Market Trends

Key Emerging Trends in the Tags Market

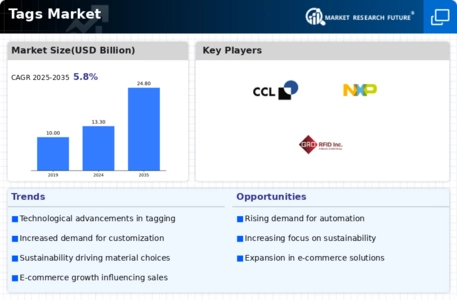

The Tags market is witnessing notable trends and growth opportunities driven by the increasing demand for identification and tracking solutions across various industries such as retail, logistics, healthcare, and automotive. Tags, also known as labels or stickers, are used for labeling, tracking, and identifying products, assets, and documents, providing valuable information throughout their lifecycle. One prominent trend in the Tags market is the growing adoption of RFID (Radio Frequency Identification) tags for inventory management and supply chain optimization. RFID tags use radio waves to transmit data to RFID readers, enabling real-time tracking and monitoring of assets and inventory in warehouses, distribution centers, and retail stores. With the rise of e-commerce and omnichannel retailing, there is a greater need for accurate and efficient inventory management solutions, driving the demand for RFID tags in the retail and logistics sectors.

Moreover, the Tags market is influenced by advancements in labeling technologies and the increasing emphasis on product authentication and anti-counterfeiting measures. Manufacturers are developing tags with advanced security features such as holographic labels, tamper-evident seals, and encrypted QR codes to protect against counterfeiting, diversion, and theft. These security tags help companies safeguard their brand reputation, ensure product authenticity, and comply with regulatory requirements in industries such as pharmaceuticals, electronics, and luxury goods, driving the growth of the Tags market in anti-counterfeiting applications.

Another key trend in the Tags market is the integration of smart tags and sensors for real-time monitoring and condition monitoring of assets and products. Smart tags, equipped with sensors such as temperature sensors, humidity sensors, and GPS modules, provide valuable data insights into the location, status, and environmental conditions of tagged items. In industries such as healthcare, cold chain logistics, and food safety, smart tags enable companies to ensure product quality, safety, and compliance with regulatory standards, driving the adoption of tags with integrated sensing capabilities.

Furthermore, the Tags market is influenced by regulatory requirements and industry standards for product labeling and traceability. Regulatory agencies and industry associations impose labeling requirements for product identification, safety warnings, and regulatory compliance, driving the demand for tags that meet specific labeling standards and guidelines. Additionally, emerging regulations such as serialization requirements for pharmaceutical products and traceability mandates for food and beverage products create opportunities for tag manufacturers to provide solutions for product traceability and supply chain transparency.

The COVID-19 pandemic has impacted the Tags market, causing disruptions in supply chains, changes in consumer behavior, and increased demand for contactless and digital solutions. However, the pandemic has also highlighted the importance of efficient inventory management, supply chain visibility, and product authentication in ensuring business continuity and resilience. As industries adapt to the new normal and invest in digital transformation initiatives, the demand for tags and labeling solutions is expected to rebound, driven by the need for efficient inventory tracking, product authentication, and compliance with regulatory requirements.

Leave a Comment