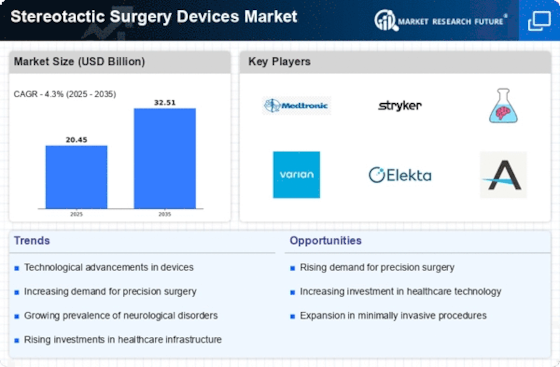

Market Analysis

In-depth Analysis of Stereotactic Surgery Devices Market Industry Landscape

The market dynamics of stereotactic surgery devices are shaped by various factors, including technological advancements, increasing prevalence of neurological disorders, and regulatory considerations. Stereotactic surgery involves the precise localization and targeting of specific areas within the brain or other body parts using a three-dimensional coordinate system. This minimally invasive approach offers several benefits, including reduced risk of complications and shorter recovery times, driving demand for stereotactic surgery devices.

One key driver of market growth is the rising prevalence of neurological disorders, such as Parkinson's disease, essential tremor, and brain tumors. As the global population ages and lifestyle factors contribute to the increasing incidence of these conditions, there is a growing need for effective treatment options. Stereotactic surgery devices enable neurosurgeons to precisely target and ablate diseased tissue or deliver therapeutic agents to the affected area, providing patients with better outcomes and improved quality of life.

Technological advancements play a crucial role in driving innovation and expanding the capabilities of stereotactic surgery devices. Manufacturers are continually developing new imaging modalities, such as magnetic resonance imaging (MRI) and computed tomography (CT), to improve preoperative planning and intraoperative navigation. Additionally, advancements in robotic-assisted surgery and image-guided systems enable greater precision and accuracy during stereotactic procedures, enhancing patient safety and surgical outcomes.

The regulatory landscape also influences the market dynamics of stereotactic surgery devices, with regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) setting standards for safety and efficacy. Obtaining regulatory approval for new devices can be a lengthy and costly process, requiring manufacturers to invest in rigorous testing and clinical trials. However, regulatory clearance is essential for gaining market access and building trust among healthcare providers and patients.

Furthermore, reimbursement policies and healthcare financing mechanisms impact the adoption of stereotactic surgery devices and the accessibility of these procedures to patients. In countries with publicly funded healthcare systems, reimbursement decisions are often based on cost-effectiveness assessments and budgetary constraints, which can vary depending on regional preferences and healthcare priorities. Private insurance coverage and out-of-pocket expenses also play a role in determining patient access to stereotactic surgery, particularly for innovative technologies with higher upfront costs.

Global market trends, such as the increasing demand for minimally invasive procedures and the growing adoption of precision medicine, are driving the expansion of the stereotactic surgery devices market. Minimally invasive techniques offer several advantages over traditional open surgery, including smaller incisions, reduced pain, and faster recovery times. Additionally, the emergence of precision medicine approaches, such as personalized targeting of tumor cells based on genetic and molecular characteristics, is revolutionizing the treatment of neurological disorders and driving demand for advanced stereotactic surgery devices.

Leave a Comment