Global Tahini Market Overview

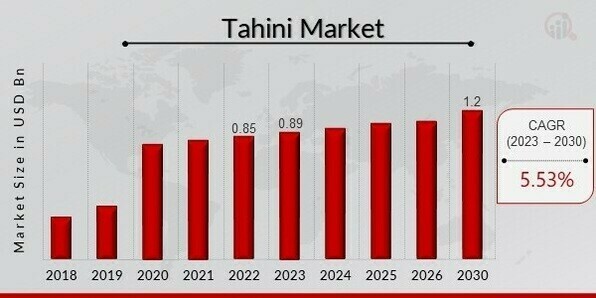

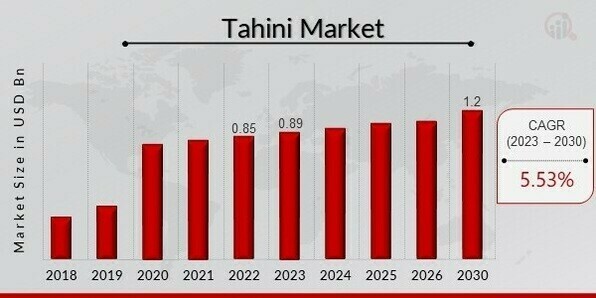

Tahini Market Size was valued at USD 0.85 billion in 2022. The tahini industry is projected to grow from USD 0.89 Billion in 2023 to USD 1.2 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 5.53% during the forecast period (2023 - 2030). Expanding Tahini Product Supply and Increasing Demand for Plant-Based Proteins are the key market drivers enhancing the market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Tahini Market Trends

- Tahini's health benefits are one of the primary elements driving the market growth

The health benefits of tahini are one of the key factors driving the growth of the tahini market. Not only are sesame seeds a good source of copper and manganese, but they are also a good source of calcium, iron, magnesium, phosphorus, vitamin B1, zinc, molybdenum, selenium, and dietary fiber. They also contain two unique substances: sesamin and sesamolin; both of these belong to a group of special beneficial fibers called lignans. They decrease cholesterol, lower blood pressure, and contain vitamin E. Sesamin can help protect the liver from oxidative damage. The seeds, like tahini, are mashed into a paste that is easy to digest; many of its nutrients enter the bloodstream within half an hour of eating. Tahini contains B vitamins (B1, B2, B3, B5, and B15), which are essential for the proper functioning of the human body. They stimulate proper cell growth and division, including that of red blood cells, which aids in the prevention of anemia. They also support and increase the rate of metabolism, enhance immune and nervous system functions, as well as help, maintain healthy skin and muscle tone. These factors will increase the market CAGR during the forecast period.

Additionally, Increased use of tahini paste and sauce in the foodservice industry will drive expansion in the tahini market. Several Middle Eastern delicacies have made their way into worldwide cuisine. Furthermore, rising consumer demand for Turkish, Israeli, and Persian cuisines is driving up tahini consumption. Tahini is used as a dip and sauce in a variety of foods, including falafel, salad, baba ghanoush, soup, and others. Its popularity is progressively growing as many cooks substitute tahini for other dressings and dips such as ranch and balsamic dressing. This is due to the numerous health benefits provided by tahini. Tahini pairs nicely with meat products and can thus be used as a mild-flavored condiment with burger patties to provide a sesame taste. Tahini is served as a dip with pita and salads in many Middle Eastern eateries. Tahini sauce is served or cooked with beef, chicken, and seafood in numerous restaurants in the UK and the US. Hence, rising consumption of tahini paste and sauce in the food service sector is likely to drive tahini demand, favorably influencing the growth of the worldwide tahini industry revenue during the forecast period.

Segment Insights

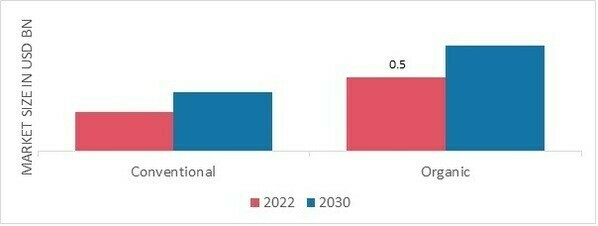

Tahini Category Insights

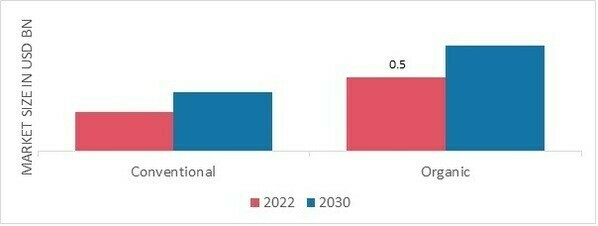

The tahini market segmentation, based on category, includes conventional and organic. Organic segment is expected to grow significantly. An increase in the consumption of organic foods has been sparked by rising health concerns among young people. Tahini products made from organic ingredients are extremely popular because of their exceptional nutritional benefits. According to Fact.M, the demand for organic tahini will make up nearly 30% of the total market demand from 2022 to 203.

Figure 1: Tahini Market, by category, 2022 & 2030 (USD billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Tahini Packaging type Insights

The tahini market segmentation, based on packaging type, includes bottles & jars, tubs and others. Others are predicted to be the fastest-growing product segment in terms of CAGR from 2012 to 2030 due to the broad product reach. Furthermore, rising living standards and increased awareness of the nutritional benefits of essential fatty acids, magnesium, phosphorus, and Vitamin B1 concentration are likely to propel the category even further.

Tahini Distribution channel Insights

The tahini market data has been bifurcated by distribution channel into store based and non-store based. The largest distribution channel segment in 2020 was store based. Among these channels are supermarkets, hypermarkets, branded outlets, convenience stores, and the unorganized retail sector. Major supermarket chains like Walmart and 7-Eleven have increased their investments in emerging nations like India, Thailand, and Taiwan in recent years with a focus on underserved communities.

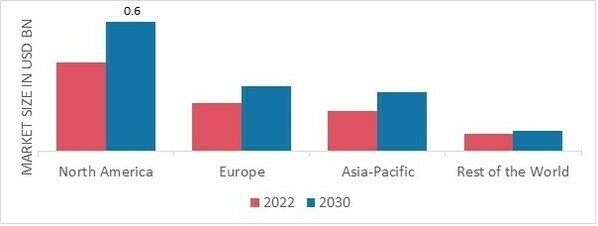

Tahini Regional Insights

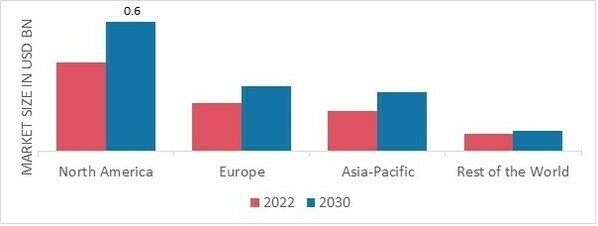

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. North America Tahini market accounted for USD 0.3 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. Market expansion prospects are anticipated to be provided by rising consumer disposable income levels and favorable governmental policies for infrastructure development.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: TAHINI MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe tahini market accounts for the second-largest market share. The country has a big number of health-conscious consumers who are willing to pay a premium for healthy food products. This is one of the primary factors driving the growth of the Tahini industry in Europe. Further, the German market of tahini held the largest market share, and the UK tahini was the fastest growing market in the European region

The Asia-Pacific Tahini Market is expected to grow at the fastest CAGR from 2022 to 2030. Growing demand for healthy and nutritious food products, rising population, and increased awareness of the health advantages of tahini are some of the key factors driving the Asia Pacific Tahini industry. Moreover, China tahini held the largest market share, and the India market of tahini was the fastest growing in the Asia-Pacific region

Tahini Key Market Players & Competitive Insights

The major market participants are investing a lot of money in R&D to expand their product portfolios, which will spur further market growth for tahini. In addition, market participants are launching new products, entering into contracts, acquiring companies, increasing investments, and working with other organizations, among other significant market developments, in an effort to expand their footprint. In order to grow and compete in a more cutthroat and competitive market climate, tahini industry competitors must provide affordable products.

Manufacturing locally to cut operational costs is one of the main business methods used by producers in the tahini industry to benefit customers and develop the market sector. The tahini business has recently given medicine some of the most important advantages. Major players in the tahini market, including Dipasa USA Inc. (US), Halwani Bros. Co. (Saudi Arabia), Kevala (US), SESAJAL S.S. de C.V. (Mexico), Prince Tahina Ltd. (Israel), and Al Wadi Al Akhdar Sal (Lebanon), are aiming to increase market demand by funding R&D initiatives.

Sunshine Biscuits, originally known as The Loose-Wiles Biscuit Company, was an American cookie, cracker, and cereal manufacturer. The company, which built a brand on a few goods such as Cheez-Its, was bought out by Keebler Company in 1996, which was then bought out by Kellogg Corporation in 2001. Sunshine Biscuits was headquartered in Elmhurst, Illinois, where Keebler was headquartered until 2001. In September 2020, Sunshine Foods just announced new items. This new product is predicted to increase market revenue.

Haitoglou Brothers S.A. is a food production and processing firm based in Greece. The company, headquartered in Thessaloniki, Greece, began as a tiny halva producer in 1924 and rapidly expanded its product line to include tahini and various other confectionary products. Haitoglou's main products include sesame seeds, tahini, halva, wafer rolls, and jam. It is Greece's leading sesame processor. It sells 45%-50% of its products to a variety of countries, particularly the EU and the United States. In October 2021, Haitoglou Family Foods recently purchased in Damanos Street in order to expand its company portfolio and develop a positive brand value.

Mighty Sesame Co., a creamy, patent-pending tahini condiment in a ready-to-use, squeezable bottle, was introduced by Rushdi Foods Industries, Ltd. in 2017. The organic, vegan, high-protein spread just made its debut in 26 Whole Foods stores in New York.

Soom Foods will release a new tahini spread in 2021. The speciality retailer expands its product offering as it introduces a distinctive spin on this well-liked spread. The premium tahini company has released their Dark Chocolate Sea Salt Sweet Tahini, and foodies are going to go crazy for it.

Soom Foods has created a snack-sized version of tahini for 2023. Soom Tahini Bites, made with dates, oats, vanilla, sea salt, and additional ingredients like dried tart cherries and cacao powder, were introduced by the company that makes sesame seed spreads.

One of Egypt's newest nutrition bar brands, Brüz Bars, features some of the most creative tastes to date in 2020. The snacks combine some of the more common nutritional food ingredients with Egyptian flavour. This product, which comes in flavours like Tahini Coffee Chocolate and Harankash Cranberry Cashews, completely understands what it means to be Egyptian while maintaining an active lifestyle. The brand-new line of products was introduced in October, and the various bars are based on traits like perseverance, willpower, motivation, and determination.

With the launch of NuttZo 5-Seed Tahini Fusion in 2021, the well-known mixed nut and seed butter company NuttZo makes its first venture into savoury spreads and cooking ingredients. NuttZo's 5-Seed Tahini Fusion is the first of a series of new products making their debut this summer and is brimming with innovative concepts. The 5-Seed blend is a novel, first-of-its-kind tahini-style seed butter produced with organic sesame, flax, sunflower, pumpkin, and chia seeds. It has a flavour that is both true to and distinctive from tahini and is rich with protein and nutrients.

Key Companies in the tahini market includes

- Al Wadi Al Akhdar Sal (Lebanon)

- Halwani Bros. Co. (Saudi Arabia)

- Kevala (US)

- SESAJAL S.S. de C.V. (Mexico)

- Prince Tahina Ltd. (Israel)

- Dipasa USA Inc. (US)

- El Rashidi El Mizan (Egypt)

- Carwari International Pty Ltd. (Australia)

- Mounir Bissat Factories (Lebanon)

- Haitoglou Family Foods (Greece)

- Sunshine Foods (US)

- Ghandour Sons S.A.L (Lebanon), among others

Tahini Industry Developments

In February 2022, the Mighty Sesame Co. launched its new sesame paste flavored with harrisa that it called The Mighty Sesame Harrisa Tahini. It is available in a squeeze bottle and can be used as dressing or dip as well as in cooking.

Soom Foods launched the Dark Chocolate Sea Salt Tahini, the latest product of the company, which medleys creamy sesame tahini with premium cocoa powder in June 2021.

During July 2023 Dubai opened up a new restaurant named Tahini itself. An apparent focus on Lebanese cuisine certainly makes this condiment obvious in several recipes listed on the menu.

May 2021 saw NuttZo, recognized for mixed nut and seed butters, add its first savory spreads and cooking essentials with NuttZo 5-Seed Tahini Fusion. They include organic sesame seeds blended with flax, sunflower, pumpkin and chia seeds to create an unusual yet authentic tahini-style seed butter full of protein and nutrients, among other things. Meanwhile, Egypt's Brüz Bars introduced Egyptian flavors into familiar nutritional ingredients through variants like Harankash Cranberry Cashews or Tahini Coffee Chocolate soon after they joined the nutrition bar industry last year. These particular bars are rooted in the Egyptian way of life while encouraging an active lifestyle by celebrating attributes like fortitude and indomitable spirit.

For example, in April 2021, Istanbul observed the inauguration of what was considered to be its foremost boutique for tahini – The Levant. Similarly some companies are now issuing kosher and halal certificates upon request from consumers because they have realized that most consumers are strictly religious people who cannot buy what is not allowed by their religion level.

In 2021, Halwani Brothers Company introduced a line of flavored tahinis such as chocolate, caramel and honey flavors to match the diverse tastes of their customers.

Prince Tahina Ltd., also in the same year, released its premium range of products made of high-quality Ethiopian sesame seeds. Health-conscious customers are targeted by these premium tahini products, which stress their nutritional values.

Dipasa USA, Inc., on the other hand in 2020, launched a new line of organic tahini products. The company’s organic tahinis incorporate ethically sourced sesame seeds as an alternative healthy and sustainable choice for buyers.

Tahini Market Segmentation

Tahini By packaging type Outlook

Tahini By Category Outlook

- Bottles & Jars

- Tubs

- Others

Tahini Distribution channel Outlook

Tahini Regional Outlook

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 0.85 billion |

| Market Size 2023 |

USD 0.89 billion |

| Market Size 2030 |

USD 1.2 billion |

| Compound Annual Growth Rate (CAGR) |

5.53% (2023-2030) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Historical Data |

2019- 2021 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

By Category, Packaging Type, Distribution Channel, and Region |

| Geographies Covered |

North America, Europe, AsiaPacific, and Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Al Wadi Al Akhdar Sal (Lebanon), Halwani Bros. Co. (Saudi Arabia), Kevala (US), SESAJAL S.S. de C.V. (Mexico), Prince Tahina Ltd. (Israel), Dipasa USA Inc. (US), El Rashidi El Mizan (Egypt), Carwari International Pty Ltd. (Australia), |

| Key Market Opportunities |

Growing Organized Retail Sector in Developing Countries and Increasing Demand for Organic Tahini |

| Key Market Dynamics |

Developing Health Awareness, Increased Plant-Based Protein Demand, and Expanding Accessibility To Packaged Tahini Products |

Tahini Market Highlights:

Frequently Asked Questions (FAQ) :

The tahini market size was valued at USD 0.85 Billion in 2023.

The market is projected to grow at a CAGR of 5.53% during the forecast period, 2023-2030.

North America had the largest share in the market

The key players in the market are Al Wadi Al Akhdar Sal (Lebanon), Halwani Bros. Co. (Saudi Arabia), Kevala (US), SESAJAL S.S. de C.V. (Mexico), Prince Tahina Ltd.

The organic tahini category dominated the market in 2023.

The store based had the largest share in the market.