Top Industry Leaders in the Surveillance Radar Market

Strategies Adopted:

Technological Innovation: Key players invest heavily in research and development to develop advanced radar systems with enhanced capabilities such as longer detection ranges, higher resolution, and improved target tracking.

Market Diversification: Companies focus on expanding their product portfolios to cater to various applications, including air defense, border surveillance, maritime security, and ground-based surveillance, to address diverse customer needs.

Strategic Partnerships: Collaboration with government agencies, defense contractors, and research institutions helps companies access new markets, leverage complementary technologies, and enhance their competitive position.

Global Presence: Establishing a strong global presence through partnerships, joint ventures, and acquisitions enables companies to tap into international markets and secure contracts from foreign governments and defense organizations.

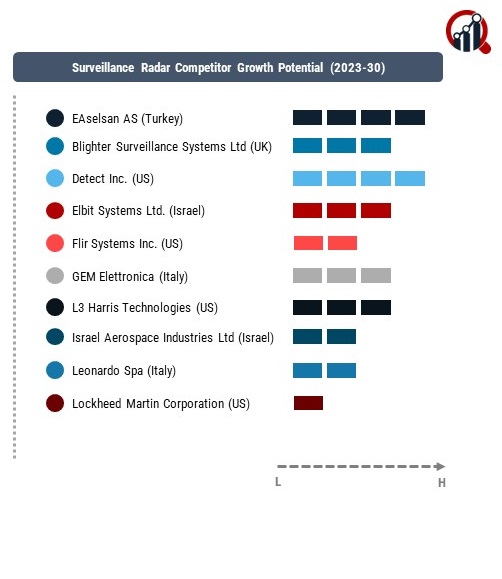

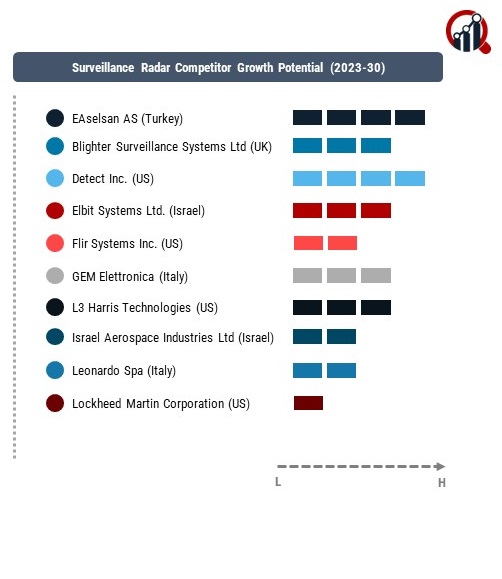

Key Companies in the Surveillance Radar market include.

EAselsan AS (Turkey)

Blighter Surveillance Systems Ltd (UK)

Detect Inc. (US)

Elbit Systems Ltd. (Israel)

Flir Systems Inc. (US)

GEM Elettronica (Italy)

L3 Harris Technologies (US)

Israel Aerospace Industries Ltd (Israel)

Leonardo Spa (Italy)

Lockheed Martin Corporation (US)

Factors for Market Share Analysis:

Performance and Reliability: The performance and reliability of surveillance radar systems play a crucial role in determining market share, with customers preferring solutions that offer high detection accuracy, minimal false alarms, and robust performance in various environmental conditions.

Integration Capabilities: Radar systems that can seamlessly integrate with existing defense systems, command and control networks, and sensor platforms are favored by customers seeking interoperability and system compatibility.

Affordability and Cost-effectiveness: Cost considerations are paramount for defense procurement agencies, making affordability and lifecycle costs key factors in the selection of surveillance radar solutions.

Customer Support and Service: Companies that offer comprehensive customer support, maintenance services, and training programs to ensure the optimal operation and longevity of their radar systems are likely to attract and retain customers.

Industry News:

Next-Generation Radar Systems: News about the development and deployment of next-generation radar systems, including active electronically scanned array (AESA) radars and multifunctional phased array radars (MPARs), highlight industry efforts to enhance surveillance capabilities.

Export Contracts and Partnerships: Reports of export contracts and partnerships between radar manufacturers and international customers or local defense contractors signify market expansion opportunities and increased competitiveness on the global stage.

Radar Upgrades and Modernization Programs: Updates on radar upgrades and modernization programs, including retrofitting older radar systems with new technology and capabilities, showcase companies' efforts to extend the lifespan and enhance the performance of existing assets.

Industry Consolidation and Mergers: News of industry consolidation, mergers, and acquisitions indicate ongoing restructuring and realignment within the surveillance radar market, potentially reshaping the competitive landscape and market dynamics.

Current Company Investment Trends:

Digital Signal Processing: Investments in digital signal processing (DSP) technologies enable companies to improve radar performance, increase detection capabilities, and enhance situational awareness through advanced signal processing algorithms and techniques.

Multi-Functional Radar Systems: Companies are investing in the development of multi-functional radar systems capable of performing multiple surveillance tasks simultaneously, such as air traffic control, weather monitoring, and ground surveillance, to address evolving defense requirements.

Counter-UAS Capabilities: With the proliferation of unmanned aerial systems (UAS), investments in counter-UAS radar technologies, including detection, tracking, and neutralization capabilities, are on the rise to mitigate the growing threat posed by rogue drones.

Export Market Expansion: Key players are investing in expanding their presence in emerging defense markets through partnerships, joint ventures, and local production facilities to capitalize on growing demand for surveillance radar solutions worldwide.

Surveillance Radar Industry Developments

For Instance, September 2021

HENSOLDT introduced a new radar product line the Quadome radar system for naval surveillance and target acquisition at DSEi. The new radar systems can strengthen situational awareness and provide fast reaction times to the naval forces.

For Instance, June 2021

Mahindra Telephonic Integrated Systems Ltd. was awarded a contract worth INR 323.47 crore by the Indian Defence Ministry to deliver and install 11 airport surveillance radars with monopulse secondary surveillance radar for the Indian Navy and Indian Coast Guard. The contract was awarded under the Buy & Make category. The new radar installation is anticipated to enhance the air domain awareness around airfields and increase safety & efficiency in the flying operations of the Indian Navy and Indian Coast Guard.