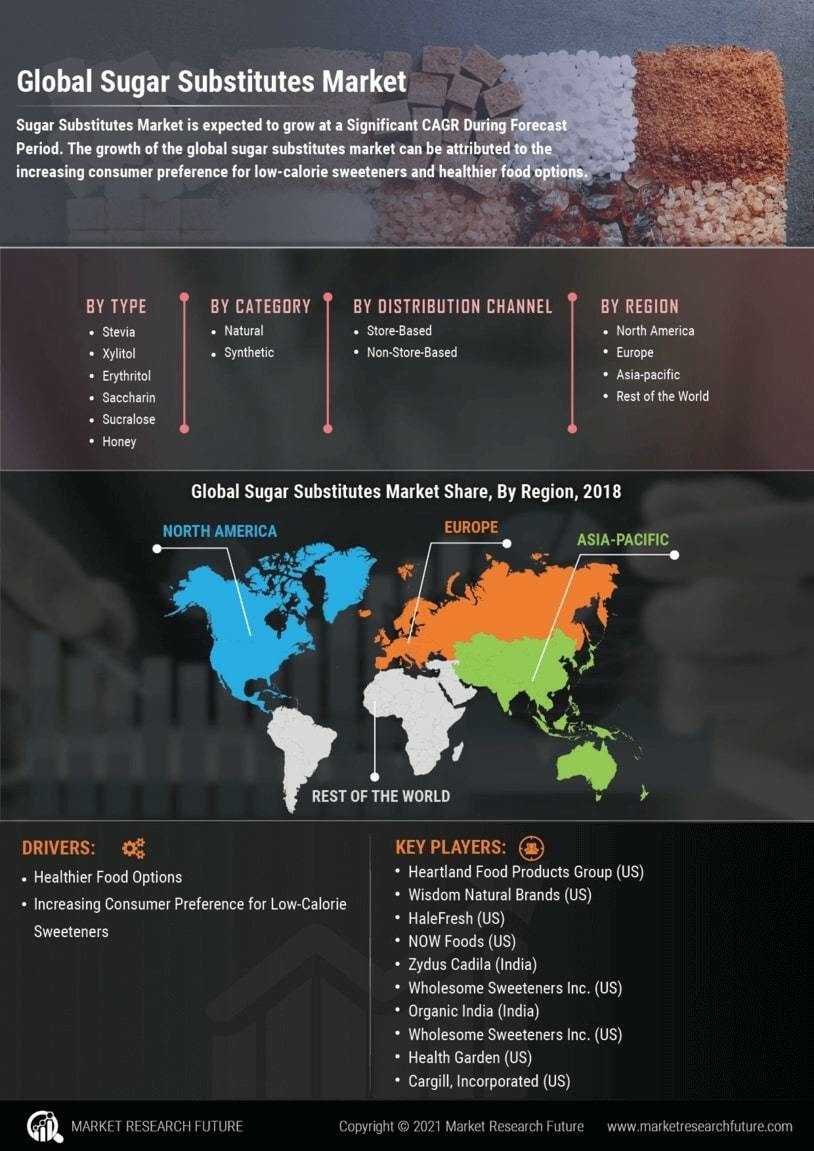

Rising Health Consciousness

The increasing awareness regarding health and wellness among consumers appears to be a primary driver for the Sugar Substitutes Market. As individuals become more informed about the adverse effects of excessive sugar consumption, they are actively seeking alternatives that can satisfy their sweet cravings without compromising their health. This trend is reflected in market data, which indicates that the demand for sugar substitutes has surged, with a projected growth rate of approximately 6.5% annually over the next five years. Consumers are gravitating towards products that offer lower calorie counts and minimal impact on blood sugar levels, thereby propelling the Sugar Substitutes Market forward. This shift in consumer behavior suggests a long-term commitment to healthier lifestyles, which is likely to sustain the growth of sugar substitutes in various food and beverage applications.

Consumer Demand for Clean Label Products

The growing consumer preference for clean label products is significantly impacting the Sugar Substitutes Market. Shoppers are increasingly scrutinizing ingredient lists and seeking products that are free from artificial additives and preservatives. This trend is particularly evident among health-conscious consumers who prioritize transparency and natural ingredients in their food choices. Market data indicates that the clean label segment is projected to grow at a rate of approximately 9% over the next few years, with sugar substitutes playing a pivotal role in this movement. As manufacturers respond to this demand by incorporating natural sweeteners into their offerings, the Sugar Substitutes Market is likely to experience a surge in popularity, as consumers gravitate towards products that align with their values of health and sustainability.

Regulatory Support for Healthier Options

Regulatory frameworks promoting healthier food options are emerging as a crucial driver for the Sugar Substitutes Market. Governments and health organizations are increasingly advocating for reduced sugar consumption to combat rising obesity rates and related health issues. This has led to the implementation of policies that encourage food manufacturers to reformulate products with lower sugar content, thereby creating a favorable environment for sugar substitutes. Market data suggests that regions with stringent regulations on sugar content are witnessing a notable increase in the adoption of sugar substitutes, with some markets reporting growth rates exceeding 7% annually. As regulatory bodies continue to emphasize the importance of healthier diets, the Sugar Substitutes Market is poised to expand, driven by the need for compliant and appealing product formulations.

Technological Advancements in Sweeteners

Technological innovations in the development of sweeteners are significantly influencing the Sugar Substitutes Market. Advances in extraction and processing techniques have led to the creation of new, high-quality sugar substitutes that mimic the taste and texture of traditional sugar. For instance, the introduction of stevia and monk fruit sweeteners has gained traction due to their natural origins and favorable health profiles. Market data indicates that the segment of natural sweeteners is expected to witness a compound annual growth rate of around 8% in the coming years. These advancements not only enhance the sensory attributes of sugar substitutes but also expand their applications across various sectors, including baking, beverages, and dairy products. Consequently, the Sugar Substitutes Market is likely to benefit from ongoing research and development efforts aimed at improving product offerings.

Expansion of Food and Beverage Applications

The diversification of applications for sugar substitutes across the food and beverage sector is emerging as a key driver for the Sugar Substitutes Market. As manufacturers explore innovative ways to incorporate sugar alternatives into their products, the range of applications continues to expand. From baked goods to beverages and dairy products, sugar substitutes are being utilized to enhance flavor profiles while reducing caloric content. Market data suggests that the beverage segment, in particular, is experiencing rapid growth, with an expected increase of around 10% in the use of sugar substitutes over the next few years. This expansion not only caters to the evolving preferences of consumers but also positions the Sugar Substitutes Market as a versatile solution for manufacturers aiming to meet the demand for healthier options.