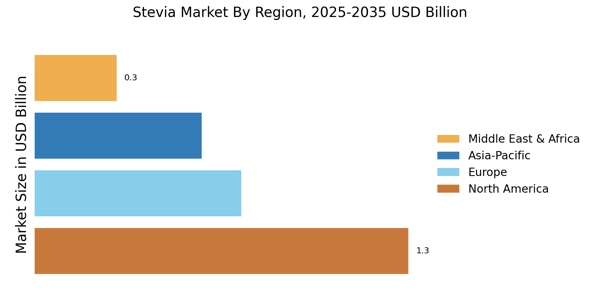

North America : Market Leader in Stevia Market

North America Stevia MarketNorth America is the largest onemarket for stevia, accounting for approximately 45% of the global share. The region's growth is driven by increasing consumer demand for natural sweeteners, health consciousness, and regulatory support for stevia products. The FDA's approval of steviol glycosides as a safe sweetener has further catalyzed market expansion. The U.S. leads the market, followed closely by Canada, which holds about 15% of the market share.

The competitive landscape in North America is robust, featuring key players such as Cargill, Pure Circle, and Stevia Market First. These companies are investing in R&D to enhance product offerings and meet consumer preferences for healthier alternatives. The presence of established distribution channels and growing partnerships with food and beverage manufacturers are also contributing to the market's growth, ensuring a steady supply of stevia products across various sectors.

Europe : Emerging Market for Stevia Market

Europe Stevia market is rapidly emerging as a significant player market for stevia, currently holding about 25% of the global market share. Spain stevia market, and France stevia market are key players responsible behind this market’s continuous growth. The growth is fueled by increasing health awareness among consumers and a shift towards natural sweeteners in food and beverages. Regulatory bodies, such as the European Food Safety Authority (EFSA), have recognized stevia as a safe alternative, which has encouraged its adoption across various sectors. The UK and Germany stevia market are the largest markets in Europe, contributing significantly to the overall demand.

The competitive landscape in Europe is characterized by a mix of local and international players, including Cargill and GLG Life Tech. Companies are focusing on product innovation and sustainability to cater to the evolving consumer preferences. The presence of stringent regulations regarding food safety and labeling is also shaping the market dynamics, pushing companies to ensure compliance while enhancing product quality and transparency.

Asia-Pacific : Emerging Powerhouse in Stevia Market

Asia-Pacific is witnessing a significant surge in the stevia market, currently holding around 20% of the global share. The region's growth is driven by rising health consciousness, increasing demand for low-calorie sweeteners, and favorable agricultural conditions for stevia cultivation. Countries like China and India are leading the market, with China being the largest producer of stevia, contributing to about 15% of the global market share. The China stevia market remains the dominant global force in raw material production, currently commanding the largest stevia market share through its massive leaf-harvesting operations and advanced high-purity extraction facilities.

The market for stevia in India is expanding rapidly as major beverage companies reformulate their products to meet the rising demand for natural sweeteners, ensuring that the stevia market in India transitions from a niche health segment into a mainstream commodity. Regulatory support for natural sweeteners is also a key driver in this region.

The competitive landscape in Asia-Pacific is diverse, with key players such as Zhejiang Huakang Pharmaceutical and Hunan Huachang Food leading the market. These companies are focusing on expanding their production capacities and enhancing product quality to meet the growing demand. The region's unique agricultural advantages and increasing investments in stevia cultivation are expected to further boost market growth, making it a focal point for stevia production and innovation.

Middle East and Africa : Untapped Potential for Stevia Market

The Middle East and Africa region is still in the nascent stages of the stevia market, holding approximately 10% of the global share. However, the potential for growth is significant due to increasing health awareness and a shift towards natural sweeteners. Countries like South Africa and the UAE are beginning to adopt stevia in various food and beverage applications, driven by changing consumer preferences and regulatory support for healthier alternatives. The region's market is expected to grow as more consumers seek low-calorie options. The competitive landscape is gradually evolving, with emerging players looking to capitalize on the growing demand for stevia. Local companies are beginning to explore partnerships with international firms to enhance their product offerings and distribution networks. As awareness of stevia's benefits increases, the market is likely to attract more investments, paving the way for innovation and expansion in the coming years.