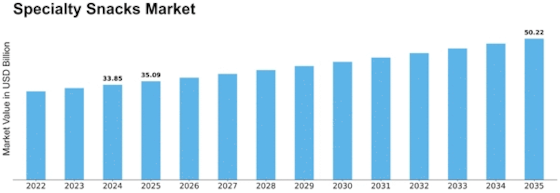

Specialty Snacks Size

Specialty Snacks Market Growth Projections and Opportunities

The specialty snacks market is influenced by several key factors that shape its growth and dynamics. One of the primary drivers of this market is the increasing consumer demand for unique and indulgent snack options. Specialty snacks, characterized by their premium ingredients, unique flavors, and innovative recipes, cater to consumers seeking more adventurous and gourmet snacking experiences. As consumer tastes evolve and become more sophisticated, there is a growing interest in specialty snacks that offer novel and exciting flavor profiles, textures, and culinary experiences.

Economic factors also play a significant role in shaping the specialty snacks market. Fluctuations in disposable income levels and consumer spending patterns can impact purchasing power and the willingness to invest in premium snack products. However, despite potential economic downturns, the demand for specialty snacks remains resilient, as consumers prioritize indulgence and treat themselves to premium snack options, particularly during special occasions or moments of relaxation.

Regulatory policies and standards are critical factors influencing the specialty snacks market. Compliance with food labeling regulations and quality standards is essential for snack manufacturers to ensure product safety and transparency. Additionally, certifications such as organic, non-GMO, or fair trade may influence purchasing decisions, particularly among consumers seeking cleaner and more sustainable snack options. Meeting these standards is crucial for maintaining consumer trust and confidence in specialty snack brands.

Technological advancements also impact the specialty snacks market, particularly in product development and packaging technologies. Innovations in ingredient sourcing, flavor extraction, and processing techniques enable snack manufacturers to create unique and innovative specialty snack offerings. Additionally, advancements in packaging materials and designs enhance product freshness, shelf life, and visual appeal, attracting consumers and differentiating brands in a crowded marketplace.

Competitive dynamics and market competition are significant factors in shaping the specialty snacks market. Established brands with strong market presence and loyal customer bases may dominate shelf space and consumer preferences, making it challenging for new entrants to gain traction. However, innovative startups and niche players can disrupt the market with unique flavor combinations, artisanal craftsmanship, and creative marketing strategies, appealing to specific consumer segments seeking premium snacking experiences.

Changing consumer lifestyles and dietary preferences also influence the specialty snacks market. As consumers become more health-conscious and seek out healthier snack alternatives, there is a growing demand for specialty snacks that offer functional benefits, such as protein-rich snacks, gluten-free options, or snacks made with natural and wholesome ingredients. Additionally, dietary trends such as plant-based diets, keto, paleo, or veganism have fueled interest in specialty snacks that cater to these dietary preferences and restrictions.

Moreover, demographic trends such as urbanization, busy lifestyles, and increasing multiculturalism have contributed to the growth of the specialty snacks market. Urban consumers, in particular, seek out convenient and on-the-go snack options that offer unique flavors and textures, reflecting diverse culinary influences and global food trends.

Leave a Comment