Top Industry Leaders in the Styrene Acrylic Emulsion Polymer Market

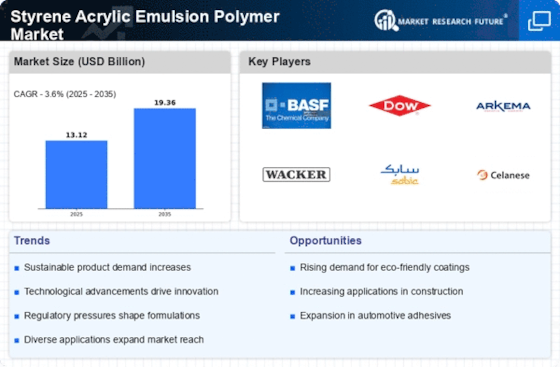

Styrene Acrylic Emulsion Polymer Market

The Styrene Acrylic Emulsion Polymer (SAEP) market is a dynamic space witnessing consistent growth driven by diverse applications like paints & coatings, textiles, adhesives, and paper industries. Understanding the competitive landscape requires analyzing key players, market share factors, recent developments, and strategic maneuvers shaping the industry. Here's a comprehensive overview encompassing these aspects:

Industry Leaders and Strategies:

-

Dow: Maintains the top position with a strong global presence, diverse product portfolio, and focus on R&D for sustainable solutions. Recent strategies include capacity expansions in Asia and collaborations for bio-based SAEP development. -

Celanese: Holds a significant market share, emphasizing technological advancements and product differentiation. They acquired Chemtura's emulsion polymer business in 2020, expanding their offerings and geographic reach. -

Lubrizol Corporation: Known for its high-performance and specialty SAEPs, they cater to niche applications like oilfield chemicals and lubricants. Strategic acquisitions and partnerships drive their growth, and sustainability initiatives like low-VOC products are gaining traction. -

H.B. Fuller: A major player in adhesives and sealants, they leverage their expertise in SAEP technology for tailored solutions. Acquisitions and joint ventures are key strategies, along with a focus on environmentally friendly products. -

Chemrez Technologies: Specializes in high-performance, water-based polymers with a strong presence in North America. They focus on innovation and customer-specific solutions, expanding their product portfolio through strategic partnerships.

Factors Influencing Market Share:

-

Product Portfolio: Offering a diverse range of SAEPs catering to various applications and performance requirements is crucial. -

Production Capacity and Geographical Reach: Having a well-established global network and efficient production facilities ensures market leadership. -

Technological Innovation: Continuous investment in R&D for improved performance, sustainability, and cost-effectiveness is essential. -

Sustainability Initiatives: Growing demand for eco-friendly and bio-based solutions is shaping market dynamics. -

Strategic Partnerships and Acquisitions: Collaborations and mergers can expand reach, product offerings, and technological capabilities.

Key Players

- Celanese Corporation

- Pexi Chem Private Limited.

- The Dow Chemical Company

- Fuller

- Acquos

- Xyntra Chemicals B.V.

- The Lubrizol Corporation

Recent News :

March 2021: To enhance the production of vinyl acetate monomer (VAM) and emulsion polymers, Celanese Corporation announced the schedule of manufacturing facility expansions, debottlenecking initiatives, and new building throughout Europe and Asia.

In July 2022, BASF SE erected an acrylic dispersions production plant at Dahej in India, which could serve coatings, construction, adhesives and paper industries for South Asian markets.

Lanxess AG has formed a joint venture with Advent International for High-Performance Engineering Polymers in May 2022.

Asahi Kasei has launched AZP low birefringence transparent polymer on a full-scale basis starting in May 2022. AZP was created by Asahi Kasei as a new low-birefringence polymer using molecular-level birefringence control. Samples have been given to possible customers, and there are good results, which led to initial sales.

One of the leading industry players, BASF Industries developed an innovative cross-linking capability with an ultra-low-VOC coating formula through unique polymer architecture in February 2022.

In January 2020, Celanese Corporation announced its plans for business expansion across the world connected with emulsion polymers. The company mainly focused on debottlenecking V.A.E production plants located in the Netherlands, China and Nanjing.