Market Analysis

In-depth Analysis of Superabsorbent Polymers Market Industry Landscape

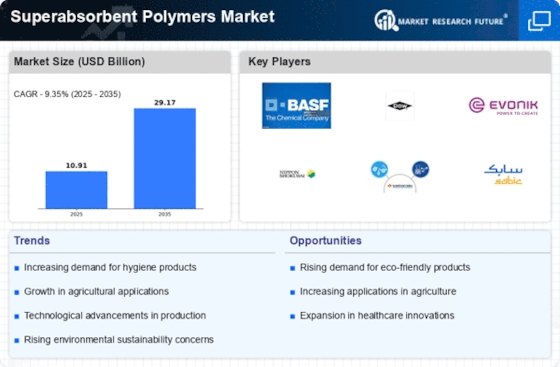

The dynamics of the Superabsorbent Polymers (SAP) market show a fascinating interaction between a number of different factors that, taken as a whole, have an effect on the industry's development and trends. The following are key factors influencing the Superabsorbent Polymers Market: Developing Interest in Cleanliness Items: The rising interest for superabsorbent polymers in cleanliness items like diapers and grown-up incontinence items is one of the essential drivers of the SAP market. The capacity of SAP to retain and hold a lot of fluid makes it a vital part in upgrading the exhibition of these cleanliness things. Farming Applications: The agricultural sector is increasingly utilizing superabsorbent polymers, particularly in dry regions. Since SAPs are used in horticulture to improve crop yield, reduce water system recurrence, and further develop soil water maintenance, they are a viable option for cultivating's water board. Advancement and Item Improvement: Progressing innovative work endeavours inside the business are prompting the presentation of cutting edge SAP items with further developed execution attributes. Producers are zeroing in on creating bio-based and harmless to the ecosystem superabsorbent polymers, lining up with the developing accentuation on manageability across ventures. End-Client Enterprises: Healthcare, agriculture, and packaging are just a few of the various end-user industries that the Superabsorbent Polymers Market serves. The adaptability of SAPs adds to their far-reaching reception, as they offer remarkable advantages across different applications, driving interest from various areas. Natural Worries and Guidelines: Controllers are upholding severe rules in regard to the usage of superabsorbent polymers because of developing ecological mindfulness. Makers are adjusting to these guidelines by creating eco-accommodating other options and supportable creation cycles to address natural worries. Trends in Geographical Markets: Geologically, the Asia-Pacific district rules the Superabsorbent Polymers Market because of the rising populace, expanding extra cash, and a developing interest for cleanliness items. North America and Europe likewise contribute fundamentally to the piece of the pie, driven by a deeply grounded cleanliness item industry and the reception of cutting edge rural practices. Price Variability of Raw Materials: The market elements are affected by the unpredictability in the costs of natural substances utilized in the development of superabsorbent polymers. Vacillations in the costs of acrylic corrosive, a critical unrefined substance, influence the general expense structure for makers, influencing the seriousness of items on the lookout. Serious Scene: The Superabsorbent Polymers Market is portrayed by extreme rivalry among vital participants endeavoring to acquire an upper hand. To build their item contributions and lay out a more grounded traction on the lookout, organizations are investing their amounts of energy into vital unions, consolidations, and acquisitions.

Leave a Comment