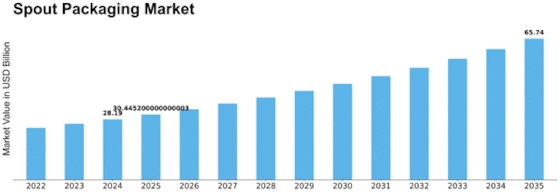

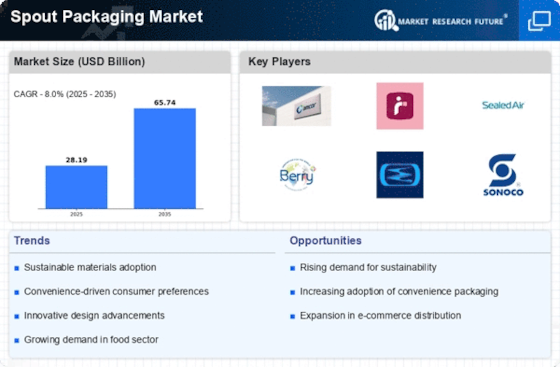

Spout Packaging Size

Spout Packaging Market Growth Projections and Opportunities

The spout packaging market is influenced by several key factors that shape its growth and development. One significant factor driving this market is the increasing demand for convenient and portable packaging solutions. Consumers are increasingly seeking packaging options that offer ease of use and portability, especially for on-the-go consumption of beverages, sauces, and other liquid or semi-liquid products. Spout packaging provides a convenient solution with its user-friendly design, allowing for easy pouring and dispensing without the need for additional utensils.

Another important market factor is the growing emphasis on sustainability and environmental responsibility. As awareness of environmental issues rises, consumers are becoming more mindful of their purchasing decisions and gravitating towards eco-friendly packaging options. Spout packaging manufacturers are responding to this trend by developing sustainable materials and innovative designs that minimize environmental impact. These efforts include the use of recyclable materials, reduced packaging waste, and the adoption of biodegradable alternatives, catering to environmentally conscious consumers.

Furthermore, market competition plays a significant role in driving innovation and product development within the spout packaging industry. With numerous players vying for market share, companies are constantly seeking ways to differentiate their products through unique features, designs, and functionalities. This competitive landscape fosters innovation in spout packaging technology, leading to advancements such as tamper-evident seals, resealable closures, and customized printing options, which enhance product visibility and consumer appeal.

Regulatory standards and requirements also influence the spout packaging market, particularly in terms of food safety and product labeling. Government regulations regarding packaging materials, manufacturing processes, and product labeling impact the design and production practices of spout packaging manufacturers. Compliance with these regulations is essential to ensure consumer safety, product quality, and legal compliance. Additionally, evolving regulatory frameworks related to sustainability and recycling further shape the landscape of spout packaging, driving the adoption of environmentally friendly practices and materials.

Moreover, shifting consumer preferences and lifestyle trends play a crucial role in driving demand within the spout packaging market. As consumers increasingly prioritize convenience, health consciousness, and customization, spout packaging offers a versatile solution that caters to these preferences. Whether it's single-serve beverage pouches, portion-controlled condiment packs, or customizable pouch designs for personal care products, spout packaging provides flexibility and adaptability to meet evolving consumer needs.

Technological advancements also contribute to the growth of the spout packaging market by enabling innovation and efficiency in manufacturing processes. Advances in packaging machinery, materials, and printing technologies enhance the production capabilities of spout packaging manufacturers, allowing for greater flexibility, speed, and quality in product development. Furthermore, integration of smart packaging technologies, such as RFID tags and QR codes, enables enhanced tracking, traceability, and interaction with consumers, driving engagement and brand loyalty.

Economic factors such as raw material prices, labor costs, and market trends also influence the dynamics of the spout packaging market. Fluctuations in raw material prices, particularly for plastics and other packaging materials, can impact production costs and profit margins for manufacturers. Similarly, changes in labor costs and market trends, such as shifts in consumer purchasing power or preferences, can influence demand and pricing strategies within the industry.

Leave a Comment