Steel Processing Size

Market Size Snapshot

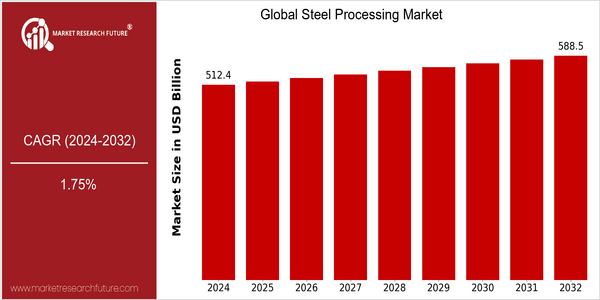

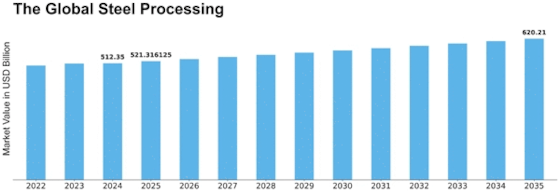

| Year | Value |

|---|---|

| 2024 | USD 512.35 Billion |

| 2032 | USD 588.5 Billion |

| CAGR (2024-2032) | 1.75 % |

Note – Market size depicts the revenue generated over the financial year

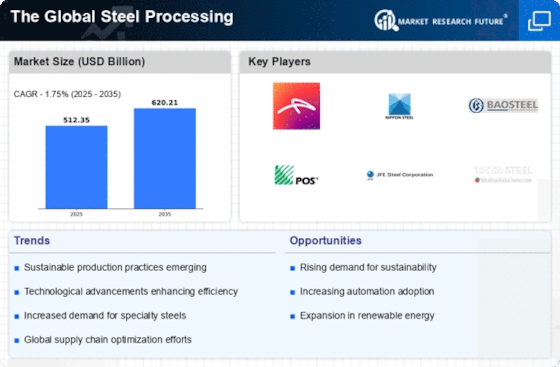

The global steel processing market is poised for steady growth, with a current market size of USD 512.35 billion in 2024, projected to reach USD 588.5 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 1.75% over the forecast period. The market's expansion can be attributed to several key factors, including increasing demand for steel in construction, automotive, and manufacturing sectors, as well as advancements in processing technologies that enhance efficiency and reduce costs.

Technological innovations, such as automation and digitalization in steel processing, are significantly driving market growth. These advancements not only improve production capabilities but also enable companies to meet stringent environmental regulations by reducing emissions and energy consumption. Major players in the industry, including ArcelorMittal, Tata Steel, and Nucor Corporation, are actively investing in research and development to innovate their processing techniques and expand their product offerings. Strategic initiatives, such as partnerships and collaborations aimed at enhancing supply chain efficiencies and sustainability practices, further underscore the dynamic nature of the steel processing market.

Regional Market Size

Regional Deep Dive

The Global Steel Processing Market is characterized by diverse dynamics across different regions, influenced by local economic conditions, regulatory frameworks, and technological advancements. In North America, the market is driven by a robust manufacturing sector and increasing demand for high-strength steel in automotive and construction applications. Europe showcases a strong emphasis on sustainability and innovation, with stringent regulations pushing for greener steel production methods. The Asia-Pacific region, particularly China and India, remains a powerhouse in steel production and processing, fueled by rapid industrialization and urbanization. Meanwhile, the Middle East and Africa are witnessing growth due to infrastructural developments and investments in the steel sector, while Latin America is focusing on enhancing its production capabilities to meet both domestic and export demands.

Europe

- The European Union's Green Deal aims to reduce carbon emissions, leading to increased investments in innovative steel processing technologies, such as hydrogen-based steelmaking, with companies like SSAB and ArcelorMittal at the forefront.

- Regulatory changes mandating stricter emissions standards are pushing European steel processors to adopt more sustainable practices, which is reshaping the competitive landscape.

Asia Pacific

- China's ongoing urbanization and infrastructure projects continue to drive demand for processed steel, with state-owned enterprises like Baowu Steel Group investing heavily in advanced processing technologies.

- India's National Steel Policy aims to increase production capacity and enhance the quality of steel, leading to significant investments in modern processing facilities and technologies.

Latin America

- Brazil's government has launched initiatives to boost the steel sector, focusing on modernization and sustainability, which is expected to enhance the competitiveness of local steel processors.

- Argentina is seeing a rise in demand for processed steel due to infrastructure projects, prompting local companies to invest in advanced processing technologies to meet this demand.

North America

- The U.S. has seen a surge in electric arc furnace (EAF) technology adoption, driven by its lower carbon footprint compared to traditional blast furnaces, with companies like Nucor leading the charge.

- Recent tariffs on imported steel have prompted domestic manufacturers to ramp up production, resulting in increased investments in steel processing facilities across the region.

Middle East And Africa

- The UAE's Vision 2021 initiative is fostering growth in the steel processing sector, with investments in new plants and technologies to support the construction boom in the region.

- South Africa's steel industry is undergoing transformation with the introduction of new regulations aimed at improving energy efficiency and reducing environmental impact, influencing processing methods.

Did You Know?

“Did you know that steel is the most recycled material in the world, with over 80% of steel produced globally coming from recycled sources?” — World Steel Association

Segmental Market Size

The Global Steel Processing Market is currently experiencing stable growth, driven by increasing demand for high-strength steel in various industries, including automotive and construction. Key factors propelling this segment include the rising need for lightweight materials to enhance fuel efficiency in vehicles and stringent regulatory policies aimed at reducing carbon emissions. Additionally, advancements in steel processing technologies, such as automation and digitalization, are further stimulating demand.

Currently, the adoption of advanced steel processing techniques is in the scaled deployment stage, with companies like ArcelorMittal and Tata Steel leading the way in innovative practices. Primary applications of this segment include the production of steel sheets and coils for automotive manufacturing and construction materials. Notable trends accelerating growth include sustainability initiatives, such as the push for recycled steel and eco-friendly production methods. Technologies like artificial intelligence and machine learning are shaping the evolution of steel processing, optimizing production efficiency and quality control.

Future Outlook

The Global Steel Processing Market is poised for steady growth from 2024 to 2032, with a projected market value increase from $512.35 billion to $588.5 billion, reflecting a compound annual growth rate (CAGR) of 1.75%. This growth trajectory is underpinned by the rising demand for steel in various sectors, including construction, automotive, and infrastructure development, particularly in emerging economies. As urbanization accelerates and infrastructure projects expand, the demand for processed steel is expected to rise, leading to increased market penetration and usage rates across multiple industries.

Key technological advancements and policy drivers will significantly shape the market landscape. Innovations in steel processing techniques, such as automation and digitalization, are enhancing efficiency and reducing production costs, thereby attracting investments. Additionally, sustainability initiatives and stricter environmental regulations are pushing steel processors to adopt greener practices, including the use of recycled materials and energy-efficient technologies. As a result, the market is likely to witness a shift towards more sustainable steel processing methods, aligning with global efforts to reduce carbon emissions and promote circular economy principles. Overall, the Global Steel Processing Market is set to evolve, driven by both demand dynamics and transformative technological advancements.

Leave a Comment