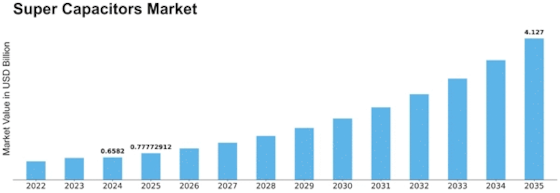

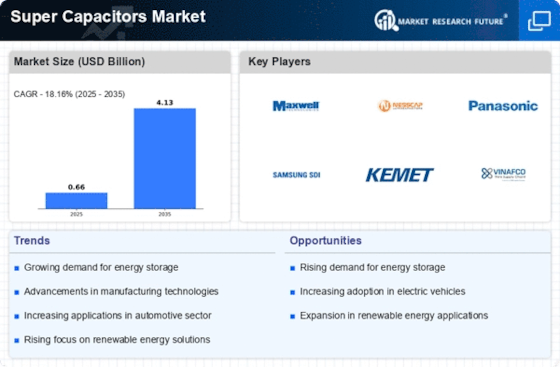

Super Capacitors Size

Super Capacitors Market Growth Projections and Opportunities

Constant effort is being made to enhance super capacitors in order to make them more energy-efficient, longer-lasting, and less expensive. As technology and knowledge in the field of materials science have advanced, better super capacitors have become a reality. Because of this, they have many more applications currently. Super capacitors are becoming more and more important with the release of new technology. The rate of market change is incredible.

The rising popularity of electric vehicles is significantly impacting the need for super capacitors in the automotive industry. To improve charging times, battery life, and general performance, several hybrid and electric vehicles are getting super capacitors. Fast charging and discharging cycles are no problem for electric vehicles, particularly when they generate power via braking. This improves their performance and makes them more eco-friendly. More and more modern vehicles need very huge capacitors. This exemplifies their significance in meeting the ever-evolving demands of transportation.

More and more individuals want cellphones and other portable gadgets, which alters the market dynamics. We need compact, reliable power banks since there are so many laptops, smart devices, and other electronic aids in circulation. Due to its ability to provide brief spikes of electricity, super capacitors are ideal for applications such as these. A growing number of consumers are looking for energy-efficient devices, which is driving increasing demand for super capacitors.

Government regulations and statutes are a major source of market shifts. All throughout the globe, super capacitors are progressively becoming more user-friendly. The goal is to promote energy-efficient products that are beneficial for the environment. People are more inclined to employ energy storage solutions if regulations, tax incentives, and financing make them more accessible. Yet, super capacitors find more applications thanks to stringent climate regulations that encourage the development of innovative technologies and the reduction of reliance on fossil fuels.

Several things are at play, such as the way the market works, how fierce the competition is, and the goals of the companies that are fighting. More and more, companies in the super capacitor business are joining forces through partnerships, mergers, and teamwork to make their goods better and get more customers. By stimulating innovation and facilitating the discovery of better methods to accomplish things like increase manufacturing efficiency while decreasing costs, these actions contribute to a more robust and competitive market.

Leave a Comment