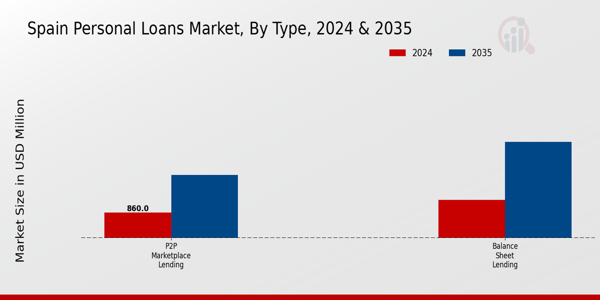

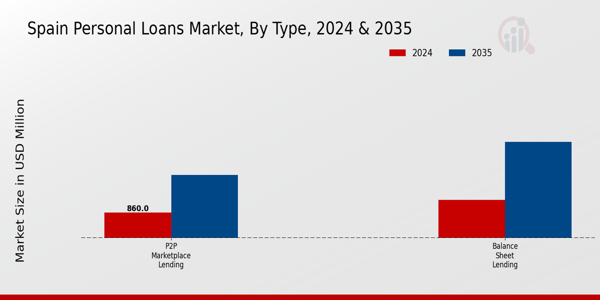

Personal Loans Market Type Insights

The Spain Personal Loans Market operates within a dynamic framework, shaped significantly by various loan types that cater to diverse consumer needs and preferences. Within this market, segments such as P2P Marketplace Lending and Balance Sheet Lending have garnered substantial attention, driven by changing consumer behaviors and advances in technology. P2P Marketplace Lending has emerged as a notable option, allowing individuals to borrow directly from other individuals without the need for traditional financial institutions as intermediaries. This segment's appeal lies in its ability to offer competitive interest rates, catering to those who may not qualify for conventional loans with banks. The increasing adoption of digital platforms in Spain further enhances the efficiency of P2P lending, making it an attractive choice among tech-savvy borrowers seeking flexibility and accessibility in their borrowing options. Moreover, Balance Sheet Lending remains a significant player in the Spain Personal Loans Market, characterized by traditional financial institutions that hold loans on their balance sheets rather than selling them off. This method is particularly advantageous for consumers seeking reliability and comprehensive support throughout the borrowing process, as established lenders often provide a sense of security and tailored financial services. The Balance Sheet Lending model allows institutions to maintain close relationships with borrowers, fostering trust and encouraging customer loyalty. Additionally, this segment tends to attract borrowers with prime credit scores, as these institutions often prefer individuals deemed lower risk, resulting in more favorable lending terms. The growth drivers behind both segments include the rising trend of personal debt among Spanish households, reflecting a shift in consumer spending habits, as well as a burgeoning digital landscape that supports innovative financial products. This transformation is further propelled by the increased need for flexible financing solutions in an evolving economy and changing lifestyle preferences among younger demographics. However, challenges such as regulatory compliance, interest rate fluctuations, and potential credit risks persist in both lending models. Despite these hurdles, opportunities abound as the demand for personal loans continues to rise, with consumers increasingly seeking personalized lending experiences tailored to their unique financial situations. Overall, as the Spain Personal Loans Market evolves, the segmentation through types like P2P Marketplace Lending and Balance Sheet Lending presents critical insights into the different avenues consumers explore to meet their borrowing needs.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Personal Loans Market Age Insights

The Spain Personal Loans Market shows a diverse segmentation based on age, reflecting the varying borrowing needs and financial behaviors across different life stages. Younger individuals, typically those aged less than 30, often seek personal loans for education, starting businesses, or consolidating debts, driving significant market engagement as they make financial decisions that often shape their future. The 30-50 age group generally represents the majority holding within the market, as these consumers typically require loans for larger purchases, such as homes or cars, or for family-related expenses.This segment is crucial as it encompasses individuals likely to have stable incomes and a greater credit history. Conversely, those older than 50 may seek loans for retirement planning, medical expenses, or investment opportunities, which can influence their borrowing patterns. The evolving trends in the Spain Personal Loans Market indicate a growing acceptance of personal financing options, highlighting the opportunities to cater specifically to these age groups. Additionally, economic conditions and financial literacy among different age segments further impact the overall Spain Personal Loans Market revenue and industry dynamics.Understanding these age-specific characteristics helps in tailoring products and marketing strategies in the competitive landscape of personal loans in Spain.

Personal Loans Market Marital Status Insights

The Spain Personal Loans Market exhibits noteworthy segmentation based on Marital Status, which plays a crucial role in understanding consumer behavior and lending patterns. With married individuals often holding a dominant position in the market, their need for personal loans typically aligns with significant life events such as home purchases, family expansion, or education for children. Meanwhile, single individuals are increasingly turning to personal loans for personal development or immediate financial needs, showing that their borrowing tendencies are often driven by different motivations compared to married borrowers.Additionally, the 'Others' category, which includes divorced, separated, or widowed individuals, presents a unique opportunity for financial institutions to tailor their offerings and address specific financial challenges faced by this group. This diversification in the population highlights the importance of a targeted approach in the Spain Personal Loans Market, allowing lenders to adapt strategies and products to meet the varied needs that arise from distinct marital statuses. By analyzing Spain Personal Loans Market segmentation and related data, lenders can optimize their product offerings and enhance customer satisfaction, driving sustained growth in the industry.Furthermore, demographic trends and evolving social norms in Spain are likely to influence borrowing patterns, making this an important area for ongoing market research and analysis.

Personal Loans Market Employment Status Insights

The Employment Status segment plays a significant role in the Spain Personal Loans Market, which has shown a steady increase in revenue. In Spain, the economic landscape includes a diverse workforce, primarily categorized into salaried individuals and business owners. Salaried individuals constitute a substantial proportion of the workforce, which is often viewed favorably by financial institutions due to their stable income streams. This stability leads to a higher likelihood of approval for personal loans, making it a dominant factor in the market.On the other hand, business owners also present unique opportunities, as they often seek personal loans to facilitate growth or personal investments. The increasing trend of entrepreneurship in Spain has bolstered the significance of this categorization, with many individuals looking for financial support to launch or expand their ventures. The overall growth of the employment sector in Spain, particularly post-pandemic recovery, contributes to the upward trajectory of the Spain Personal Loans Market. Understanding these segments enables lenders to tailor their offerings effectively, ensuring alignment with the evolving needs and preferences of borrowers in the region.

Spain Personal Loans Market Key Players and Competitive Insights:

The Spain Personal Loans Market exhibits a dynamic landscape characterized by a variety of financial institutions offering a range of products tailored to meet consumer needs. Intense competition exists among banks, credit institutions, and fintech companies, each seeking to capture market share through innovative solutions and targeted marketing strategies. As consumers increasingly demand flexibility, speed, and transparency in financial services, the sector has evolved to incorporate digital solutions that streamline the borrowing process. With the continuing impact of economic changes and consumer behavior shifts, understanding the competitive insights within this market becomes crucial for players aiming to succeed. The emergence of technology-driven lenders and changes in regulatory frameworks contribute to an ever-changing competitive environment that benefits consumers while challenging traditional lenders.Panda stands out in the Spain Personal Loans Market due to its unique approach to customer service and innovative lending solutions. The company's emphasis on providing personalized loan products allows it to cater effectively to diverse customer profiles, from individuals seeking quick loans for emergencies to those needing larger sums for significant life events. Panda's strengths lie in its capability to quickly process loan applications, often offering competitive interest rates and terms that attract borrowers. Furthermore, by leveraging digital platforms for an efficient application process, the company enhances user experience and builds customer loyalty. This commitment to service excellence and adaptability positions Panda favorably in Spain's competitive personal loans arena, enabling it to maintain a solid customer base and grow its brand presence.Banco Santander, as a key player in the Spain Personal Loans Market, offers a comprehensive suite of financial products, including personal loans, home equity loans, and credit lines tailored to meet various consumer needs. The bank's widespread presence in Spain, coupled with its extensive branch network and robust online banking platform, allows for greater accessibility and convenience for customers seeking to secure personal loans. One of Banco Santander's strengths is its recognized brand credibility and stability, which are supported by a history of successful financial services. The institution continues to innovate by introducing flexible borrowing options and competitive pricing. Its strategic approach often includes mergers and acquisitions that bolster its service offerings and market reach. By continuously adapting to market demands and consumer preferences, Banco Santander remains a formidable force in the personal loans sector within Spain, ensuring that it meets the evolving financial needs of its customers.

Key Companies in the Spain Personal Loans Market Include:

- Panda

- Banco Santander

- Liberbank

- Iban Wallet

- Evo Banco

- Bankia

- BBVA

- Kiva

- Cetelem

- Abanca

- Vivus

- CaixaBank

- ING

- Unicaja Banco

- Banco Sabadell

Spain Personal Loans Industry Developments

In Spain's personal loans market, recent developments indicate a growing competition among financial institutions. Banco Santander continues to expand its digital offerings, enhancing customer experience in personal lending through technology. Evo Banco and ING are pushing for innovation in their loan products, aiming to attract tech-savvy millennials. In April 2023, the acquisition of Liberbank by Unicaja Banco strengthened its market position, allowing for an expanded customer base and increased resources. The combined entity is focusing on providing more personalized loan solutions. Additionally, CaixaBank has reported a steady rise in personal loan demand, underscoring a recovering economy post-COVID-19. Kiva's initiatives in Spain are noteworthy for supporting underserved communities with microloans and promoting financial inclusion. As of August 2023, interest rates are generally low, contributing to a rise in borrowing, while institutions like BBVA and Bankia are seen pivoting towards sustainable finance offerings. The competition among key players is expected to drive innovation and better terms for consumers in the personal loans sector, reflecting the overall economic resilience and increasing demand for consumer credit within Spain.

Personal Loans Market Segmentation Insights

-

Personal Loans Market Type Outlook

-

P2P Marketplace Lending

-

Balance Sheet Lending

-

Personal Loans Market Age Outlook

-

Less Than 30

-

30-50

-

More Than 50

-

Personal Loans Market Marital Status Outlook

-

Personal Loans Market Employment Status Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

1.63 (USD Billion) |

| MARKET SIZE 2024 |

2.16 (USD Billion) |

| MARKET SIZE 2035 |

5.43 (USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

8.724% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Panda, Banco Santander, Liberbank, Iban Wallet, Evo Banco, Bankia, BBVA, Kiva, Cetelem, Abanca, Vivus, CaixaBank, ING, Unicaja Banco, Banco Sabadell |

| SEGMENTS COVERED |

Type, Age, Marital Status, Employment Status |

| KEY MARKET OPPORTUNITIES |

Rising digital lending platforms, Increasing demand for debt consolidation, Growth in e-commerce financing, Emergence of alternative credit scoring, Consumer preference for fast approvals |

| KEY MARKET DYNAMICS |

Economic conditions, Consumer credit demand, Regulatory environment, Interest rates trends, Digital lending growth |

| COUNTRIES COVERED |

Spain |

Frequently Asked Questions (FAQ) :

The projected market size of the Spain Personal Loans Market in 2024 is expected to be valued at 2.16 billion USD.

By 2035, the Spain Personal Loans Market is expected to be valued at 5.43 billion USD.

The expected CAGR for the Spain Personal Loans Market from 2025 to 2035 is 8.724 percent.

P2P Marketplace Lending is valued at 0.86 billion USD in 2024 and expected to reach 2.15 billion USD by 2035.

The Balance Sheet Lending segment is valued at 1.3 billion USD in 2024, with an expected rise to 3.28 billion USD by 2035.

Major players in the Spain Personal Loans Market include Panda, Banco Santander, Liberbank, and Iban Wallet among others.

The current economic environment may influence consumer borrowing behavior and, consequently, impact the Spain Personal Loans Market's growth trajectory.

Key trends in the Spain Personal Loans Market include the rise of digital lending platforms and increased consumer demand for quick and accessible loan options.

Challenges in the Spain Personal Loans Market include regulatory changes and increased competition among lending institutions.

Growing demand for personal loans and the expansion of online lending platforms present significant growth opportunities in the Spain Personal Loans Market.