Technological Advancements in Banking

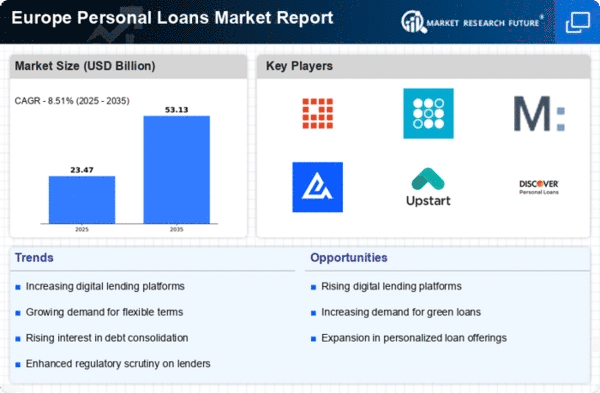

The personal loans market in Europe is experiencing a transformation due to rapid technological advancements in banking. Innovations such as artificial intelligence and machine learning are streamlining the loan application process, enhancing customer experience, and reducing operational costs. As of 2025, approximately 60% of personal loans are processed through digital channels, indicating a shift towards online lending. This trend is likely to continue, as consumers increasingly prefer the convenience of digital platforms. Furthermore, the integration of advanced analytics allows lenders to assess creditworthiness more accurately, potentially reducing default rates. Consequently, these technological improvements are expected to drive growth in the personal loans market, as they facilitate quicker approvals and more tailored loan products for consumers.

Rising Consumer Demand for Flexible Financing

In the personal loans market, there is a notable increase in consumer demand for flexible financing options. As individuals seek to manage their finances more effectively, the appeal of personal loans that offer customizable repayment terms is growing. Recent data suggests that around 45% of borrowers prioritize flexibility when choosing a loan product. This trend is particularly evident among younger demographics, who often prefer loans that can adapt to their changing financial situations. Lenders are responding by offering a variety of loan structures, including variable interest rates and extended repayment periods. This shift towards flexibility is likely to enhance competition within the personal loans market, as providers strive to meet the evolving needs of consumers.

Competitive Landscape and Market Consolidation

The personal loans market is currently characterized by a competitive landscape that is undergoing consolidation. As smaller lenders struggle to compete with larger financial institutions, there is a trend towards mergers and acquisitions. This consolidation is expected to enhance operational efficiencies and broaden product offerings, ultimately benefiting consumers. Recent analyses suggest that the top five lenders now control approximately 50% of the market share, indicating a shift towards fewer, more dominant players. This trend may lead to increased standardization in loan products, but it also raises concerns about reduced competition. As the personal loans market continues to evolve, the implications of this consolidation will be closely monitored by stakeholders.

Demographic Shifts and Changing Borrower Profiles

The personal loans market is witnessing significant demographic shifts that are influencing borrower profiles. An increasing number of millennials and Generation Z individuals are entering the market, bringing different financial needs and preferences. This younger demographic tends to favor online lending solutions and is more likely to seek personal loans for purposes such as education and travel. Data indicates that nearly 30% of personal loan borrowers are now under the age of 35, a notable increase from previous years. As lenders adapt their offerings to cater to these emerging borrower profiles, the personal loans market is likely to evolve, with a focus on digital engagement and tailored products.

Economic Recovery and Increased Consumer Confidence

The personal loans market in Europe is benefiting from a broader economic recovery, which appears to be fostering increased consumer confidence. As economic indicators show improvement, such as rising employment rates and higher disposable incomes, individuals are more inclined to take on personal loans for various purposes, including home improvements and debt consolidation. Recent statistics indicate that personal loan origination volumes have surged by approximately 20% in the past year, reflecting this renewed optimism. This trend suggests that as consumers feel more secure in their financial situations, they are more likely to engage with the personal loans market, driving further growth and innovation.