Market Trends

Key Emerging Trends in the Sulfur Dioxide Market

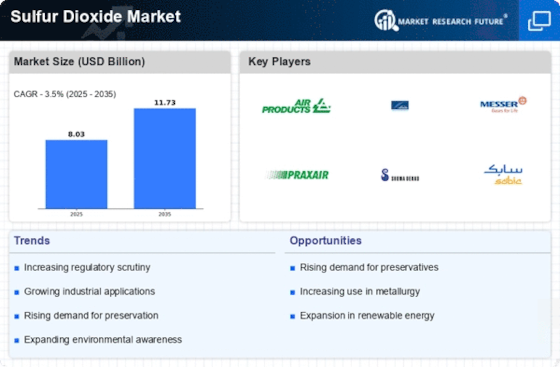

The Sulfur Dioxide market is experiencing notable trends and growth opportunities driven by its diverse applications in industries such as food processing, pulp and paper production, chemical manufacturing, and environmental protection. Sulfur dioxide, a chemical compound composed of sulfur and oxygen, is valued for its versatile properties as a preservative, bleaching agent, reducing agent, and chemical intermediate. One prominent trend in the Sulfur Dioxide market is the increasing demand for sulfur dioxide as a food preservative and antioxidant in the food processing industry. Sulfur dioxide is commonly used to extend the shelf life of fruits, vegetables, and processed foods by inhibiting microbial growth, preventing enzymatic browning, and maintaining product freshness, driving market growth in the food industry.

Moreover, the Sulfur Dioxide market is influenced by its applications in pulp and paper production for bleaching wood pulp and reducing lignin content. Sulfur dioxide gas is used in the sulfite pulping process to bleach wood pulp and remove lignin, resulting in brighter and whiter paper products. With the growing demand for paper and packaging materials in e-commerce, packaging, and printing industries, there is a sustained demand for sulfur dioxide as a bleaching agent in the pulp and paper industry, driving market growth.

Another key trend in the Sulfur Dioxide market is the use of sulfur dioxide in chemical manufacturing for producing sulfuric acid, sulfur dioxide derivatives, and specialty chemicals. Sulfur dioxide is a key raw material for the production of sulfuric acid, which is widely used in various industries such as fertilizers, metal processing, wastewater treatment, and battery manufacturing. Additionally, sulfur dioxide is used to produce sulfur dioxide derivatives such as sodium bisulfite, sodium metabisulfite, and sulfur dioxide polymers, which find applications as antioxidants, reducing agents, and chemical intermediates in pharmaceuticals, textiles, and water treatment, driving market growth in the chemical manufacturing sector.

Furthermore, the Sulfur Dioxide market is influenced by its role in environmental protection and air pollution control. Sulfur dioxide emissions from industrial processes, combustion of fossil fuels, and volcanic eruptions contribute to air pollution, acid rain, and environmental degradation. As governments implement regulations and emission control measures to reduce sulfur dioxide emissions and mitigate air pollution, there is a growing demand for sulfur dioxide scrubbers, flue gas desulfurization systems, and sulfur dioxide monitoring equipment in industries such as power generation, oil and gas, and manufacturing, driving market growth in the environmental protection sector.

The COVID-19 pandemic has impacted the Sulfur Dioxide market, causing disruptions in supply chains, changes in consumer behavior, and fluctuations in industrial activity. However, the pandemic has also highlighted the importance of food preservation, hygiene, and environmental sustainability, driving greater demand for sulfur dioxide in food processing, pulp and paper production, and environmental protection. As economies recover and industries adapt to the new normal, the demand for sulfur dioxide is expected to rebound, driven by its essential applications in various industries and its role in supporting public health and environmental sustainability.

Leave a Comment