Research Methodology – Global PERSONAL LOANS Market

Purchased Database:

- Includes company databases such as Hoover’s:This helps us identify financial information, industry competitive landscape, structure of the market Also, it serves as an important step in market sizing, especially in case of commodity-flow techniques.

- Industry databases, e.g., Factiva. helps us gain access to industry statistics, and KoL opinions & formulate

- Other sources include SME journals, and pertinent databases from third-party vendors to gain insights into:

- Procedure statistics

- Potential market related statistics

- Information on unmet needs

- Regional expenditure pattern

- Investment information or opportunity-based statistics

Following databases were used but are not limited to,

- Euromonitor

- Factiva

- Bloomberg

- Statista

- Hoovers

- Dun & Bradstreet

- CrunchBase

- ZoomInfo

- Pitchbook

MRFR’s Internal Database

- Includes our internal database of data points,collected because of previous research & studies and information made available via our database management

- Also includes internal audit reports & archives.

Secondary Sources:

- A list of secondary sources along with the information extracted from them will beavailableinthefinal

Notable examples include white papers, government statistics published by organizations like IRU, NGOs etc., KoL publications, company filings, investor documents etc.

Some of the sources used in the report include,

- IEEE

- Research Gate

- Science Direct

- Forbes

- McKinsey

- American Bankers Association (ABA)

- Consumer Bankers Association (CBA)

- Mortgage Bankers Association (MBA)

- National Association of Consumer Finance Associations (NACFA)

- National Association of Independent Financial Advisors (NAIFA)

- National Association of Real Estate Brokers (NAREB)

- National Foundation for Credit Counseling (NFCC)

Third Party Perspective:

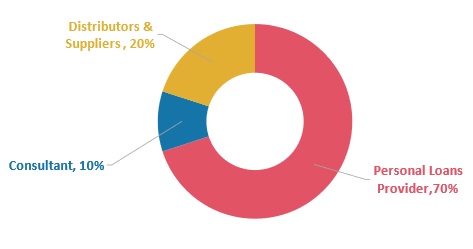

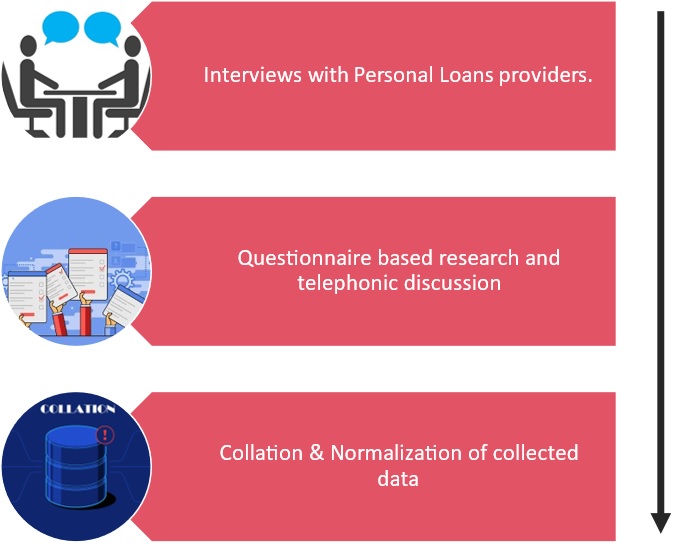

Primary Research

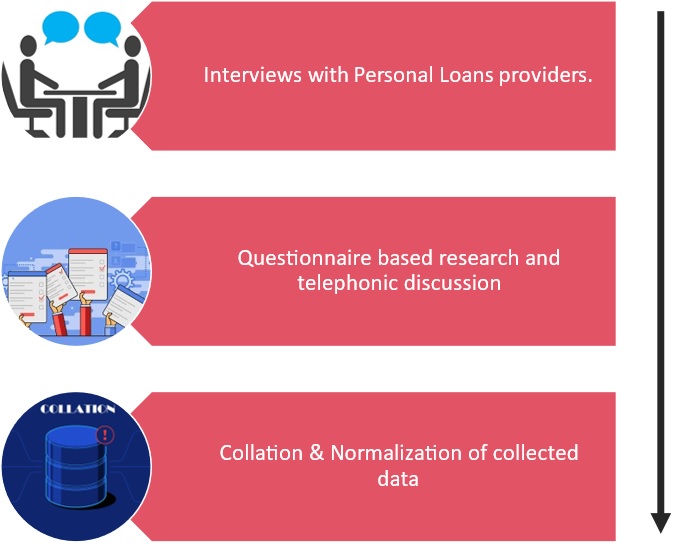

The primary interviews and surveys derive directions from extensive secondary research. Secondary research is a continuous process and is conducted at each level along the value chain.

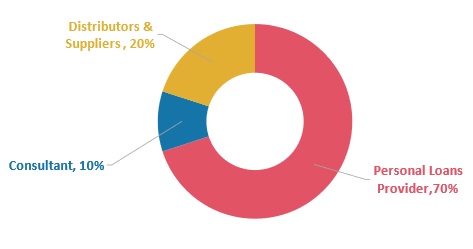

Interview Scope:

- Research tools: Questionnaire- based research and telephonic discussions

- Database: Paid vendors, LinkedIn, Hoover’s, Factiva, Sources extracted from previous pertinent studies

- Market scope: All segments within the scope of the Interviews of KoLs from non- English-speaking countries are conducted via our vendors and questionnaires.

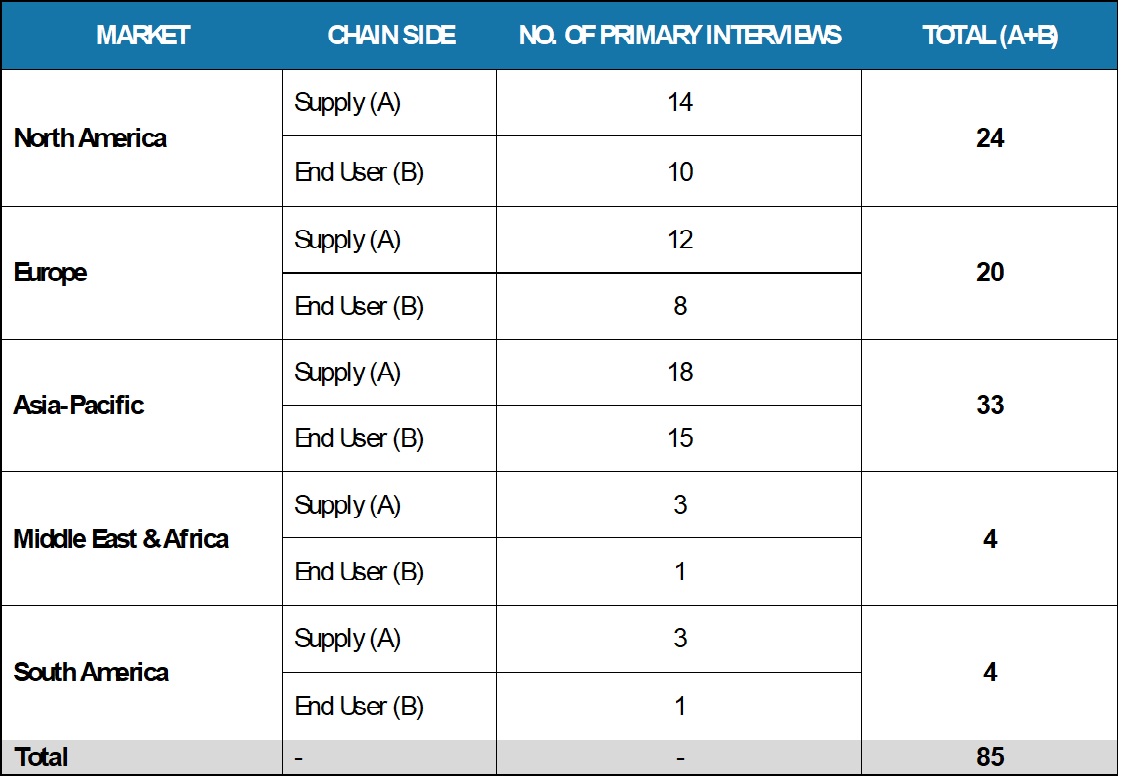

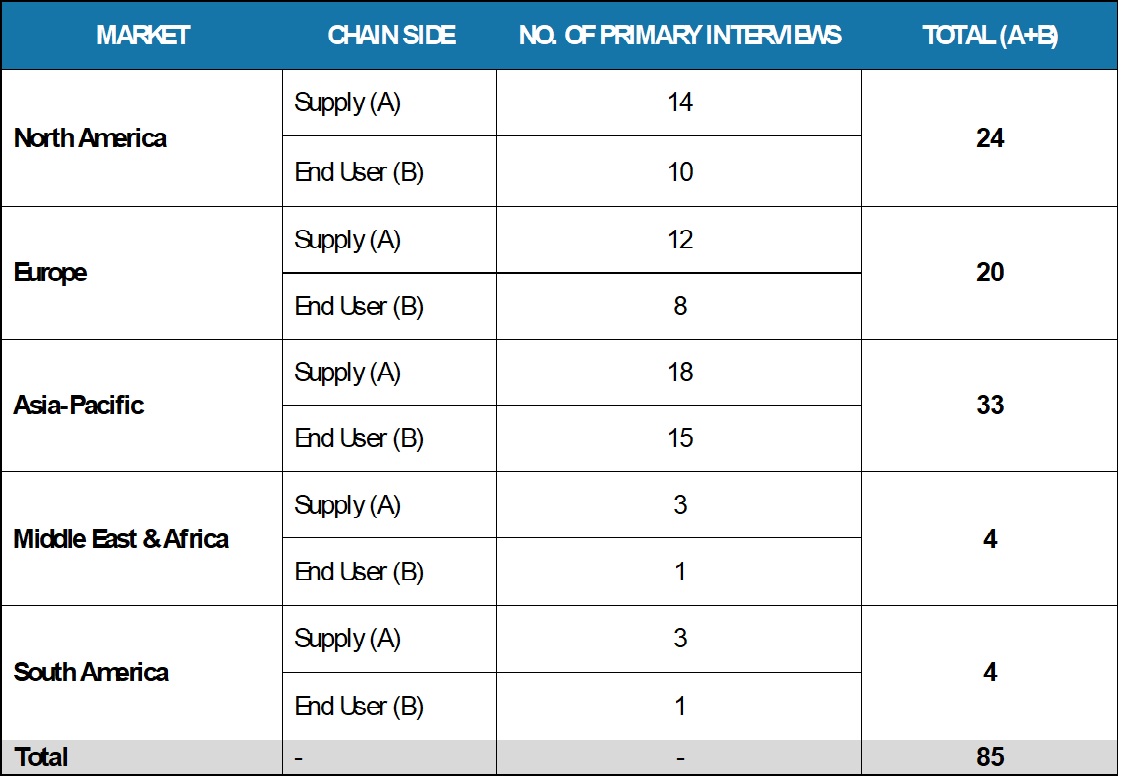

Sample size for the study:

Data Analysis

- Information procured from secondary and primary initiativesis then,analyzed by using the following tools/models:(apartiallist)

- Identifying variables and establishing the market impact

- Establishing market trends

- Analyzing future opportunities and market penetration rates by understanding product commercialization,regional expansion

- Analyzing reimbursement trends and changes in market dynamics to establish future

- Analyzing sustainability strategies adhered to by market participants in an attempt to determine the future course of the

- Analyzing historical market trends and super-imposing the monthe current and future variables to determine year-on-year

- Understanding procedure trends framework

- Keeping atrack of technological advancements inindividual segments

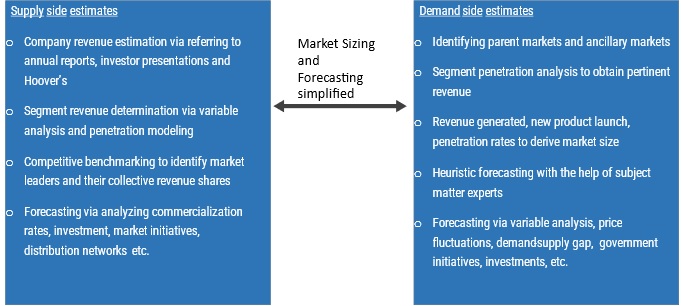

- Base numbers are established by analyzing the following:

- Company revenues and market share (this list generally includes the analysis of revenue published by publicly listed manufacturers)

- Derivation of market estimates via analysing parent and ancillary markets

- Modelselection:demand-basedbottom-up approach,rates-basedapproach,andmixed approach (topdownandbottomup)

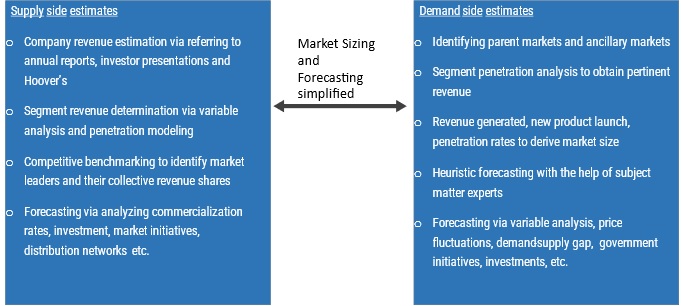

Data Analysis: Market Formulation:

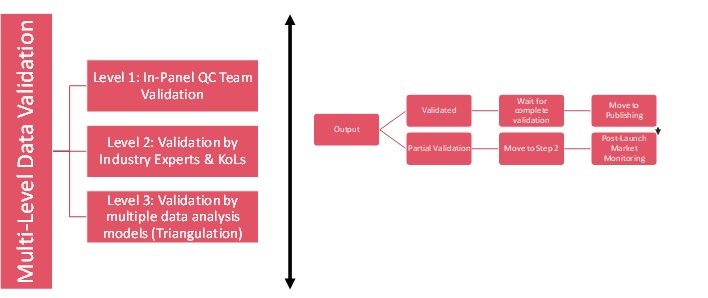

- This step involves the finalization of market This step on an internal level is designed to manage out puts from the Data Analysis step.

- Datanormalization

- The final market estimates & forecasts are then aligned and sent to industry experts in-panel quality control managers for

- This stepal so entails the finalization of the report scope and data representation

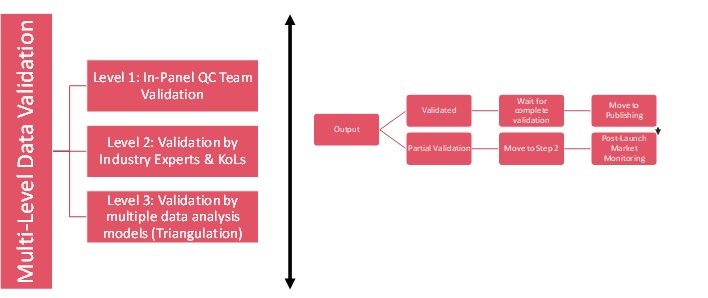

The process entails multiple levels of validation. All these steps are run in parallel, and the study is forwarded for publishing only if all three levels re

MARKET RESEARCH APPROACHES

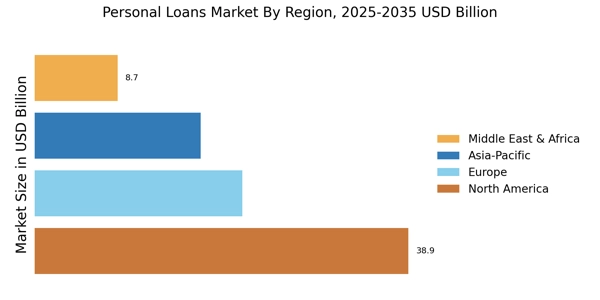

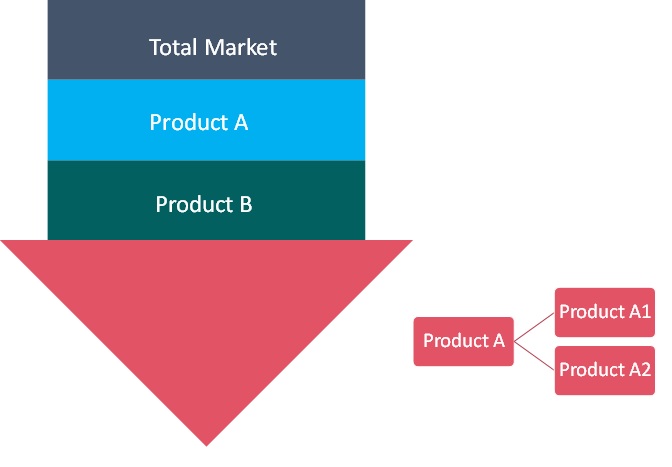

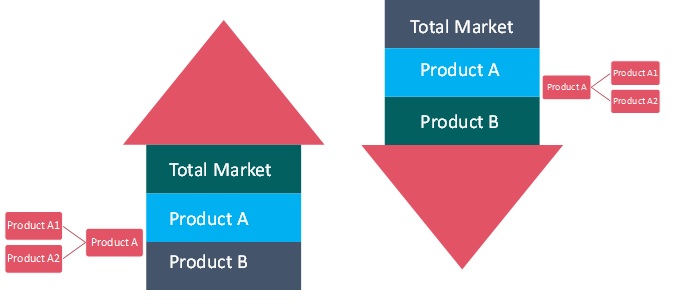

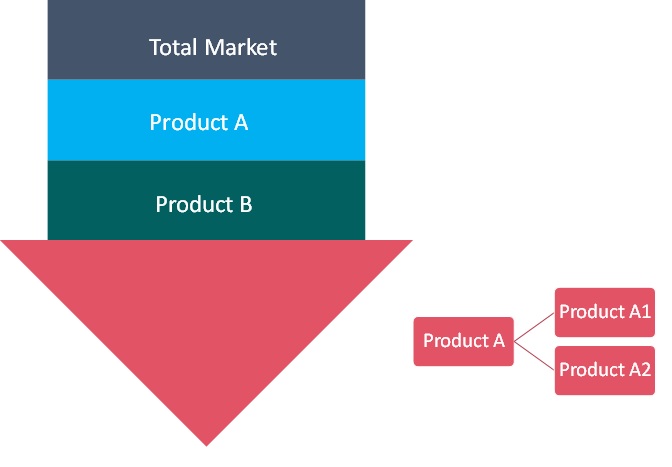

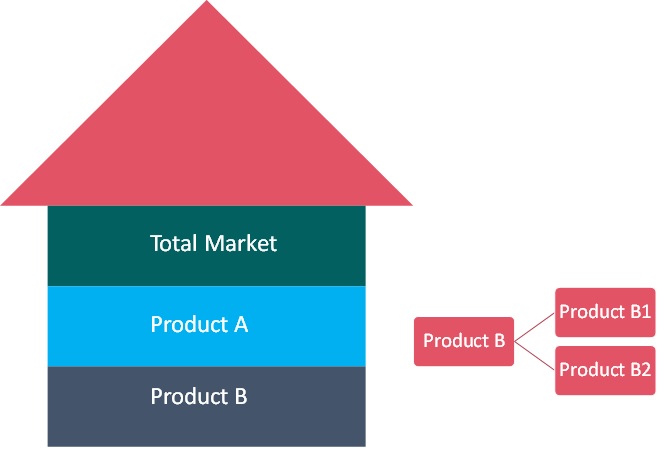

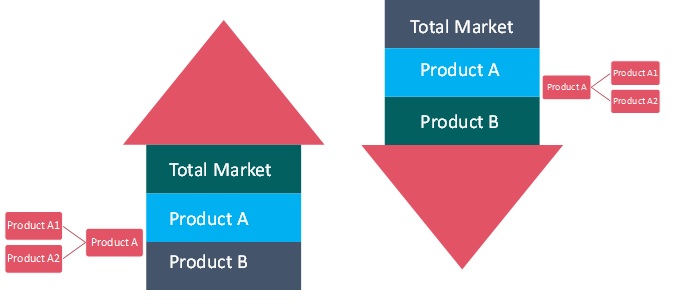

Bottom-up Demand Approach

- Demand estimation of each product across countries/regions summed to form the total market

- Variable analysis for demand forecasting

- Demand estimation via analyzing paid databases, and company financials either via annual reports or paid databases

- Primary interviews for data revalidation and insight collection

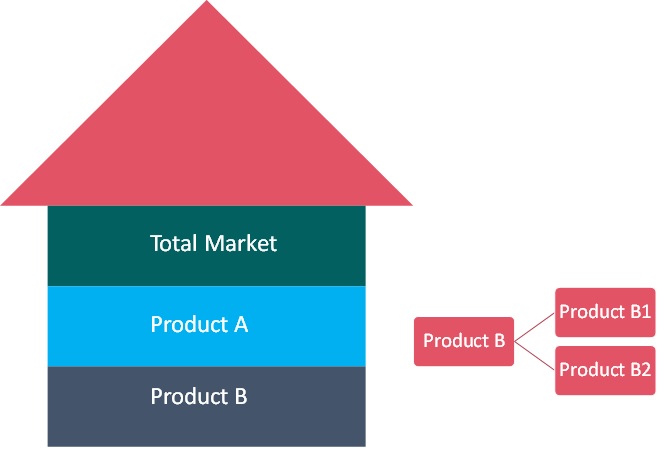

Top-Down Approach

- Used extensively for new product forecasting oranalyzing penetration levels

- Use of regression and multi-variate analyses for forecasting involves extensive use of paid and public databases

- Primary interviews and vendor based primary research for user preferences

Combined Approach

VALUE CHAIN BASED SIZING & FORECASTING

Penetrationmodeling for products

- Determining and forecasting penetration via analysing product features, availability of internal and external substitutes

- Heuristic estimation of year-on-year sales by conducting primary interviews with:

- Personal Loans providers

- Industry experts & KoLs

- QFD modelling for market share assessment (an example cited in the figure below)

- Referring to historic data to establish base

- Analysing current needs and determining penetration to estimate market size or

- Using unmet needs and capitalization rates to determine

- Trend analysis (based on year-on-year trending models)

QFD MODELING FOR MARKET SHARE ASSESSMENT

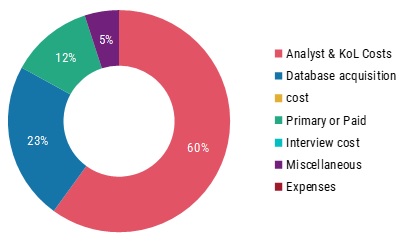

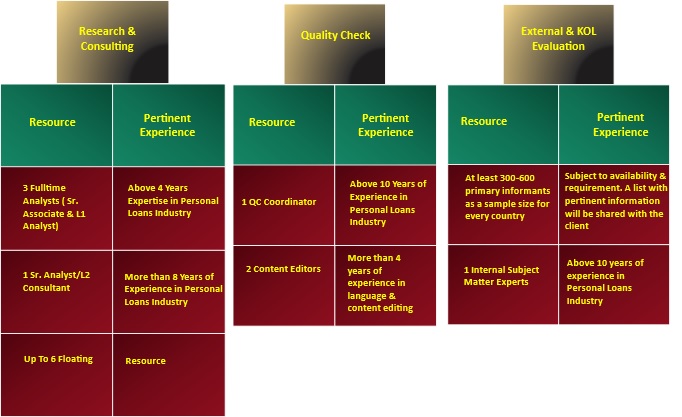

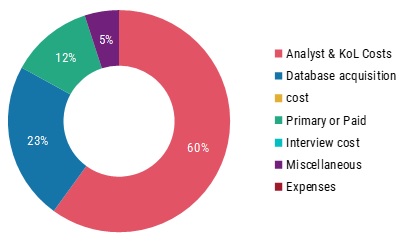

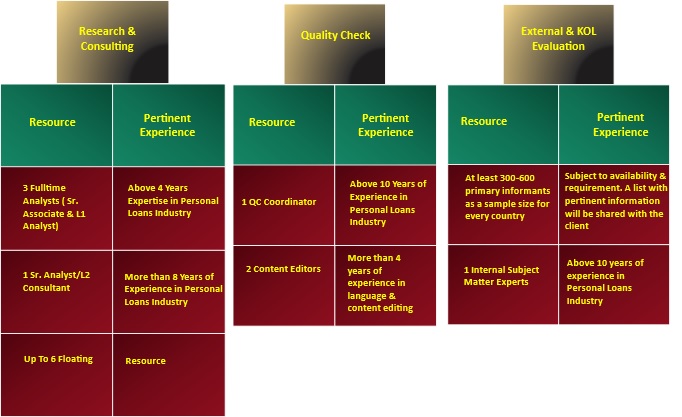

Resource Allocation & Cost Structure

COST STRUCTURE