Super Absorbent Polymer Size

Super Absorbent Polymer Market Growth Projections and Opportunities

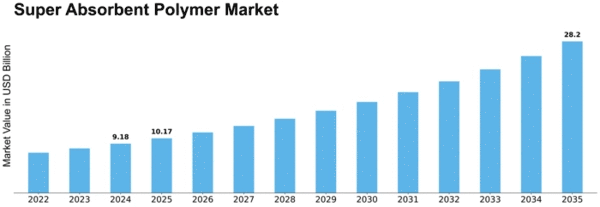

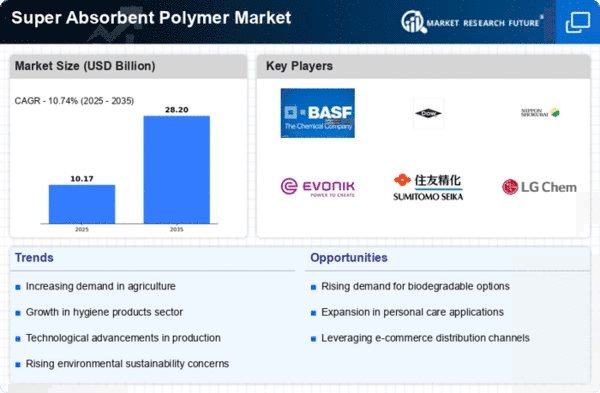

The market size of Super Absorbent Polymer (SAP) is shaped by several factors that collectively influence its dynamics and growth. The major driver for the SAP Market is the extensive application of superabsorbent polymers in various sectors, with an emphasis on hygiene and the agricultural industry. Manufacturers of diapers, adult incontinence products, and feminine hygiene products make use of SAPs because they have a greater capacity to retain water. The size of the super absorbent polymer market was $6.76 billion in 2022. This represented an increase from $7.79 billion in 2023 to $15.20 billion by 2030 at a CAGR of 10.70%. One of the key drivers for the SAP Market is the hygiene product industry. They are incorporated into absorbent hygiene products to improve their performance and functionality. The agriculture sector is yet another significant driving force for the SAP Market. They can be used as agricultural water retention systems to enhance soil moisture conservation and minimize irrigation runoff losses, thus improving irrigation efficiency, among others, in the agriculture sector. Technological advancements and innovations in SAP formulations are crucial factors shaping the Super Adsorbent Polymer Market. Continuous research and development lead to improvement in these superabsorbent polymers, making them more efficient, degradable, and pocket-friendly. Environmental regulations and sustainability considerations are some of the factors shaping this market called SAP Market. The growing concern over environmental impact has led companies to introduce biodegradable or eco-friendly super absorbent polymers into their production lines. As companies face mounting pressure from regulators to come up with environmentally friendly alternatives, there has been increased focus on developing bio-degradable and eco-friendly SAPs.Compliance with strict environmental regulations along with responsible sourcing mechanisms supports its transformation. A drive towards reduced ecological impacts, as well as sustainable water governance practices by industry, influences the market at large. Consumer preferences, together with market trends, also play a critical role in determining the SAP market dynamics. Increasingly, consumers are becoming more aware of environmental sustainability, product safety and hygiene, and agricultural products in particular, leading to rising interest in eco-friendly, efficient formulations containing SAPs. The market is adaptive to end-user industry trends where SAPs are instrumental in obtaining high performance, comfort, and sustainability objectives. Competitive pricing and the availability of alternative materials are major factors that determine the SAP Market. Crucially, companies adopting these products have to consider whether it would be more cost-effective to use SAP instead of any other water-absorbent material or traditional farming practices. Additionally, there could be substitutes available, such as bio-based super absorbents or different water retention technologies, that may either support or hinder market advancement. The development in pricing trends, production efficiency, and overall cost competitiveness of super-absorbing polymers influences the changes made by the SAP Market due to shifts in supply-demand fundamentals.

Leave a Comment