Sustainable Fabrics Size

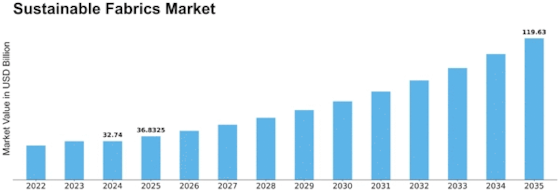

Sustainable Fabrics Market Growth Projections and Opportunities

A variety of factors combine to define the landscape of the Sustainable Fabrics market. It is essential for industry players to comprehend these market factors in order to navigate and take advantage of chances within the Sustainable Fabrics sector. Here is a brief synopsis presented in the style of a paragraph with a pointer structure: Increasing Knowledge of the Environment: The market for sustainable fabrics is driven by consumers' growing consciousness of environmental issues and their desire for eco-friendly products. Customers are becoming more aware of how their decisions affect the environment, which is causing a shift toward textiles made using eco-friendly materials and procedures. Trends in the Fashion Industry: The market for sustainable fabrics is significantly shaped by the fashion industry. Using eco-friendly fibers like recycled polyester, organic cotton, and other eco-friendly materials, designers and brands are embracing sustainable methods, contribute to the mainstream adoption of sustainable fabrics. Government initiatives and legislation that support sustainable practices in the textile industry have an impact on market dynamics. The development of sustainable materials is aided by laws limiting the use of specific chemicals, organic textile certifications, and eco-labeling standards. Circular Economy Principles: One of the main forces behind the development of sustainable textiles is the textile industry's acceptance of circular economy concepts, such as recycling and upcycling. The sustainability of the entire textile supply chain is aided by the recycling of post-consumer textile waste and the development of closed-loop technologies. Consumer Choices in Ethical Clothing: The demand for sustainable materials is influenced by shifting customer demands for fashion that is morally and socially conscious. Customers are backing companies that put fair labor practices and sustainable sourcing first by demanding transparency in the supply chain. Innovation in Fiber Technology: The market for Sustainable Fabrics is heavily dependent on ongoing advancements in fiber technology. The emergence of novel sustainable fibers, such Tencel, lyocell, and recycled polyester, impacts product offerings and market competitiveness by offering substitutes for conventional textiles that need a lot of resources. Corporate Social Responsibility (CSR) and Brand Image: Businesses are realizing the value of including sustainability in their CSR and brand image campaigns. Using sustainable materials improves a brand's reputation among consumers who care about the environment and is in line with consumer ideals.

Leave a Comment