Top Industry Leaders in the Specialty Oilfield Chemicals Market

Specialty Oilfield Chemicals Market

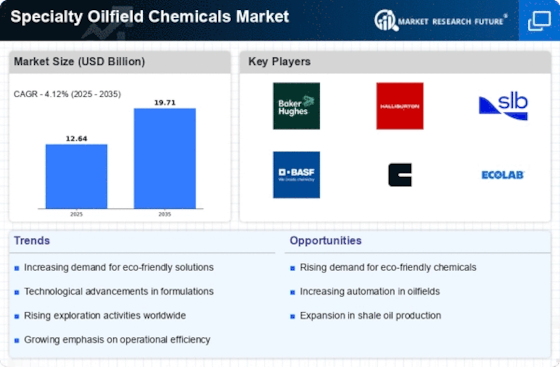

The specialty oilfield chemicals market, estimated at $10.65 billion in 2022, is a crucial cog in the oil and gas extraction machinery. These diverse chemicals optimize efficiency, enhance well productivity, and mitigate environmental impacts, making them indispensable for oilfield operations. The landscape, however, is fiercely competitive, with established giants and agile newcomers vying for dominance.

Strategies for a Sticky Situation:

-

Innovation Prowess: R&D reigns supreme. Companies like BASF, Solvay, and Ecolab are investing heavily in developing environmentally friendly, bio-based, and high-performance chemicals to meet evolving regulations and address industry challenges. Schlumberger's recent launch of an AI-powered drilling fluids platform exemplifies this trend. -

Geographic Expansion: Emerging markets with burgeoning exploration activities in North America and Asia Pacific are key targets. Halliburton's acquisition of Cudd Energy Services solidifies its presence in the Permian Basin, while Baker Hughes' joint venture in China taps into the region's shale gas potential. -

Diversification Play: Leading players are venturing beyond traditional applications. AkzoNobel's foray into water treatment solutions for fracking operations and Dow's focus on enhanced oil recovery (EOR) technologies showcase this strategic shift. -

Partnerships and Collaborations: Mergers and acquisitions are rife, consolidating market share and expertise. The integration of ChampionX into Baker Hughes strengthens their completions offerings, while Solvay's partnership with Huntsman boosts their production of high-performance drilling fluids.

Factors Dictating Market Share:

-

Technological Advancements: Chemicals enabling efficient drilling through complex formations, improved well stimulation, and effective corrosion control will command premium prices. -

Environmental Regulations: The push for sustainable practices is increasing demand for green chemicals and bio-based alternatives. Companies with eco-friendly solutions hold an edge. -

Regional Exploration & Production Activities: Rising shale gas exploration in North America and growing oilfield activities in Asia Pacific will drive demand in these regions. -

Oil Price Fluctuations: Volatile oil prices impact spending on exploration and production, affecting the demand for specialty chemicals.

Key Companies in the Specialty Oilfield Chemicals market include

- BASF SE (Germany)

- Solvay (Belgium)

- Akzo Nobel NV (Netherlands)

- Huntsman International LLC (US)

- Thermax Global (India)

- Sadara (Saudi Arabia)

- DowDuPont (US)

- Shrieve (US)

- SMC Oilfield Chemicals (US)

- Roemex Limited (UK)

- KMCO LLC (US)

- Global Drilling Fluids & Chemicals Limited (India).

Recent Developments:

-

July 2023: Dow Chemical announces a collaboration with a leading oilfield operator to develop new high-performance fracturing fluids for unconventional reservoirs. -

August 2023: Halliburton unveils a next-generation drilling fluid system designed to minimize environmental impact and enhance operational efficiency. -

September 2023: Baker Hughes secures a major contract with a national oil company in Asia Pacific for providing completion fluids and services for multiple offshore wells. -

October 2023: ExxonMobil introduces a new bio-based corrosion inhibitor, marking a significant step towards sustainable oilfield operations. -

November 2023: Schlumberger partners with a technology startup to develop AI-powered software for real-time optimization of fracking operations, reducing chemical usage. -

December 2023: The International Energy Agency projects a 1.7% increase in global oil demand in 2024, potentially stimulating the Specialty Oilfield Chemicals market.